MoneyGram 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

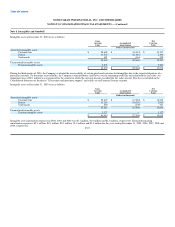

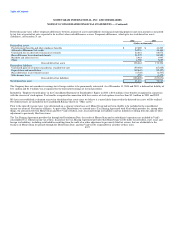

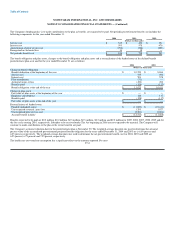

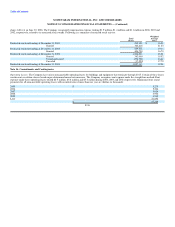

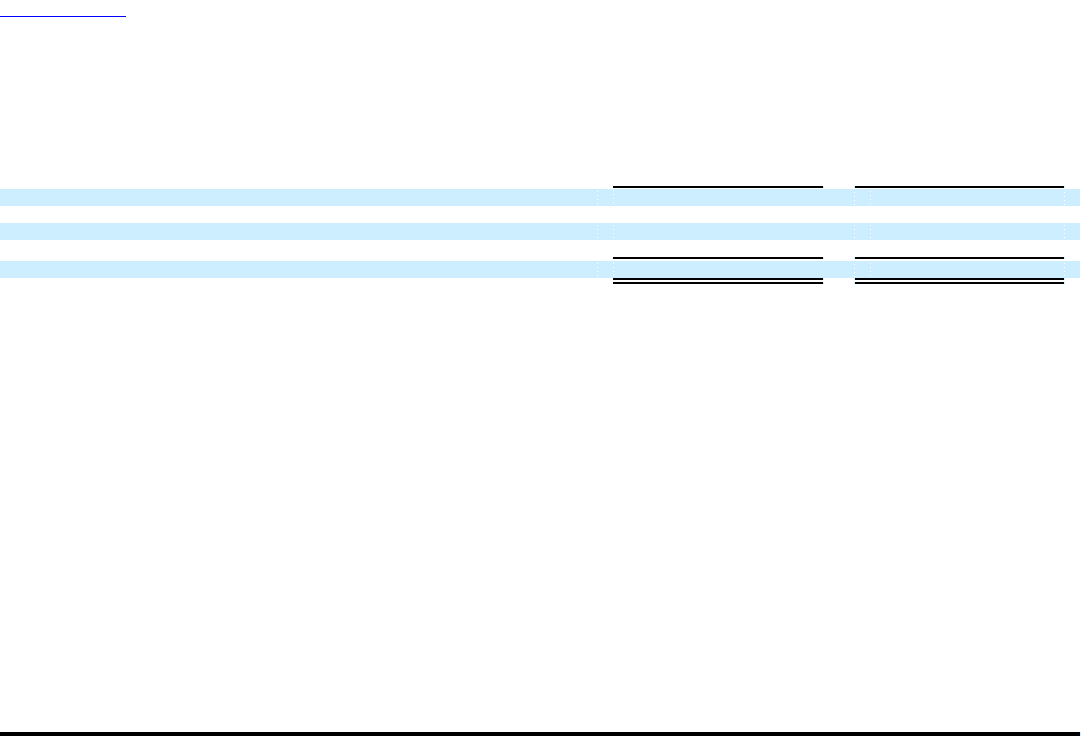

The Company's weighted average asset allocation for the funded pension plan by asset category at December 31 is as follows:

2004 2003

Equity securities 56.2% 54.4%

Fixed income securities 38.2% 35.3%

Real estate 2.6% 7.0%

Other 3.0% 3.3%

100.0% 100.0%

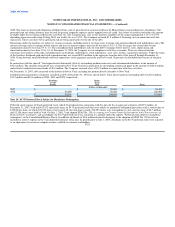

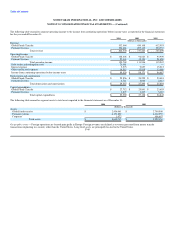

The Company employs a total return investment approach whereby a mix of equities and fixed income securities are used to maximize the long-term return of

plan assets for a prudent level of risk. Risk tolerance is established through careful consideration of plan liabilities, plan funded status and corporate financial

condition. The investment portfolio contains a diversified blend of equity and fixed income securities. Furthermore, equity securities are diversified across

U.S. and non-U.S. stocks, as well as growth, value and small and large capitalizations. Other assets such as real estate and cash are used judiciously to

enhance long-term returns while improving portfolio diversification. The Company strives to maintain an equity and fixed income securities allocation mix of

approximately 55 percent and 35 percent, respectively. Investment risk is measured and monitored on an ongoing basis through quarterly investment portfolio

reviews and annual liability measurements.

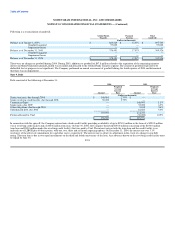

Postretirement Benefits Other Than Pensions — The Company has unfunded defined benefit postretirement plans that provide medical and life insurance for

eligible employees, retirees, and dependents. The related postretirement benefit liabilities are recognized over the period that services are provided by the

employees. Upon the Distribution, the Company assumed the benefit obligation for current and former employees assigned to MoneyGram. Viad retained the

benefit obligation for postretirement benefits other than pensions for all Viad and non-MoneyGram employees, with the exception of one executive.

In May 2004, the FASB issued FASB Staff Position ("FSP") FAS 106-2 on the accounting for the effects of the Medicare Prescription Drug, Improvement

and Modernization Act of 2004 (the "Act") which was enacted into law on December 8, 2003. The Act introduces a Medicare prescription drug benefit, as

well as a federal subsidy to sponsors of retiree health care plans that provide a benefit that is at least substantially equivalent to the Medicare benefit. The

Company made a one-time election, under the previously issued FSP FAS 106-1, to defer recognition of the effects of the Act until further authoritative

guidance was issued. With FSP FAS 106-2, which superceded FSP FAS 106-1, specific guidance was provided in accounting for the subsidy. The Company

adopted FSP FAS 106-2 in the third quarter of 2004 using the prospective method, which means the reduction of the Accumulated Postretirement Benefit

Obligation (APBO) of $1.4 million is recognized over future periods. This reduction in the APBO is due to a subsidy available on prescription drug benefits

provided to plan participants determined to be actuarially equivalent to the Act. While specific guidance regarding the determination as to whether a plan is

actuarially equivalent is not currently available, the Company believes that its postretirement plan will be actuarially equivalent to the Act. The postretirement

benefits expense for the second half of 2004 was reduced by $90,000 due to the reductions in the APBO and the current period service cost.

F-33