MoneyGram 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

pliance with anti-money laundering requirements. We have established internal policies relating to business conduct, ethics and compliance with applicable

requirements, as well as procedures designed to ensure that these policies are followed.

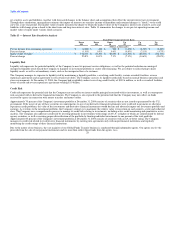

Foreign Currency Exchange Risk

Foreign currency exchange risk represents the potential adverse effect on the Company's earnings from fluctuations in foreign exchange rates affecting certain

receivables and payables denominated in foreign currencies. The Company is primarily affected by fluctuations in the U.S. dollar as compared to the British

pound and the Euro. The foreign currency exposure that does exist is limited by the fact that foreign currency denominated assets and liabilities are generally

very short-term in nature. The Company primarily utilizes forward contracts to hedge its exposure to fluctuations in exchange rates. These forward contracts

generally have maturities of less than thirty days. The forward contracts are recorded on the Consolidated Balance Sheets, and the net effect of changes in

exchange rates and the related forward contracts is not significant.

Had the British pound and Euro increased up to twenty percent over actual exchange rates for 2004, pre-tax operating income would have seen a benefit of up

to $1.1 million for the year. Had the British pound and Euro decreased up to twenty percent over actual exchange rates for 2004, pre-tax operating income

would have seen a decrease of up to $1.7 million for the year. This sensitivity analysis considers both the impact on translation of our foreign denominated

revenue and expense streams and the impact on our hedging program.

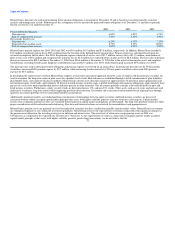

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with GAAP requires estimates and assumptions that affect the reported amounts of assets and liabilities,

revenues and expenses, and related disclosures of contingent assets and liabilities in the consolidated financial statements. Critical accounting policies are

those policies that management believes are most important to the portrayal of a company's financial position and results of operations, and that require

management to make estimates that are difficult, subjective or complex. Based on this criteria, management has identified and discussed with the Audit

Committee the following critical accounting policies and estimates, and the methodology and disclosures related to those estimates:

Fair Value of Investment Securities — Our investment securities are classified as available-for-sale, including securities being held for indefinite periods of

time and those securities that may be sold to assist in the clearing of payment service obligations or in the management of securities. These securities are

carried at market value (or fair value), with the net after-tax unrealized gain or loss reported as a separate component of stockholders' equity. Fair value is

generally based on quoted market prices. However, certain investment securities are not readily marketable. As a result, the carrying value of these

investments is based on cash flow projections that require a significant degree of management judgment as to default and recovery rates of the underlying

investments. Accordingly, the estimates determined may not be indicative of the amounts that could be realized in a current market exchange. The use of

different market assumptions or valuation methodologies may have a material effect on the estimated fair value amounts. In general, as interest rates increase,

the fair value of the available-for-sale portfolio and stockholders' equity decreases and as interest rates fall, the fair value of the available-for-sale portfolio

increases, along with stockholders' equity.

Other Than Temporary Impairments — Securities with gross unrealized losses at the consolidated balance sheet date are subjected to the Company's process

for identifying other-than-temporary impairments in accordance with SFAS No. 115, Accounting For Certain Investments in Debt and Equity Securities, and

EITF Issue No. 99-20, Recognition of Interest Income and Impairment on Purchased and Retained Beneficial Interests in Securitized Financial Assets. The

Company writes down to fair value securities that it deems to be other-then-temporarily impaired in the period the securities are deemed to be impaired.

Under SFAS No. 115, the assessment of whether such impairment has occurred is based on management's case-by-case evaluation of the underlying reasons

for the decline in fair value. Management considers a wide range of factors about the security and uses its best judgment in evaluating the cause of the decline

in the estimated fair value of the security and in assessing the prospects for recovery. The Company evaluates investments rated A and below for which risk of

credit loss is deemed more than remote for impairment under EITF 30