MoneyGram 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

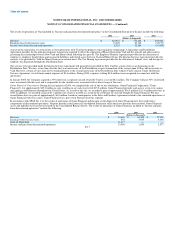

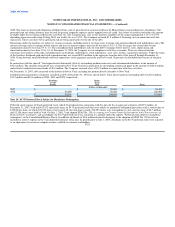

losses are measured as of a point in time and could fluctuate significantly as interest rates change.

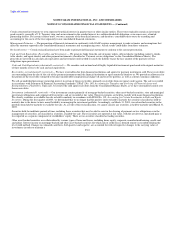

In December 2004, the FASB issued an SFAS No. 123R, Share-Based Payment. This standard, which is effective for the Company beginning in the third

quarter of 2005, requires that all share-based compensation awards be measured at fair value at the date of grant and expensed over their vesting or service

periods. The Company will adopt SFAS No. 123R on January 1, 2005 using the modified prospective method. We anticipate that the impact of adopting

SFAS No. 123R will result in annual expense in 2005 of approximately $2.8 million based on known grants.

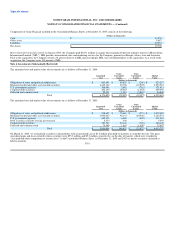

In May 2004, the FASB issued FSP SFAS 106-2 on the accounting for the effects of the Medicare Prescription Drug, Improvement and Modernization Act of

2003 (the "Medicare Act"), which was enacted into law on December 8, 2003, and which provides a federal subsidy to employers that sponsor postretirement

health care plans that provide certain prescription drug benefits to the extent such benefits are deemed "actuarially equivalent" to Medicare Part D. The

Company made a one-time election, under the previously issued FSP SFAS 106-1, to defer recognition of the effects of the Medicare Act until further

authoritative guidance was issued. With the issuance of FSP FAS 106-2 in May 2004, which superceded FSP SFAS 106-1, specific guidance was provided in

accounting for the subsidy. The Company adopted FSP SFAS 106-2 on July 1, 2004, using the prospective method. Refer to Note 14 for the effects of the

Medicare Act on our Consolidated Balance Sheets and Consolidated Statements of Income.

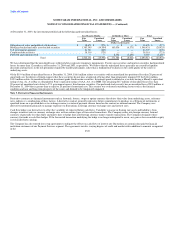

On October 22, 2004, the President signed the American Jobs Creation Act of 2004 (the "Jobs Act"). The Jobs Act creates a temporary incentive for

U.S. corporations to repatriate accumulated income earned abroad by providing an 85 percent dividends received deduction for certain dividends from

controlled foreign corporations. The Company has historically recognized a deferred tax liability on its undistributed foreign earnings as these earnings were

not considered indefinitely reinvested. As of December 31, 2004, the Company has deferred tax liabilities of $4.1 million related to undistributed foreign

earnings of $30.8 million. Although the deduction is subject to a number of limitations and, as of today, significant uncertainty remains as to how to interpret

numerous provisions in the Jobs Act, the Company believes that it has the information necessary to make an informed decision on the impact of the Jobs Act

on its repatriation plans. Based on that decision, the Company does not plan to repatriate any amounts as extraordinary dividends, as defined by the Jobs Act,

during 2005. The Company will continue to recognize a deferred tax liability on its undistributed foreign earnings.

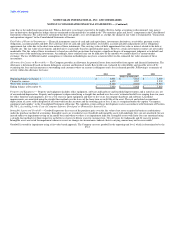

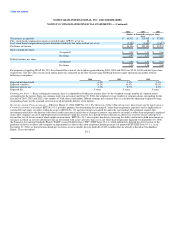

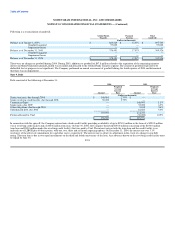

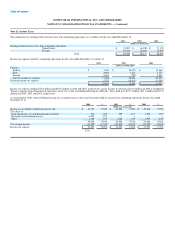

Note 3. Discontinued Operations and Acquisitions

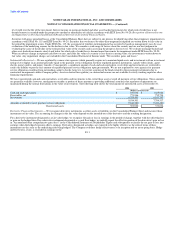

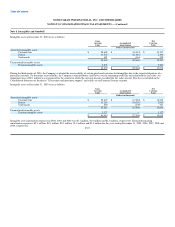

Viad Corp: MoneyGram is considered the divesting entity and treated as the "accounting successor" to Viad for financial reporting purposes. The continuing

business of Viad is referred to as "New Viad." The spin off of New Viad was accounted for pursuant to APB Opinion No. 29, Accounting for Nonmonetary

Transactions, and was based upon the recorded amounts of the net assets divested. On June 30, 2004, we charged the historical cost carrying amount of the

net assets of New Viad of $426.6 million directly to equity as a dividend. As a result, the results of operations of New Viad (with certain adjustments) are

included in the Consolidated Statement of Income in "Income and gain from discontinued operations" in accordance with the provisions of SFAS No. 144,

Accounting for the Impairment or Disposal of Long-Lived Assets. Also included in "Income and gain from discontinued operations" in the Consolidated

Statement of Income for 2004 is a charge for spin-off related costs of $14.6 million relating primarily to legal and consulting costs.

F-16