MoneyGram 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

remaining $200.0 million of the MoneyGram credit facilities is available for general corporate purposes.

Basis of Presentation

Our consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States of America ("GAAP").

The consolidated financial statements include the historical results of operations of Viad in discontinued operations in accordance with the provisions of

Statement of Financial Accounting Standards ("SFAS") No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. There are certain amounts

related to other investment income, debt and costs associated with Viad's centralized corporate functions that are related to Viad, but in accordance with

GAAP are not allowed to be reflected in discontinued operations as these costs were not specifically allocated to Viad subsidiaries. The consolidated financial

statements may not necessarily be indicative of our results of operations, financial position and cash flows in the future or what our results of operations,

financial position and cash flows would have been had we operated as a stand-alone company during the periods presented.

In March 2004, we completed the sale of Game Financial Corporation for approximately $43.0 million in cash. Game Financial Corporation provides cash

access services to casinos and gaming establishments throughout the United States. As a result of the sale, we recorded an after-tax gain of $11.4 million in

the first quarter of 2004. In addition, in June 2004, we recorded an after-tax gain of $1.1 million from the settlement of a lawsuit brought by Game Financial

Corporation. These amounts are reflected in the Consolidated Statements of Income in "Income and gain from discontinued operations, net of tax."

The "Income and gain from discontinued operations, net of tax" component in the consolidated statement of income contains the operating results of Viad,

including spin related costs of $14.6 million, in addition to the Game Financial Corporation gains totaling $12.5 million as described above. The following

discussion of our results of operations is focused on our continuing businesses.

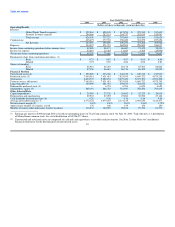

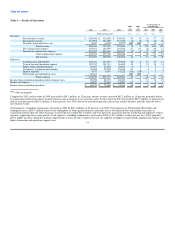

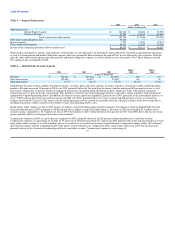

RESULTS OF OPERATIONS

Highlights

Following are highlights of operating results from continuing operations and trends in 2004:

• The Global Funds Transfer segment revenue grew 18 percent in 2004, driven by 28 percent revenue growth in money transfer.

• Our money order transaction volume was relatively flat in 2004, despite a market trend of declining paper-based instruments. Based on current industry

information, the trend in paper-based payment instruments is estimated to be an annual decline of five to eight percent.

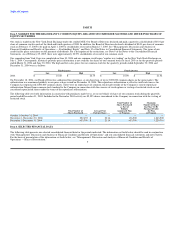

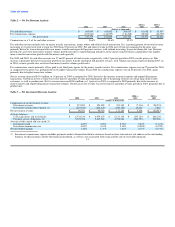

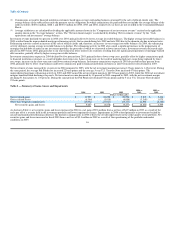

• The net investment margin of 1.42 percent (see Table 3) improved over the 2003 net investment margin of 1.30 percent primarily due to declining swap

costs.

• We had net securities gains of $9.6 million pre-tax in 2004 compared to net securities losses of $4.9 million in 2003. This improvement resulted primarily

from the early pay off of a security in the third quarter of 2004 for a gain and lower impairment costs as the overall credit quality of our portfolio improved

over 2003.

• A charge of $20.7 million pre-tax for preferred stock and debt redemption costs was incurred in connection with the spin-off.

• We wrote off capitalized technology costs primarily related to a discontinued development project with Concorde EFS in the third quarter of 2004. The

third quarter charge of $3.1 million pre-tax is included in "Transaction and operations support" expense.

• We wrote off other intangible assets related to acquired customer lists for a known departure of a customer in the third quarter of 2004. The charge of

$2.1 million pre-tax is included in "Transaction and operations support" expense.

• We incurred $10.2 million of spin-off transaction costs in the first half of 2004 as the accounting successor to Viad that could not be reflected in

discontinued operations.

In 2003 and 2002, we faced market challenges and difficult economic conditions. While our businesses experienced increased transaction volume and higher

investment balances, our operating income growth was slowed due to historically low interest rates and unprecedented mortgage refinancing activity. With

higher average float balances from greater numbers of 12