MoneyGram 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

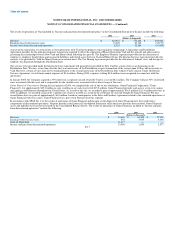

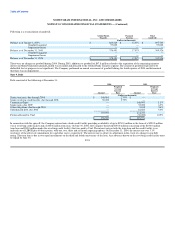

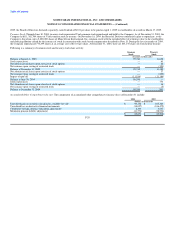

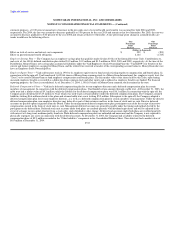

Note 11. Income Taxes

The components of earnings before income taxes from continuing operations are as follows for the year ended December 31:

2004 2003 2002

(Dollars in thousands)

Earnings before income taxes from continuing operations:

United States $ 53,507 $ 64,259 $ 71,178

Foreign 35,513 23,912 15,509

Total $ 89,020 $ 88,171 $ 86,687

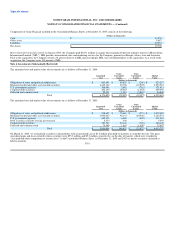

Income tax expense related to continuing operations for the year ended December 31 consists of:

2004 2003 2002

(Dollars in thousands)

Current:

Federal $ 4,386 $ 24,370 $ 15,346

State 4,962 3,233 3,771

Foreign 8,261 (702) 3,856

Current income tax expense 17,609 26,901 22,973

Deferred income tax expense 6,282 (14,416) (11,050)

$ 23,891 $ 12,485 $ 11,923

Income tax expense totaling $13.8 million and $25.0 million in 2004 and 2003, respectively, and an income tax benefit of $11.0 million in 2002 is included in

"Income and gain from discontinued operations, net of tax" in the Consolidated Statement of Income. Taxes paid were $35.7 million, $24.1 million and $31.4

million for 2004, 2003 and 2002, respectively.

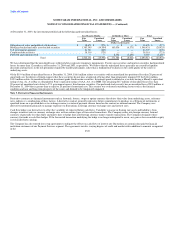

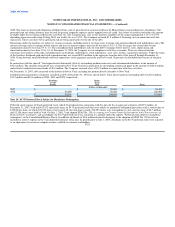

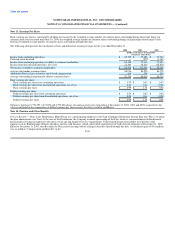

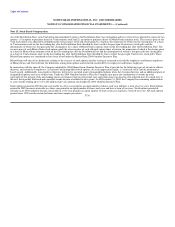

A reconciliation of the expected federal income tax at statutory rates to the actual taxes provided on income from continuing operations for the year ended

December 31 is:

2004 % 2003 % 2002 %

(Dollars in thousands)

Income tax at statutory federal income tax rate $ 31,157 35.0% $ 30,860 35.0% $ 30,340 35.0%

Tax effect of:

State income tax, net of federal income tax effect 910 1.0% 959 1.1% 1,293 1.5%

Preferred stock redemption costs 6,004 6.7% — — — —

Other 1,348 1.5% 1,166 1.3% 1,993 2.3%

39,419 44.2% 32,985 37.4% 33,626 38.8%

Tax-exempt income (15,528) (17.4%) (20,500) (23.2%) (21,703) (25.0%)

Income tax expense $ 23,891 26.8% $ 12,485 14.2% $ 11,923 13.8%

F-26