MoneyGram 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

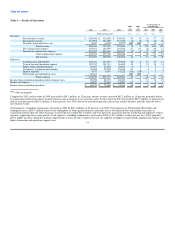

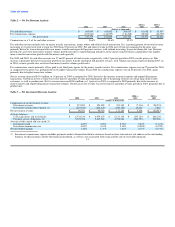

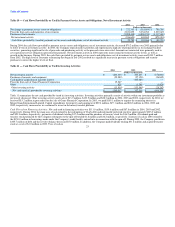

Expenses

Expenses include various operating expenses, other than commissions. As MoneyGram is the accounting successor to Viad, expenses through June 30, 2004

also include corporate overhead that Viad did not allocate to its subsidiaries and, consequently, cannot be classified as discontinued operations. Included in the

first six months of 2004 are approximately $10.2 million of these expenses, which will not be incurred by MoneyGram in the future. However, we are

obligated under an Interim Services Agreement with Viad to pay approximately $1.6 million annually from July 1, 2004 for certain corporate services

provided to MoneyGram by Viad. In addition, during the second half of 2004, MoneyGram incurred approximately $4.6 million in public company and

related expenses.

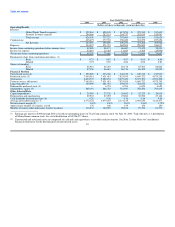

Following is a discussion of the operating expenses for the periods presented in Table 1.

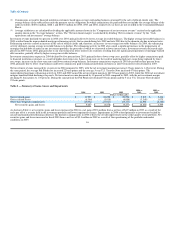

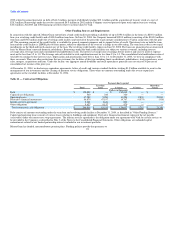

Compensation and benefits — Compensation and benefits includes salaries and benefits, management incentive programs, severance costs and other

employee related costs. Included in 2004 are $4.3 million of expenses allocated from Viad that will not recur in 2005. Compensation and benefits increased 18

percent in 2004 compared to 2003, primarily driven by higher incentive accruals, higher pension and benefit costs and hiring of additional employees. In

addition, 2003 benefited from a pension curtailment gain of $3.8 million. Because of the adverse impact that declining interest rates had on the Company's

performance in 2003, incentive accruals were substantially lower in 2003. The total number of employees increased in 2004 to drive money transfer growth

and handle public company responsibilities. Compensation and benefits increased eight percent in 2003 compared to 2002, primarily driven by additional

employees supporting the money transfer growth and higher incentive accruals, partially offset by the $3.8 million pension curtailment gain.

Transaction and operations support — Transaction and operations support expenses include marketing costs, professional fees and other outside services

costs, telecommunications and forms expense related to our products. Included in 2004 are $5.4 million of expenses allocated from Viad that will not recur in

2005. Transaction and operations support costs were up 19 percent in 2004 over 2003, partially driven by the impairment of capitalized technology costs of

$4.5 million related to the discontinued development of a project with Concorde EFS and other discontinued projects and the impairment of intangible assets

of $2.1 million related to a purchased customer list for an expected customer departure. The remaining increase in transaction and operations support expense

is driven primarily by higher insurance costs, public company costs and higher provisions for uncollectible agent receivables. The higher provision for

uncollectible agent receivables is primarily the result of losses experienced in the check casher channel. Certain agents, particularly in New York, have

experienced reduced liquidity as a result of the withdrawal of a major financial institution that previously served this channel. Transaction and operations

support expenses increased five percent in 2003 over 2002, primarily due to higher legal and other professional services in the money transfer business and

increases in general insurance costs and recruiting costs, partially offset by higher interest income. In addition, 2002 included $5.3 million of minority interest

expense related to a joint venture.

Depreciation and amortization — Depreciation and amortization includes depreciation on point of sale equipment, computer hardware and software

(including capitalized software development costs), and office furniture, equipment and leasehold improvements. Depreciation and amortization expense was

up eight percent in 2004 over 2003, primarily due to the amortization of capitalized software developed to enhance the money transfer platform. These

investments helped drive the growth in the money transfer product. Fiscal 2003 saw an increase of five percent in depreciation and amortization expense over

2002, primarily due to investments in money transfer equipment and money order signage.

Occupancy, equipment and supplies — Occupancy, equipment and supplies includes facilities rent and maintenance costs, software and equipment

maintenance costs, freight and delivery costs, and supplies. Included in 2004 are $0.4 million of expenses allocated from Viad that will not recur in 2005.

Occupancy, equipment and supplies in 2004 increased 21 percent over 2003, primarily due to normal increases in facilities rent, higher software maintenance

costs and losses on disposal of equipment. Fiscal 2003 saw a one percent increase in occupancy, equipment and supplies expense over 2002, primarily due to

software and equipment maintenance costs.

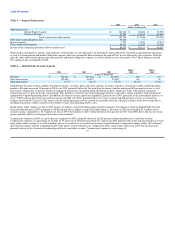

Interest expense — Interest expense declined 43 percent in 2004 as compared to 2003 on lower average outstanding debt balances and lower average interest

17