MoneyGram 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

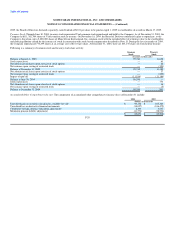

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

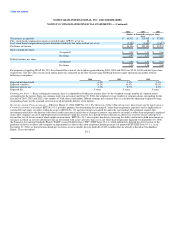

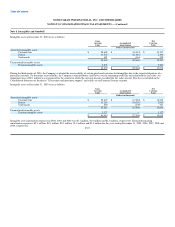

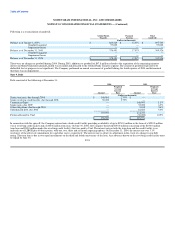

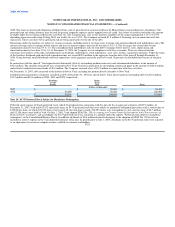

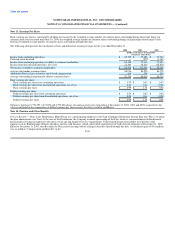

Note 8. Intangibles and Goodwill

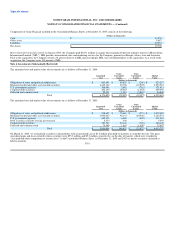

Intangible assets at December 31, 2004 were as follows:

Gross Net

Carrying Accumulated Carrying

Value Amortization Value

(Dollars in thousands)

Amortized intangible assets:

Customer lists $ 28,688 $ (18,491) $ 10,197

Patents 13,200 (11,010) 2,190

Trademarks 481 (161) 320

42,369 (29,662) 12,707

Unamortized intangible assets:

Pension intangible assets 2,503 — 2,503

$ 44,872 $ (29,662) $ 15,210

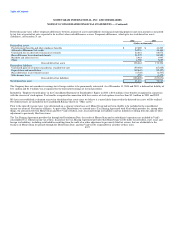

During the third quarter of 2004, the Company evaluated the recoverability of certain purchased customer list intangibles due to the expected departure of a

particular customer. To determine recoverability, the Company estimated future cash flows over the remaining useful life and calculated the fair value. An

impairment loss of $2.1 million was recognized for the amount in which the carrying amount exceeded the fair value amount. This loss is included on the

Consolidated Statement of Income in "Transaction and operations support" and relates to our Payment Systems segment.

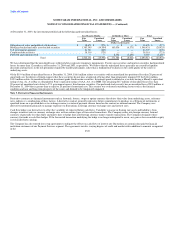

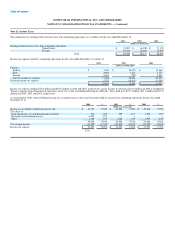

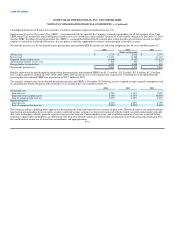

Intangible assets at December 31, 2003 were as follows:

Gross Net

Carrying Accumulated Carrying

Value Amortization Value

(Dollars in thousands)

Amortized intangible assets:

Customer lists $ 29,607 $ (17,062) $ 12,545

Patents 13,200 (10,385) 2,815

Trademarks 480 (149) 331

43,287 (27,596) 15,691

Unamortized intangible assets:

Pension intangible assets 3,127 — 3,127

$ 46,414 $ (27,596) $ 18,818

Intangible asset amortization expense for 2004, 2003 and 2002 was $2.1 million, $1.9 million and $1.8 million, respectively. Estimated remaining

amortization expense is $2.1 million, $2.1 million, $2.1 million, $1.8 million and $1.4 million for the years ending December 31, 2005, 2006, 2007, 2008 and

2009, respectively. F-23