MoneyGram 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Product Development and Enhancements

Our product development activities have focused on new ways to transfer money and pay bills. In March 2004, we launched our MoneyGram eMoney

Transfer service that allows online money transfers and bill payments to be initiated on our website using credit cards and bank account debits. We are

developing a prepaid debit card that we plan to introduce in the first half of 2005. The debit card would allow customers to load cash onto a card that can be

used to make purchases and ATM withdrawals. The cards would be reloadable at designated MoneyGram agent locations. In addition, we are enhancing our

systems to provide customers with the ability to transfer money directly into a bank account. We believe these features will provide customers with added

flexibility and convenience to help meet their financial services needs.

Competition

The various industries in which we operate are very competitive, and we face a variety of competitors across our businesses. New competitors or alliances

among established companies may emerge. We compete for agents and financial institution customers on the basis of value, service, quality, technical and

operational differences, price and financial incentives paid to agents once they have entered into an agreement. In turn, we compete for consumers on the basis

of number and location of agent locations, price, convenience and technology.

The Global Funds Transfer segment of our business competes in a concentrated industry, with a small number of large competitors and a large number of

small, niche competitors. Our large competitors are other providers of money orders and money transfer services, including Western Union, a subsidiary of

First Data Corporation, other subsidiaries of First Data Corporation and the U.S. Postal Service with respect to money orders. We also compete with banks

and niche person-to-person money transfer service providers that serve select send and receive corridors.

The Payment Systems segment of our business competes in a concentrated industry with a small number of large competitors. Our competitors in this segment

are Integrated Payment Systems, a subsidiary of First Data Corporation, and Federal Home Loan Banks. We also compete with financial institutions that have

developed internal processing capabilities or services similar to ours and do not outsource these services.

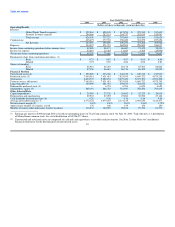

Regulation

Compliance with legal requirements and government regulations is an integral part of our operations. Financial transaction reporting and state banking

department regulations also affect our business.

As a money order issuer and a money transmitter, we must comply with a number of domestic and international regulatory requirements, including:

• state licensing laws;

• federal and state anti-money laundering and the federal government's Office of Foreign Assets Control ("OFAC") regulations;

• laws of various foreign countries regulating the ability to conduct a money transfer business and requiring compliance with anti-money laundering

regulations;

• state unclaimed property reporting; and

• state, federal and international privacy laws.

In the United States, 45 states, the District of Columbia and Puerto Rico require us to be licensed in order to conduct business within their jurisdiction.

Requirements to be so licensed generally include minimum net worth, surety bonds, operational procedures and reserves or "permissible investments" that

must be maintained in an amount equivalent to all outstanding payment obligations issued by us. The types of securities that are considered "permissible

investments" vary from state to state, but generally include U.S. government securities and other highly rated debt instruments. Most states require us to file

reports on a quarterly or more frequent basis, verifying our compliance with their requirements.

Internationally, we are registered as required in Germany, the Netherlands, Switzerland and the United Kingdom. The regulatory requirements in Germany

and the United Kingdom are focused mainly on money laundering prevention. In addition, many international jurisdictions impose restrictions on the type of

entity that can serve as a money transfer agent. In some jurisdictions, we are restricted to doing business with banks or other licensed financial entities.

We and our agents are required to report suspicious activity. In addition, under the Patriot Act, money service businesses, including our agents, are required

4