MoneyGram 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

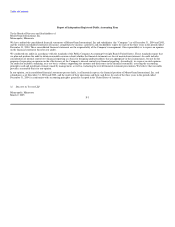

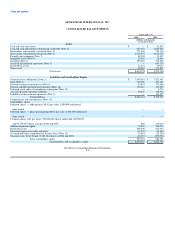

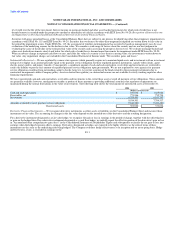

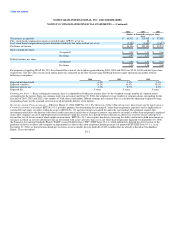

MONEYGRAM INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31,

2004 2003 2002

(Dollars in thousands)

Cash flows from operating activities

Net income $ 86,412 $ 113,902 $ 57,886

Adjustments to reconcile net income to net cash provided by (used in) operating activities:

Net earnings in discontinued operations (21,283) (37,027) (16,878)

Depreciation and amortization 29,567 27,295 25,894

Investment impairment charges 15,932 27,917 25,777

Provision for deferred income taxes 6,282 (14,416) (11,050)

Net gain on sale of investments (25,539) (23,039) (16,500)

Debt redemption and retirement costs 20,661 — —

Net amortization of investment premium 19,070 38,242 (4,351)

Asset impairments and adjustments 6,590 4,275 3,100

Provision for uncollectible receivables 6,422 3,987 5,932

Non-cash compensation expense 1,934 1,378 1,103

Other non-cash items, net 2,817 5,695 (30,158)

Changes in foreign currency translation adjustments 1,807 2,848 1,564

Loss on sale of property and equipment 1,603 373 987

Changes in assets and liabilities:

Other assets 27,381 (5,745) 5,917

Accounts payable and other liabilities (5,522) 29,724 52,045

Total adjustments 87,722 61,507 43,382

Change in cash and cash equivalents (substantially restricted) 75,937 286,364 (554,374)

Change in receivables, net (substantially restricted) (22,654) (243,789) 166,439

Change in payment service obligations 219,100 (404,474) 1,176,233

Net cash provided by (used in) continuing operating activities 446,517 (186,490) 889,566

Cash flows from investing activities

Proceeds from sales of investments classified as available-for-sale 1,053,128 1,660,238 1,345,821

Proceeds from maturities of investments classified as available-for-sale 1,798,767 3,410,855 1,148,417

Proceeds from maturities of investment securities classified as held-to-maturity — 283,690 745,387

Purchases of investments classified as available-for-sale (3,098,498) (4,888,918) (3,341,956)

Purchase of investments classified as held-to-maturity — — (775,670)

Purchases of property and equipment (29,589) (27,128) (26,842)

Cash paid for acquisition of MoneyGram International Limited — (105,080) —

Proceeds from the sale of Game Financial Corporation, net of cash sold 15,247 — —

Other investing activities 428 (1,341) (1,420)

Net cash provided by (used in) investing activities (260,517) 332,316 (906,263)

Cash flows from financing activities

Payments on debt (205,182) (105,738) (44,230)

Proceeds from debt 100,000 — —

Net change in revolver 50,000 (5,000) 6,543

Proceeds from exercise of options 1,693 3,745 10,372

Preferred stock redemption (23,895) — —

Purchase of treasury stock (16,181) (976) (28,309)

Cash dividends paid (17,409) (31,603) (32,149)

Net cash used in financing activities (110,974) (139,572) (87,773)

Net cash provided by (used in) discontinued operations (108,858) (11,547) 108,555

Net (decrease) increase in cash and cash equivalents (33,832) (5,293) 4,085

Cash and cash equivalents — beginning of period 33,832 39,125 35,040

Cash and cash equivalents — end of period $ — $ 33,832 $ 39,125

See Notes to Consolidated Financial Statements

F-7