MoneyGram 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

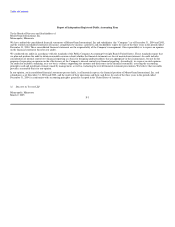

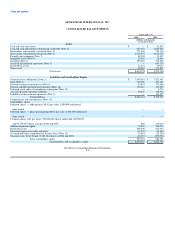

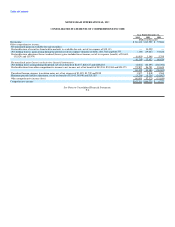

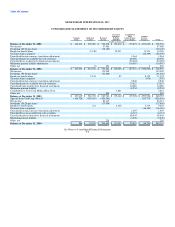

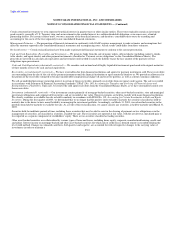

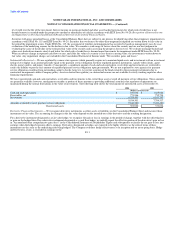

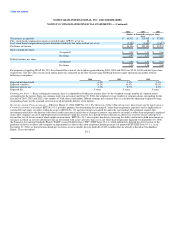

MONEYGRAM INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Year Ended December 31,

2004 2003 2002

(Dollars in thousands)

Net income $ 86,412 $113,902 $ 57,886

Other comprehensive income:

Net unrealized gains on available-for-sale securities:

Reclassification of securities from held-to-maturity to available-for-sale, net of tax expense of $18,133 — 30,222 —

Net holding (losses) gains arising during the period, net of tax expense (benefit) of ($66), ($11,788) and $32,777 (110) (19,647) 54,628

Reclassification adjustment for net realized (losses) gains included in net income, net of tax expense (benefit) of $3,603,

($1,829) and ($3,479) (6,005) 3,048 5,798

(6,115) 13,623 60,426

Net unrealized gains (losses) on derivative financial instruments:

Net holding losses arising during the period, net of tax benefit of $2,437, $25,617 and $108,184 (4,062) (42,695) (180,306)

Reclassifications from other comprehensive income to net income, net of tax benefit of $43,504, $52,069 and $50,175 72,507 86,781 83,624

68,445 44,086 (96,682)

Unrealized foreign currency translation gains, net of tax expense of $1,085, $1,709 and $938 1,807 2,848 1,564

Minimum pension liability adjustment, net of tax benefit of $1,943, $4,940 and $10,180 (3,238) (8,234) (16,967)

Other comprehensive income (loss) 60,899 52,323 (51,659)

Comprehensive income $147,311 $166,225 $ 6,227

See Notes to Consolidated Financial Statements.

F-6