MoneyGram 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

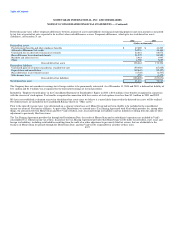

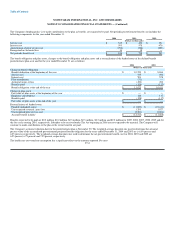

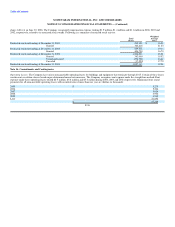

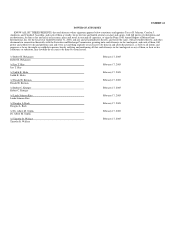

Following is a summary of stock option activity:

Weighted

Average

Total Exercise Options

Shares Price Exercisable

Options outstanding at December 31, 2001 5,650,668 $ 16.29 3,466,201

Granted 1,082,217 20.57

Exercised (703,923) 12.27

Canceled (568,497) 19.26

Options outstanding at December 31, 2002 5,460,465 17.36 3,711,237

Granted 937,150 15.66

Exercised (297,865) 10.54

Canceled (469,291) 18.74

Options outstanding at December 31, 2003 5,630,459 17.31 4,322,053

Granted 724,700 19.32

Exercised (519,169) 12.03

Canceled (239,249) 18.70

Options outstanding at December 31, 2004 5,596,741 17.99 4,370,671

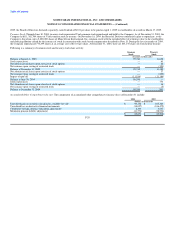

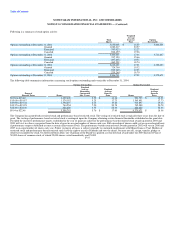

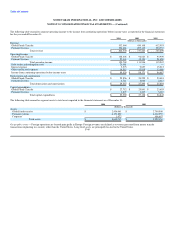

The following table summarizes information concerning stock options outstanding and exercisable at December 31, 2004:

Options Outstanding Options Exercisable

Weighted

Average Weighted Weighted

Remaining Average Average

Range of Contractual Exercise Exercise

Exercise Prices Shares Life (Years) Price Shares Price

$9.94 to $15.62 1,459,408 5.50 $ 14.16 921,735 $ 13.31

$15.68 to $18.87 1,374,182 5.25 17.73 1,365,851 17.73

$19.00 to $19.32 1,592,297 6.15 19.24 913,897 19.18

$19.37 to $21.25 744,254 7.20 20.78 742,588 20.78

$22.46 to $22.46 426,600 4.35 22.46 426,600 22.46

$9.94 to $22.46 5,596,741 5.76 $ 17.99 4,370,671 $ 18.08

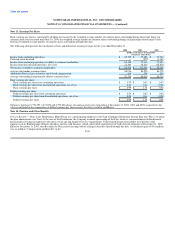

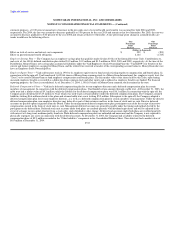

The Company has granted both restricted stock and performance-based restricted stock. The vesting of restricted stock is typically three years from the date of

grant. The vesting of performance-based restricted stock is contingent upon the Company obtaining certain financial thresholds established on the grant date.

Provided the incentive performance targets established in the year of grant are achieved, the performance-based restricted stock awards granted in 2004 and

2003 will vest in a three-year period from the date of grant in an equal number of shares each year. Full ownership of shares could vest on an accelerated basis

if performance targets established are met at certain achievement levels. The performance-based restricted stock awards granted in 2002 will vest in 2006 and

2007 in an equal number of shares each year. Future vesting in all cases is subject generally to continued employment with MoneyGram or Viad. Holders of

restricted stock and performance-based restricted stock have the right to receive dividends and vote the shares, but may not sell, assign, transfer, pledge or

otherwise encumber the stock. On the Distribution Date, our Chairman of the Board was granted a restricted stock award under our 2004 Incentive Plan of

50,000 shares of common stock, of which 25,000 shares vested immediately and 25,000

F-37