MoneyGram 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

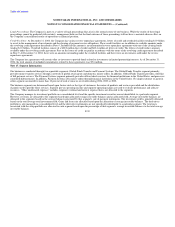

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

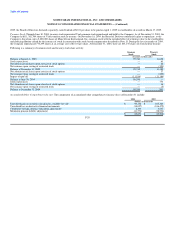

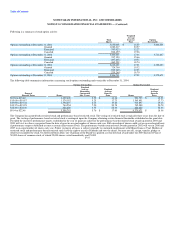

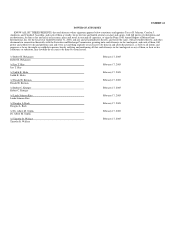

shares will vest on June 30, 2006. The Company recognized compensation expense totaling $1.9 million, $1.4 million and $1.1 million in 2004, 2003 and

2002, respectively, related to its restricted stock awards. Following is a summary of restricted stock activity:

Weighted

Total Average

Shares Price

Restricted stock outstanding at December 31, 2001 295,900 $ 16.58

Granted 363,616 21.23

Restricted stock outstanding at December 31, 2002 659,516 19.14

Granted 406,700 16.70

Restricted stock outstanding at December 31, 2003 1,066,216 18.21

Granted 342,900 19.52

Vested and issued (294,721) 16.62

Canceled (17,250) 17.70

Restricted stock outstanding at December 31, 2004 1,097,145 19.06

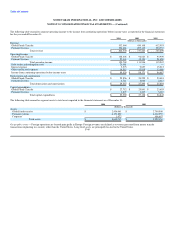

Note 16. Commitments and Contingencies

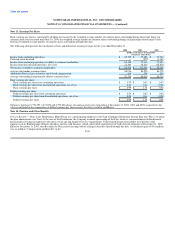

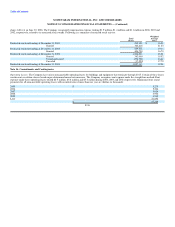

Operating Leases: The Company has various noncancelable operating leases for buildings and equipment that terminate through 2015. Certain of these leases

contain rent escalation clauses based on pre-determined annual rate increases. The Company recognizes rent expense under the straight-line method. Rent

expense under these operating leases totaled $6.5 million, $5.8 million and $5.4 million during 2004, 2003 and 2002 respectively. Minimum future rental

payments for all noncancelable operating leases with an initial term of more than one year are (dollars in thousands):

2005 $ 5,279

2006 5,266

2007 5,014

2008 4,906

2009 4,932

Later 21,892

$ 47,289

F-38