MoneyGram 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

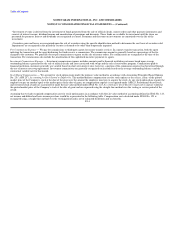

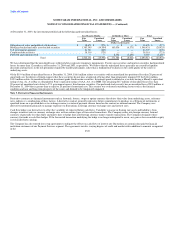

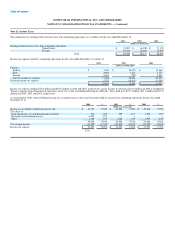

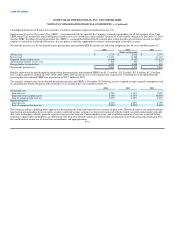

Following is a reconciliation of goodwill:

Global Funds Payment Total

Transfer Systems Goodwill

(Dollars in thousands)

Balance as of January 1, 2003 $ 280,629 $ 17,075 $ 297,704

Goodwill acquired 97,822 — 97,822

Impairment losses — — —

Balance as of December 31, 2003 378,451 17,075 395,526

Goodwill acquired — — —

Impairment losses — — —

Balance as of December 31, 2004 $ 378,451 $ 17,075 $ 395,526

There were no changes to goodwill during 2004. During 2003, additions to goodwill of $97.8 million related to the acquisition of the remaining minority

interest in MoneyGram International Limited was recorded and allocated to the Global Funds Transfer segment. The amount of goodwill expected to be

deductible for tax purposes is not significant. The Company performed an annual assessment of goodwill during the fourth quarter of 2004 and determined

that there was no impairment.

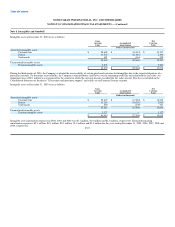

Note 9. Debt

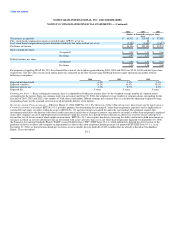

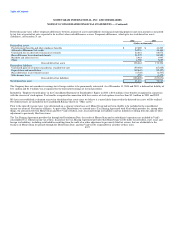

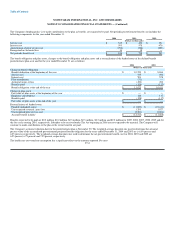

Debt consisted of the following at December 31:

2004 2003

Weighted Weighted

Average Average

Interest Interest

Amount Rate Amount Rate

(Dollars in thousands)

Senior term note, due through 2008 $ 100,000 2.79% $ —

Senior revolving credit facility, due through 2008 50,000 2.79% —

Commercial Paper — 168,000 1.1%

Senior notes, due 2009 — 35,000 6.3%

Other obligations, due through 2016 — 9,848 3.6%

Subordinated debt, due 2006 — 18,503 5.0%

150,000 231,351

Portion allocated to Viad — (30,000) 10.5%

$ 150,000 $ 201,351

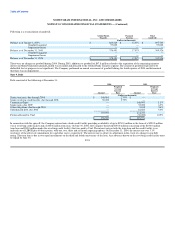

In connection with the spin-off, the Company entered into a bank credit facility providing availability of up to $350.0 million in the form of a $250.0 million

4 year revolving credit facility and a $100.0 million term loan. On June 30, 2004, the Company borrowed $150.0 million (consisting of the $100.0 million

term loan and $50.0 million under the revolving credit facility) that was paid to Viad. The interest rate on both the term loan and the credit facility is an

indexed rate of LIBOR plus 60 basis points, with one, two, three and six month repricing options. On December 31, 2004, the interest rate was 3.1%

(exclusive of the effects of commitment fees and other costs), respectively. The interest rate is subject to adjustment in the event of a change in our debt

rating. The term loan is due in two equal installments on the third and fourth anniversary of the loan. Any advances drawn on the revolving credit facility must

be repaid by June 30, F-24