MoneyGram 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

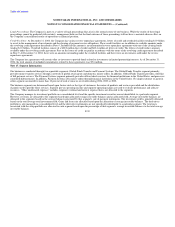

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

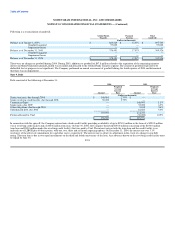

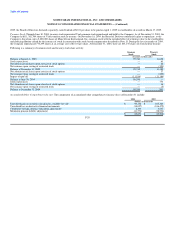

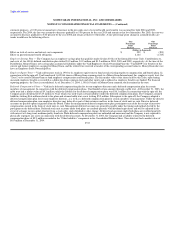

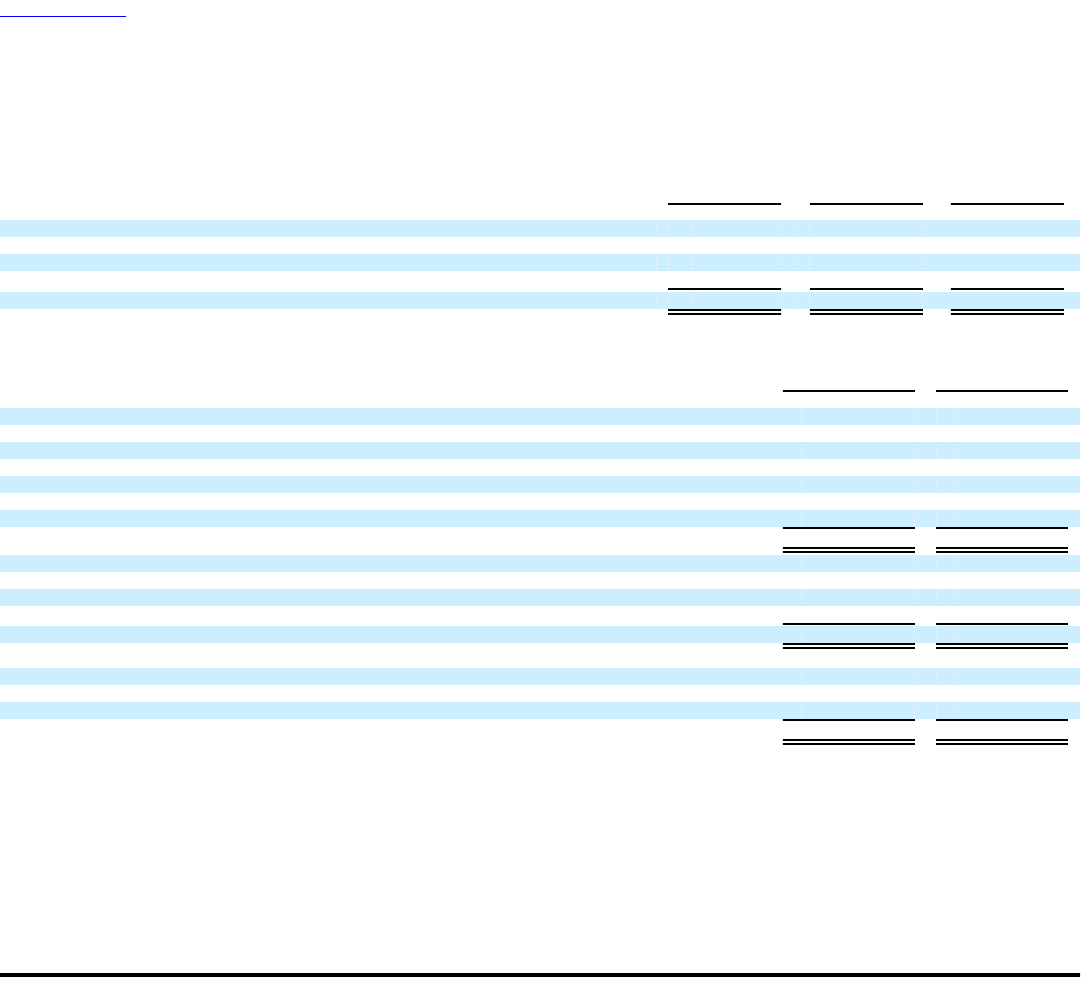

The Company's funding policy is to make contributions to the plan as benefits are required to be paid. Net periodic postretirement benefit cost includes the

following components for the year ended December 31:

