MoneyGram 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

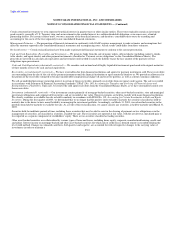

Note 1. Description of the Business

MoneyGram International, Inc. offers products and services including global money transfer, urgent bill payment services, issuance and processing of money

orders, processing of official checks and share drafts, controlled disbursement processing and routine bill payment service. These products and services are

offered to consumers and businesses through a network of agents and financial institution customers located around the world.

On December 18, 2003, MoneyGram International, Inc. ("MoneyGram") was incorporated in the state of Delaware as a subsidiary of Viad Corp ("Viad") to

effect the spin off of Viad's payment services business operated by Travelers Express Company, Inc. ("Travelers") to its stockholders. On June 30, 2004 (the

"Distribution Date"), Travelers was merged with a subsidiary of MoneyGram, and Viad then distributed 88,556,077 million shares of MoneyGram common

stock in a tax-free distribution (the "Distribution"). Stockholders of Viad received one share of MoneyGram common stock for every share of Viad common

stock owned on the record date, June 24, 2004. Due to the relative significance of MoneyGram to Viad, MoneyGram is the divesting entity and treated as the

"accounting successor" to Viad for financial reporting purposes in accordance with Emerging Issues Task Force ("EITF") Issue No. 02-11, Accounting for

Reverse Spinoffs. See Note 3 regarding the spin-off transaction and resulting discontinued operations of Viad. References to "MoneyGram," the "Company,"

"we," "us" and "our" are to MoneyGram International, Inc. and its subsidiaries and consolidated entities.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation — The consolidated financial statements of MoneyGram are prepared in conformity with accounting principles generally accepted in

the United States of America ("GAAP"). The Consolidated Balance Sheets are unclassified due to the short-term nature of the settlement obligations,

contrasted with the ability to invest cash awaiting settlement in long-term investment securities.

Principles of Consolidation — The consolidated financial statements include the accounts of MoneyGram International, Inc. and its subsidiaries. All material

inter-company profits, transactions, and account balances have been eliminated in consolidation.

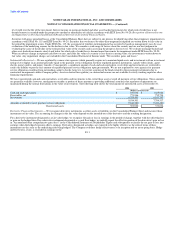

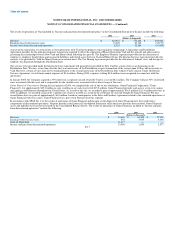

Consolidation of Special Purpose Entities — We participate in various trust arrangements (special purpose entities) related to official check processing

agreements with financial institutions and structured investments within the investment portfolio. These special purpose entities are included in our

consolidated financial statements. Working in cooperation with certain financial institutions, we have established separate consolidated entities (special-

purpose entities) and processes that provide these financial institutions with additional assurance of our ability to clear their official checks. These processes

include maintenance of specified ratios of segregated investments to outstanding payment instruments, typically 1 to 1. In some cases, alternative credit

support has been purchased that provides backstop funding as additional security for payment of instruments. However, we remain liable to satisfy the

obligations, both contractually and by operation of the Uniform Commercial Code, as issuer and drawer of the official checks. Accordingly, the obligations

have been recorded in the Consolidated Balance Sheets under "Payment service obligations." Under certain limited circumstances, clients have the right to

either demand liquidation of the segregated assets or to replace us as the administrator of the special-purpose entity. Such limited circumstances consist of

material (and in most cases continued) failure of MoneyGram to uphold its warranties and obligations pursuant to its underlying agreements with the financial

institution clients. While an orderly liquidation of assets would be required, any of these actions by a client could nonetheless diminish the value of the total

investment portfolio, decrease earnings, and result in loss of the client or other customers or prospects. We offer the special purpose entity to certain financial

institution clients as a benefit unique in the payment services industry. F-9