MoneyGram 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Consolidated Statement of Income. It is our policy to fund the minimum required contribution for the year.

Supplemental Executive Retirement Plan (SERP) — In connection with the spin-off, the Company assumed responsibility for all but a portion of the Viad

SERP, while Viad retained the benefit obligation related to two of its subsidiaries, representing 13 percent of Viad's benefit obligation at December 31, 2003.

Another SERP, the MoneyGram International, Inc. SERP, is a nonqualified defined benefit pension plan, which provides postretirement income to eligible

employees selected by the Board of Directors. It is our policy to fund the supplemental executive retirement plan as benefits are paid.

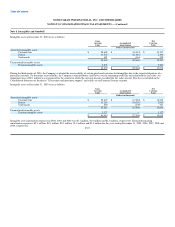

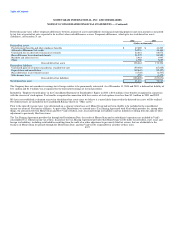

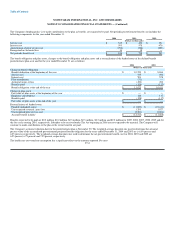

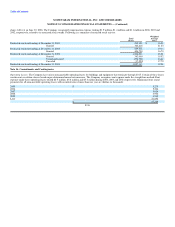

Net periodic pension cost for the defined benefit pension plan and combined SERPs includes the following components for the year ended December 31:

2004 2003 2002

(Dollars in thousands)

Service cost $ 1,717 $ 2,912 $ 2,776

Interest cost 11,333 11,260 11,119

Expected return on plan assets (8,804) (9,627) (11,935)

Amortization of prior service cost 768 516 579

Recognized net actuarial loss 3,990 1,854 456

Net periodic pension cost $ 9,004 $ 6,915 $ 2,995

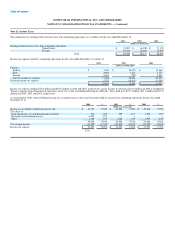

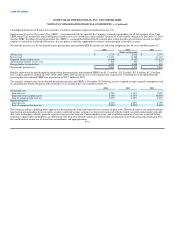

Benefits expected to be paid through the defined benefit pension plan and combined SERPS are $11.3 million, $12.2 million, $12.5 million, $12.5 million,

$12.7 million and $65.1 million for 2005, 2006, 2007, 2008, 2009 and for the five years starting 2010, respectively. Contributions to the defined benefit

pension plan and combined SERPS are expected to be $15.7 million in 2005.

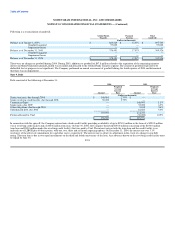

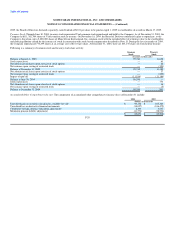

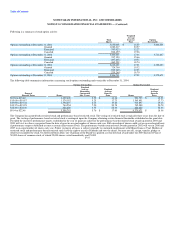

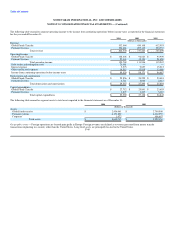

The actuarial valuation date for the defined benefit pension plan and SERPs is November 30. Following are the weighted average actuarial assumptions used

in calculating the benefit obligation and net benefit cost as of and for the years ended December 31:

2004 2003 2002

Net benefit cost:

Discount rate 6.25% 6.75% 7.25%

Expected return on plan assets 8.75% 8.75% 10.00%

Rate of compensation increase 4.50% 4.50% 4.50%

Benefit obligation:

Discount rate 6.00% 6.25% 6.75%

Rate of compensation increase 4.50% 4.50% 4.50%

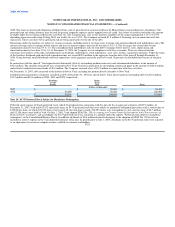

The Company utilizes a building-block approach in determining the long-term expected rate of return on plan assets. Historical markets are studied and long-

term historical relationships between equity securities and fixed income securities are preserved consistent with the widely accepted capital market principle

that assets with higher volatility generate a greater return over the long run. Current market factors such as inflation and interest rates are evaluated before

long-term capital market assumptions are determined. The long-term portfolio return also takes proper consideration of diversification and rebalancing. Peer

data and historical returns are reviewed for reasonableness and appropriateness.

F-31