MoneyGram 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

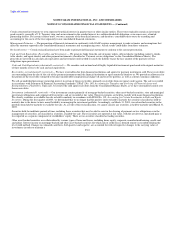

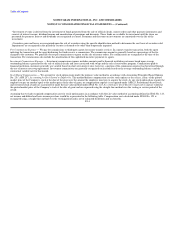

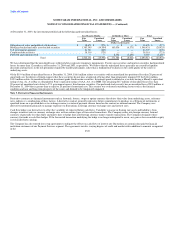

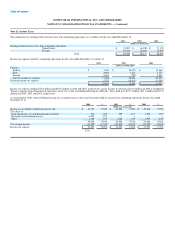

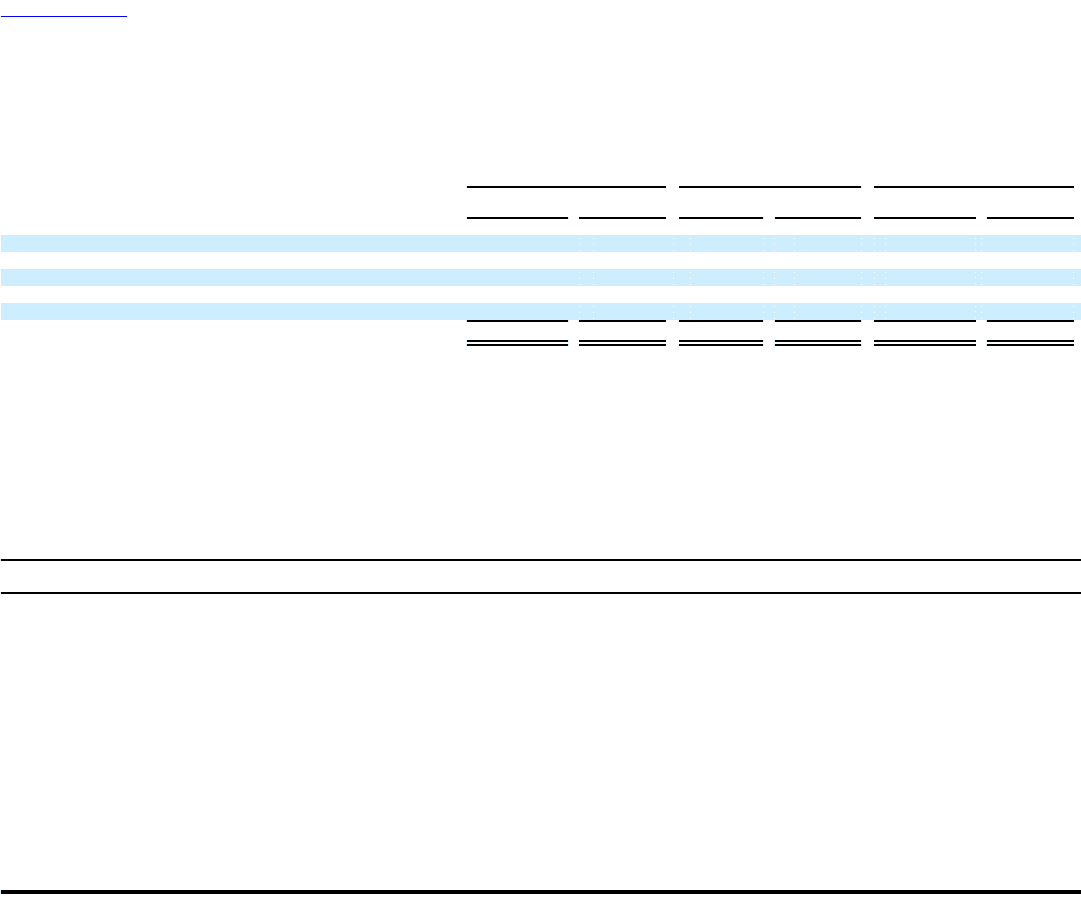

At December 31, 2003, the investment portfolio had the following aged unrealized losses:

Less Than 12 Months 12 Months or More Total

Fair Unrealized Fair Unrealized Fair Unrealized

Value Losses Value Losses Value Losses

(Dollars in thousands)

Obligations of states and political sub-divisions $ 18,670 $ (271) $ — $ — $ 18,670 $ (271)