2004 2003 2002

(Dollars in thousands)

Service cost $ 515 $ 490 $ 354

Interest cost 593 578 476

Amortization of prior service cost (294) (288) (288)

Recognized net actuarial loss 14 18 —

Net periodic benefit cost $ 828 $ 798 $ 542

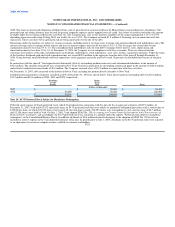

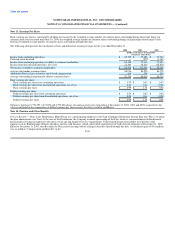

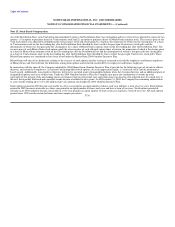

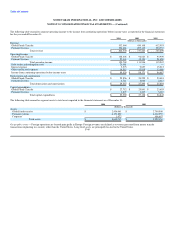

The benefit obligation and plan assets, changes to the benefit obligation and plan assets and a reconciliation of the funded status of the defined benefit

postretirement plan as of and for the year ended December 31 are as follows:

2004 2003

(Dollars in thousands)

Change in benefit obligation:

Benefit obligation at the beginning of the year $ 10,570 $ 8,964

Service cost 515 490

Interest cost 593 578

Plan amendments (71) —

Actuarial (gain) or loss (456) 496

Benefits paid (128) (117)

Benefit obligation at the end of the year $ 11,023 $ 10,411

Change in plan assets:

Fair value of plan assets at the beginning of the year $ — $ —

Employer contributions 128 117

Benefits paid (128) (117)

Fair value of plan assets at the end of the year $ — $ —

Reconciliations of funded status:

Funded (unfunded) status $ (11,023) $ (10,411)

Unrecognized actuarial (gain) loss 1,293 1,927

Unrecognized prior service cost (2,781) (3,004)

Accrued benefit liability $ (12,511) $ (11,488)

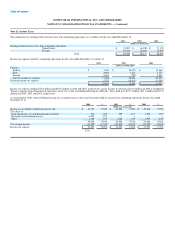

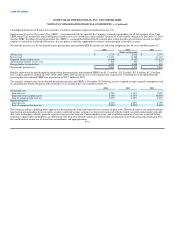

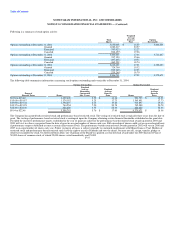

Benefits expected to be paid are $0.2 million, $0.2 million, $0.3 million, $0.3 million, $0.3 million and $2.0 million for 2005, 2006, 2007, 2008, 2009 and for

the five years starting 2010, respectively. Subsidies to be received under The Act beginning in 2006 are not expected to be material. The Company will

continue to make contributions to the plan to the extent benefits are paid.

The Company's actuarial valuation date for the postretirement plan is November 30. The weighted-average discount rate used to determine the actuarial

present value of the accumulated postretirement projected benefit obligation for the years ended December 31, 2004 and 2003 are is 6.00 percent and

6.25 percent, respectively. The weighted-average discount rates used to determine the net postretirement benefit cost for 2004, 2003 and 2002 are

6.25 percent, 6.75 percent and 7.25 percent, respectively.

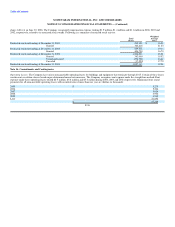

The health care cost trend rate assumption has a significant effect on the amounts reported. For mea-

F-34