MoneyGram 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

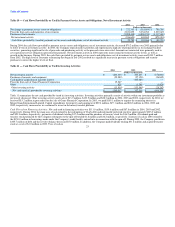

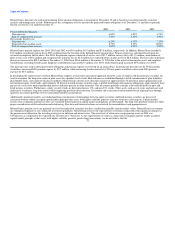

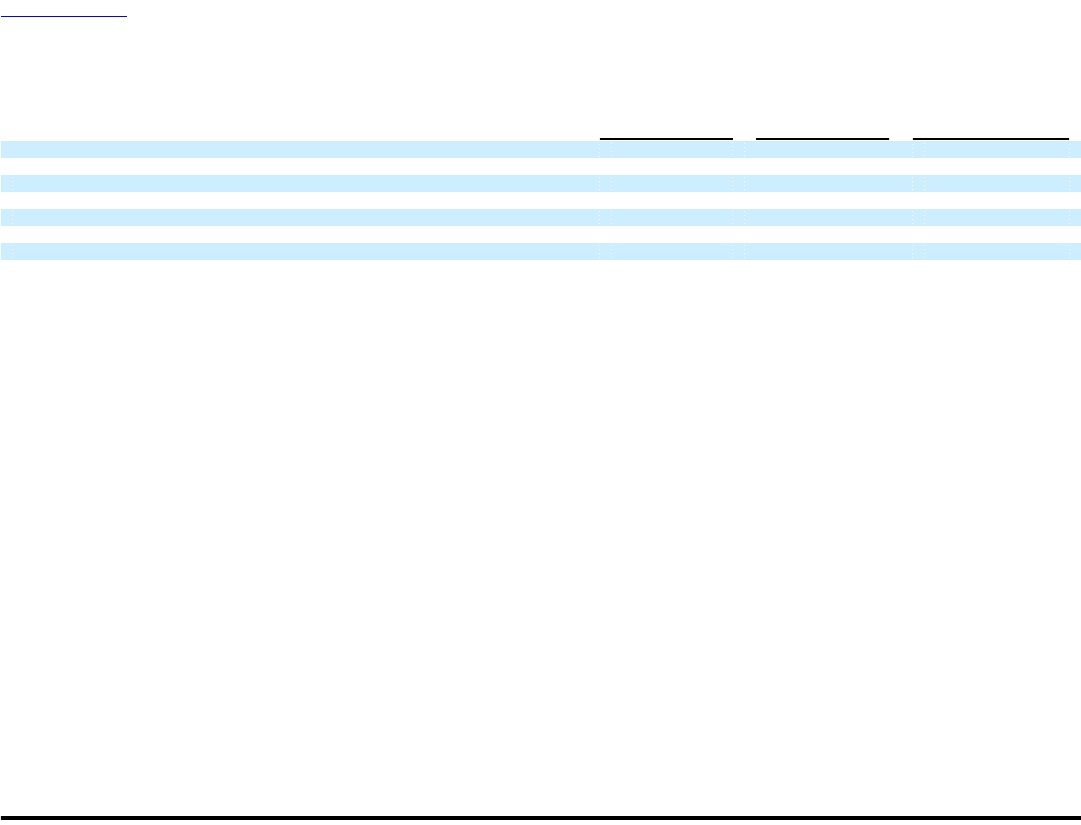

MoneyGram's discount rate used in determining future pension obligations is measured on November 30 and is based on rates determined by actuarial

analysis and management review. Following are the assumptions used to measure the projected benefit obligation as of December 31, and the net periodic

benefit cost for the year ended December 31:

2004 2003 2002

Projected benefit obligation:

Discount rate 6.00% 6.25% 6.75%

Rate of compensation increase 4.50% 4.50% 4.50%

Net periodic benefit cost:

Discount rate 6.25% 6.75% 7.25%

Expected return on plan assets 8.75% 8.75% 10.00%

Rate of compensation increase 4.50% 4.50% 4.50%

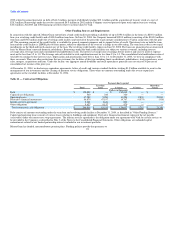

MoneyGram's pension expense for 2004, 2003 and 2002 was $9.0 million, $6.9 million and $3.0 million, respectively. In addition, MoneyGram recorded a

$3.8 million curtailment gain in fiscal 2003 resulting from the freezing of the defined benefit pension plan. Pension expense is calculated based upon the

actuarial assumptions shown above. For 2004, the pension expense consisted of service cost of $1.7 million, interest cost of $11.3 million, amortization of

prior service cost of $0.8 million and recognized net actuarial loss of $4.0 million less expected return on plan assets of $8.8 million. The fair value of pension

plan assets increased to $98.1 million at December 31, 2004 from $96.4 million at December 31, 2003 due to the actual return on plan assets and employer

contributions exceeding benefits paid. Employer contributions increased $2.3 million over 2003, while benefits paid increased $0.9 million over 2003.

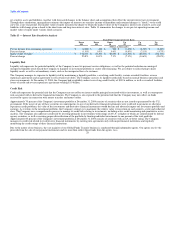

The discount rates used to determine benefit obligation and pension expense is reviewed on an annual basis. Lowering the discount rate by 50 basis points

would have increased 2004 pension expense by $0.7 million, while increasing the discount rate by 50 basis points would have decreased 2004 pension

expense by $0.5 million.

In developing the expected rate of return, MoneyGram employs a total return investment approach whereby a mix of equities and fixed income securities are

used to maximize the long-term return of plan assets for a prudent level of risk. Risk tolerance is established through careful consideration of plan liabilities,

plan funded status, and corporate financial condition. MoneyGram's current asset allocation consists of approximately 56 percent in large capitalization and

international equity stock funds, approximately 38 percent in fixed income securities such as global bond funds and corporate obligations, approximately three

percent in a real estate limited partnership interest and three percent in other securities. The investment portfolio contains a diversified blend of equity and

fixed income securities. Furthermore, equity security funds are diversified across U.S. and non-U.S. stocks. Other assets such as real estate and cash are used

judiciously to enhance long-term returns while improving portfolio diversification. Investment risk is measured and monitored on an ongoing basis through

quarterly investment portfolio reviews and annual liability measurements.

Additionally, historical markets are studied and long-term historical relationships between equity securities and fixed income securities are preserved

consistent with the widely accepted capital market principle that assets with higher volatility generate a greater return over the long run. Current market

factors such as inflation and interest rates are evaluated before long-term capital market assumptions are determined. The long-term portfolio return also takes

proper consideration of diversification and rebalancing. Peer data and historical returns are reviewed for reasonableness and appropriateness.

MoneyGram's pension assets are primarily invested in marketable securities that have readily determinable current market values. MoneyGram's investments

are rebalanced regularly to stay within the investment guidelines. MoneyGram reviews the expected rate of return in connection with significant changes in

the pension asset allocation, the investing strategy or in inflation and interest rates. The actual rate of return on average pension assets in 2004 was

8.00 percent, as compared to the expected rate of return of 8.75 percent. As the expected rate of return is a long-term assumption and the widely accepted

capital market principle is that assets with higher volatility generate greater long-term returns, we do not believe that the

32