MoneyGram 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

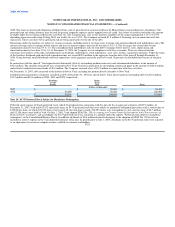

2008. The loans are unsecured obligations of MoneyGram, and are guaranteed on an unsecured basis by MoneyGram's material domestic subsidiaries. The

proceeds from any future advances may be used for general corporate expenses and to support letters of credit. Any letters of credit issued reduce the amount

available under the revolving credit facility (see Note 16). The Company pays a fee on the facilities regardless of the usage ranging from 0.1% to 0.375%

depending upon our credit rating. During 2004, our facility fee was 0.15%. The Company incurred $1.2 million of financing costs in connection with this

transaction. These costs have been capitalized and are being amortized over the life of the debt.

Borrowings under the facilities are subject to various covenants, including interest coverage ratio, leverage ratio and consolidated total indebtedness ratio. The

interest coverage ratio of earnings before interest and taxes to interest expense must not be less than 3.5 to 1.0. The leverage ratio of total debt to total

capitalization must be less than 0.5 to 1.0. The consolidated total indebtedness ratio of total debt to earnings before interest, taxes, depreciation and

amortization must be less than 3.0 to 1.0. At December 31, 2004, the Company was in compliance with these covenants. There are other restrictions

customary for facilities of this type, including limits on dividends, indebtedness, stock repurchases, asset sales, merger, acquisitions and liens. Under the terms

of the facilities, dividends paid and stock repurchased may not exceed $20.0 million in the aggregate from the date of the spin-off through December 31,

2004. Going forward, annual dividends and stock repurchases in the aggregate generally may not exceed 30 percent of consolidated net income of the prior

year.

In connection with the spin-off, Viad repurchased substantially all of its outstanding medium-term notes and subordinated debentures in the amount of

$52.6 million. The amounts not paid off were retained by New Viad. Viad also repaid all of its outstanding commercial paper in the amount of $188.0 million

and retired its industrial revenue bonds of $9.0 million. The Company incurred a loss of $3.5 million in connection with these activities.

On December 31, 2003, debt consisted of the historical debt of Viad, excluding the portion directly allocable to New Viad.

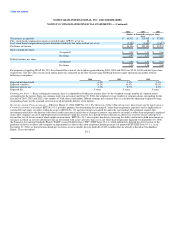

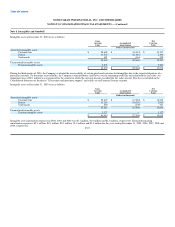

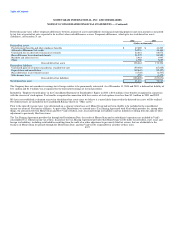

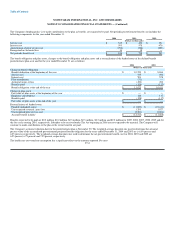

Scheduled annual maturities of amounts classified as debt at December 31, 2004 are shown below. Total interest paid on outstanding debt was $2.0 million,

$13.5 million and $18.6 million in 2004, 2003 and 2002, respectively.

Revolving Senior

Credit Term

Facility Loan Total

(Dollars in thousands)

2007 $ — $ 50,000 $ 50,000

2008 50,000 50,000 100,000

$ 50,000 $ 100,000 $ 150,000

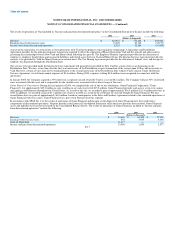

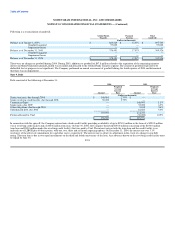

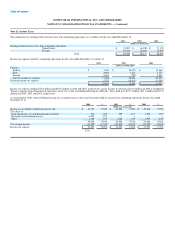

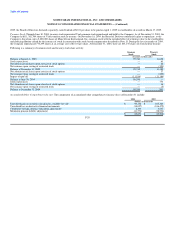

Note 10. $4.75 Preferred Stock Subject to Mandatory Redemption

Preferred stock consists of Viad's preferred stock, which Viad redeemed in connection with the spin-off for an aggregate call price of $23.9 million. At

December 31, 2003, Viad had 442,352 authorized shares of $4.75 preferred stock that were subject to mandatory redemption provisions with a stated value of

$100.00 per share, of which 328,352 shares were issued. Of the total shares issued, 234,983 shares were outstanding at a net carrying value of $6.7 million,

and 93,369 shares were held by Viad. On July 1, 2003, Viad adopted SFAS No. 150, Accounting for Certain Financial Instruments with Characteristics of

Both Liabilities and Equity, and accordingly, the $4.75 preferred stock was classified as a liability under the caption "Preferred stock subject to mandatory

redemption" in the Consolidated Balance Sheets. In addition, dividends of $0.6 million declared subsequent to the adoption of SFAS No. 150 have been

included as interest expense in the Consolidated Statements of Income. In periods prior to July 1, 2003, dividends on the $4.75 preferred stock were reported

as an adjustment to income to compute income available to common stockholders.

F-25