MoneyGram 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

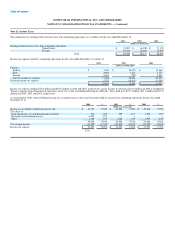

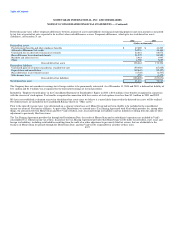

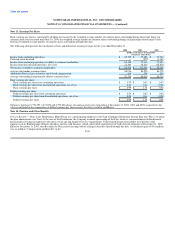

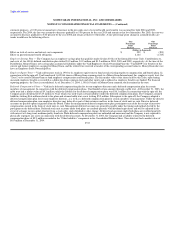

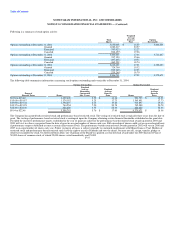

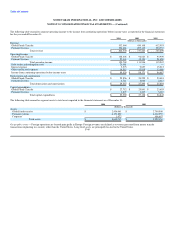

Note 15. Stock-Based Compensation

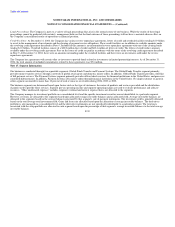

As of the Distribution Date, each Viad option that immediately prior to the Distribution Date was outstanding and not exercised was adjusted to consist of two

options: (1) an option to purchase shares of Viad common stock and (2) an option to purchase shares of MoneyGram common stock. The exercise price of the

Viad stock option was adjusted by multiplying the exercise price of the old stock option by a fraction, the numerator of which was the closing price of a share

of Viad common stock on the first trading day after the Distribution Date (divided by four to reflect the post-spin Viad reverse stock split) and the

denominator of which was that price plus the closing price for a share of MoneyGram common stock on the first trading day after the Distribution Date. The

exercise price of each MoneyGram stock option equals the exercise price of each old stock option times a fraction, the numerator of which is the closing price

of a share of MoneyGram common stock on the first trading day after the Distribution Date and the denominator of which is that price plus the closing price

of a share of Viad common stock on the first trading day after the Distribution Date (divided by four to reflect the post-spin Viad reverse stock split). These

MoneyGram options are considered to have been issued under the MoneyGram 2004 Omnibus Incentive Plan.

MoneyGram will take all tax deductions relating to the exercise of stock options and the vesting of restricted stock held by employees and former employees

of MoneyGram, and Viad will take the deductions arising from options and restricted stock held by its employees and former employees.

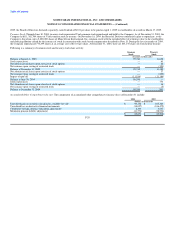

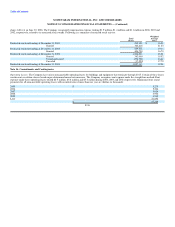

In connection with the spin-off, the Company adopted the 2004 MoneyGram Omnibus Incentive Plan to provide for the following types of awards to officers,

directors, and certain key employees: (a) incentive and nonqualified stock options; (b) stock appreciation rights; (c) restricted stock; and (d) performance

based awards. Additionally, non-employee directors will receive an initial grant of nonqualified options when they become directors and an additional grant of

nonqualified options each year of their term. Under the 2004 Omnibus Incentive Plan, the Company may grant any combination of awards up to the

equivalent of two percent of the outstanding shares of common stock in each period. Any equivalent shares not used in a fiscal period may be carried over to

the next fiscal period. Forfeited and cancelled awards become available for new grants. As of December 31, 2004, the Company has remaining authorization

to issue awards totaling up to 3,471,220 million shares of common stock under the 2004 Omnibus Incentive Plan.

Stock options granted in 2004 become exercisable in a five-year period in an equal number of shares each year and have a term of seven years. Stock options

granted in 2003 become exercisable in a three-year period in an equal number of shares each year and have a term of ten years. Stock options granted in

calendar years 2002 and prior became exercisable in a two-year period in an equal number of shares each year and have a term of ten years. All stock options

granted since 1998 contain certain forfeiture and non-compete provisions. F-36