Mortgage-backed and other asset-backed securities 1,383,395 (14,554) 163,036 (6,371) 1,546,431 (20,925)

U.S. government agencies 81,747 (405) — — 81,747 (405)

Corporate debt securities 38,319 (721) — — 38,319 (721)

Preferred and common stock — — 8,350 (1,650) 8,350 (1,650)

Total $ 1,522,131 $ (15,951) $ 171,386 $ (8,021) $ 1,693,517 $ (23,972)

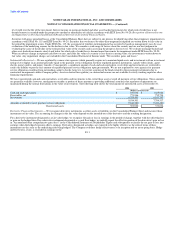

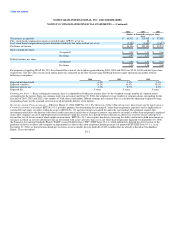

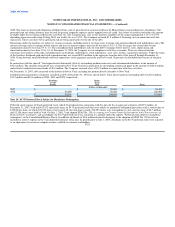

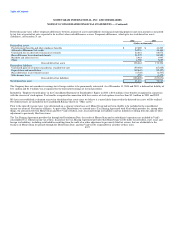

We have determined that the unrealized losses reflected above represent temporary impairments. Twenty-one securities and nineteen securities had unrealized

losses for more than 12 months as of December 31, 2004 and 2003, respectively. We believe that the unrealized losses generally are caused by liquidity

discounts and increases in the risk premiums required by market participants, rather than a fundamental weakness in the credit quality of the issuer or

underlying assets.

Of the $19.4 million of unrealized losses at December 31, 2004, $16.6 million relates to securities with an unrealized loss position of less than 20 percent of

amortized cost, the degree of which suggests that these securities do not pose a high risk of being other than temporarily impaired. Of the $16.6 million,

$15.9 million relates to unrealized losses on investment grade fixed income securities. Investment grade is defined as a security having a Moody's equivalent

rating of Aaa, Aa, A or Baa or a Standard & Poor's equivalent rating of AAA, AA, A or BBB. The remaining $0.7 million of unrealized losses less than

20 percent of amortized cost relates to U.S. government agency fixed income securities. One preferred stock security has an unrealized loss of $2.8 million at

December 31, 2004 that is greater than or equal to 20 percent of amortized cost. This security was evaluated considering factors such as the financial

condition and near and long-term prospects of the issuer and deemed to be temporarily impaired.

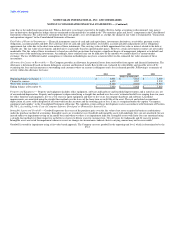

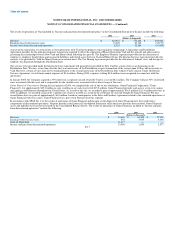

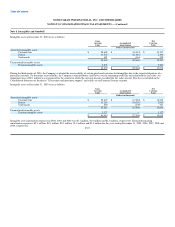

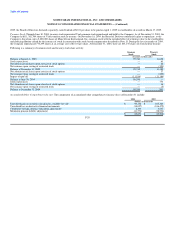

Note 5. Derivative Financial Instruments

Derivative contracts are financial instruments such as forwards, futures, swaps or option contracts that derive their value from underlying assets, reference

rates, indices or a combination of these factors. A derivative contract generally represents future commitments to purchase or sell financial instruments at

specified terms on a specified date or to exchange currency or interest payment streams based on the contract or notional amount. The Company uses

derivative instruments primarily to manage exposures to fluctuations in foreign currency exchange rates and interest rates.

Cash flow hedges use derivatives to offset the variability of expected future cash flows. Variability can arise in floating rate assets and liabilities, from

changes in interest rates or currency exchange rates or from certain types of forecasted transactions. The Company enters into foreign currency forward

contracts of generally less than thirty and ninety days to hedge forecasted foreign currency money transfer transactions. The Company designates these

currency forwards as cash flow hedges. If the forecasted transaction underlying the hedge is no longer anticipated to occur, any gain or loss recorded in equity

is reclassified into earnings.

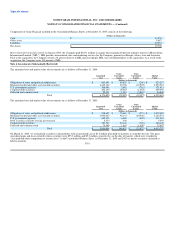

The Company has also entered into swap agreements to mitigate the effects on cash flows of interest rate fluctuations on commissions paid to financial

institution customers of our Payment Services segment. The agreements involve varying degrees of credit and market risk in addition to amounts recognized

in the F-20