MoneyGram 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

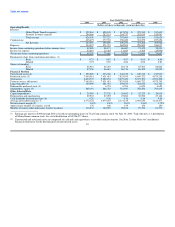

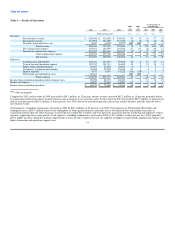

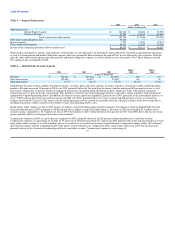

(3) Long-term debt for 2000 through 2003 represents Viad's long-term debt prior to the June 30, 2004 spin-off. In connection with the spin-off, Viad

repurchased $52.6 million of its medium-term notes and subordinated debt. In addition, Viad repaid $188.0 million of its outstanding commercial paper

and retired $9.0 million of industrial revenue bonds.

(4) Redeemable preferred stock relates solely to shares issued by Viad and redeemed in connection with the June 30, 2004 spin-off.

(5) Stockholders' equity for 2000 through 2003 represents Viad's capital structure prior to the June 30, 2004 spin-off.

(6) Cash dividends declared per share for 2000 through 2003 is based on dividends declared by Viad to holders of its common stock. Viad declared

dividends of $0.18 per share during the first half of 2004. MoneyGram declared dividends of $0.02 per share during the second half of 2004.

(7) Investable balances are comprised of cash and cash equivalents and investments.

(8) Net investment margin is determined as net investment revenue (investment revenue less investment commissions) divided by daily average investable

balances.

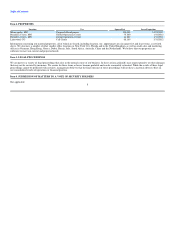

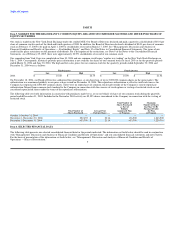

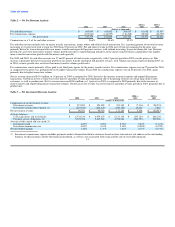

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with MoneyGram International, Inc.'s consolidated financial statements and related notes. This

discussion contains forward-looking statements that involve risks and uncertainties. MoneyGram's actual results could differ materially from those anticipated

due to various factors discussed under "Forward-Looking Statements" and elsewhere in this Annual Report on Form 10-K.

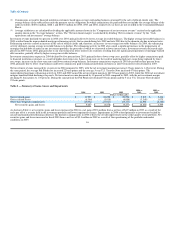

Our Separation from Viad Corp

On July 24, 2003, Viad announced a plan to separate its payment services segment, operated by Travelers, from its other businesses into a new company, and

to effect a tax-free distribution of its shares in that company to Viad's stockholders. On December 18, 2003, MoneyGram was incorporated in Delaware as a

subsidiary of Viad for the purpose of effecting the proposed distribution. On June 30, 2004, Travelers was merged with a wholly owned subsidiary of

MoneyGram, and then Viad distributed 88,556,077 shares of MoneyGram common stock to Viad stockholders in a tax-free distribution. Stockholders of Viad

received one share of MoneyGram common stock for every one share of Viad common stock owned.

The continuing business of Viad consists of the businesses of the convention show services, exhibit design and construction, and travel and recreation services

operations, including Viad's centralized corporate functions located in Phoenix, Arizona ("New Viad"). Notwithstanding the legal form of the spin-off, due to

the relative significance of MoneyGram to Viad, MoneyGram is considered the divesting entity and treated as the accounting successor to Viad for financial

reporting purposes in accordance with the Emerging Issues Task Force ("EITF") Issue No. 02-11 Accounting for Reverse Spin-offs. The spin-off of New Viad

has been accounted for pursuant to Accounting Principles Board ("APB") Opinion No. 29, Accounting for Non-Monetary Transactions. MoneyGram charged

$426.6 million directly to equity as a dividend, which is the historical cost carrying amount of the net assets of New Viad.

As part of the separation from Viad, we entered into a variety of agreements with Viad to govern each of our responsibilities related to the distribution. These

agreements include a Separation and Distribution Agreement, a Tax Sharing Agreement, an Employee Benefits Agreement and an Interim Services

Agreement. See "Business — Relationship with Viad."

In connection with the spin-off, we entered into a bank credit agreement providing availability of up to $350.0 million in the form of a $250.0 million

revolving credit facility and a $100.0 million term loan. On June 30, 2004, we borrowed $150.0 million under this facility, which was paid to and used by

Viad to repay $188.0 million of its commercial paper. Viad also retired a substantial majority of its outstanding subordinated debentures and medium term

notes for an aggregate amount of $52.6 million (including a tender premium), retired industrial revenue bonds of $9.0 million and redeemed outstanding

preferred stock at an aggregate call price of $23.9 million. The 11