MoneyGram 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

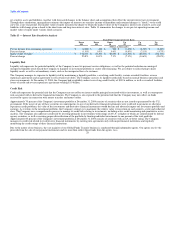

actual return for one year is significantly different from the expected return used to determine the benefit obligation. Changing the expected rate of return by

50 basis points would have increased 2004 pension expense by $0.5 million.

Future actual pension income or expense will depend on future investment performance, changes in future rates and various other factors related to the

populations participating in MoneyGram's pension plans.

Stock-based compensation — As permitted by SFAS No. 123, Accounting for Stock-Based Compensation and SFAS No. 148, Accounting for Stock-Based

Compensation-Transition and Disclosure, MoneyGram uses the intrinsic value method prescribed by APB Opinion No. 25,Accounting for Stock Issued to

Employees, and related interpretations in accounting for its stock-based compensation plans. Under our stock option plans, options are granted at exercise

prices equal to the market price of our stock on the date of grant; accordingly, under APB 25, no compensation expense is recognized on these options. Under

our restricted stock and performance based restricted stock plans, compensation expense is measured under APB 25 at the market price of our stock on the

date of grant and is recognized over the vesting period of the award. See Note 2 of the Notes to the Consolidated Financial Statements for the pro forma

impact of stock-based awards using the fair value method of accounting. As described in Note 2 of the Notes to the Consolidated Financial Statements, the

Company will be required to use the fair value method to account for its stock-based compensation plans beginning in 2005 under the newly issued SFAS

No. 123R, Share-Based Payment.

Recent Accounting Developments

Recent accounting developments are set forth in Note 2 of the Notes to the Consolidated Financial Statements.

FORWARD LOOKING STATEMENTS

The statements contained in this Annual Report on Form 10-K that are not historical facts are forward-looking statements and are made under the Safe Harbor

provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and are subject to

uncertainty and changes in circumstances due to a number of factors, including, but not limited to:

• Interest Rate Fluctuations. Fluctuations in interest rates may materially adversely affect revenue derived from investment of funds received from the sale

of our payment instruments. See "Enterprise Risk Management — Interest Rate Risk" above.

• Market Value of Securities. Material changes in the market value of securities we hold may materially adversely affect our results of operation and

financial condition. See "Enterprise Risk Management — Interest Rate Risk" above.

• Liquidity. Material changes in our need for and the availability of liquid assets may affect our ability to meet our payment service obligations and may

materially adversely affect our results of operation and financial condition. See "Enterprise Risk Management — Liquidity Risk" above.

• Credit Risk. If an issuer of securities in our investment portfolio defaulted on its payment obligations, the value of our securities would decline, adversely

affecting the value of our investment portfolio. In addition, we may face credit risk if we are unable to collect on funds received by agents for our products

and services or if we experience fraud. See "Enterprise Risk Management — Credit Risk" above.

• Business Interruption. We may suffer direct or indirect losses resulting from inadequate or failed internal processes, people and systems or from third

parties or external events. See "Enterprise Risk Management — Operational Risk" above.

• International. Our business and results of operations may be adversely affected by political, economic or other instability in countries in which we have

material agent relationships. See "Enterprise Risk Management — Operational Risk" above.

• Security. We may be subject to a material breach of security of any of our systems. See "Enterprise Risk Management — Operational Risk" above.

• Regulation. Changes in laws, regulations or other industry practices and standards may require

33