MoneyGram 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

2002 related to normal payments on debt of $44.2 million, payment of dividends totaling $32.1 million and the acquisition of treasury stock at a cost of

$28.3 million. Borrowings under the revolver increased $6.5 million in 2002 and the Company received proceeds upon stock option exercises totaling

$10.4 million. All 2003 and 2002 financing activities relate to actions taken by Viad.

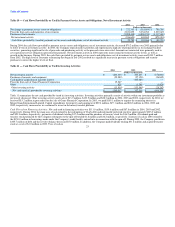

Other Funding Sources and Requirements

In connection with the spin-off, MoneyGram entered into a bank credit facility providing availability of up to $350.0 million in the form of a $250.0 million

four-year revolving credit facility and a $100.0 million term loan. On June 30, 2004, the Company borrowed $150.0 million (consisting of the $100.0 million

term loan and $50.0 million under the revolving credit facility) and used all of the proceeds to pay merger consideration to Viad in connection with the spin-

off. The remaining amount of the credit facility is available for general corporate purposes and to support letters of credit. The interest rate on both the term

loan and the credit facility is LIBOR plus 60 basis points, subject to adjustment in the event of a change in our debt rating. The term loan is due in two equal

installments on the third and fourth anniversary of the loan. The revolving credit facility expires on June 30, 2008. The loans are guaranteed on an unsecured

basis by MoneyGram's material domestic subsidiaries. Borrowings under the bank credit facilities are subject to various covenants, including interest

coverage ratio, leverage ratio and consolidated total indebtedness ratio. The interest coverage ratio of earnings before interest and taxes to interest expense

must not be less than 3.5 to 1.0. The leverage ratio of total debt to total capitalization must be less than 0.5 to 1.0. The consolidated total indebtedness ratio of

total debt to earnings before interest, taxes, depreciation and amortization must be less than 3.0 to 1.0. At December 31, 2004, we were in compliance with

these covenants. There are other restrictions that are customary for facilities of this type including limits on dividends, indebtedness, stock repurchases, asset

sales, mergers, acquisitions and liens. Under the facility, our aggregate annual dividends and stock repurchases generally may not exceed 30 percent of

consolidated net income of the prior year.

At December 31, 2004, we had reverse repurchase agreements, letters of credit and various overdraft facilities totaling $1.9 billion available to assist in the

management of our investments and the clearing of payment service obligations. There where no amounts outstanding under the reverse repurchase

agreements or the overdraft facilities at December 31, 2004.

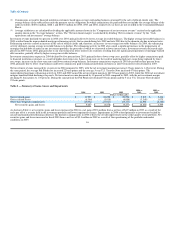

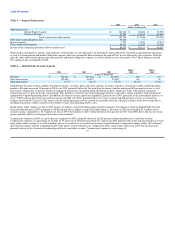

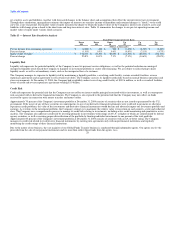

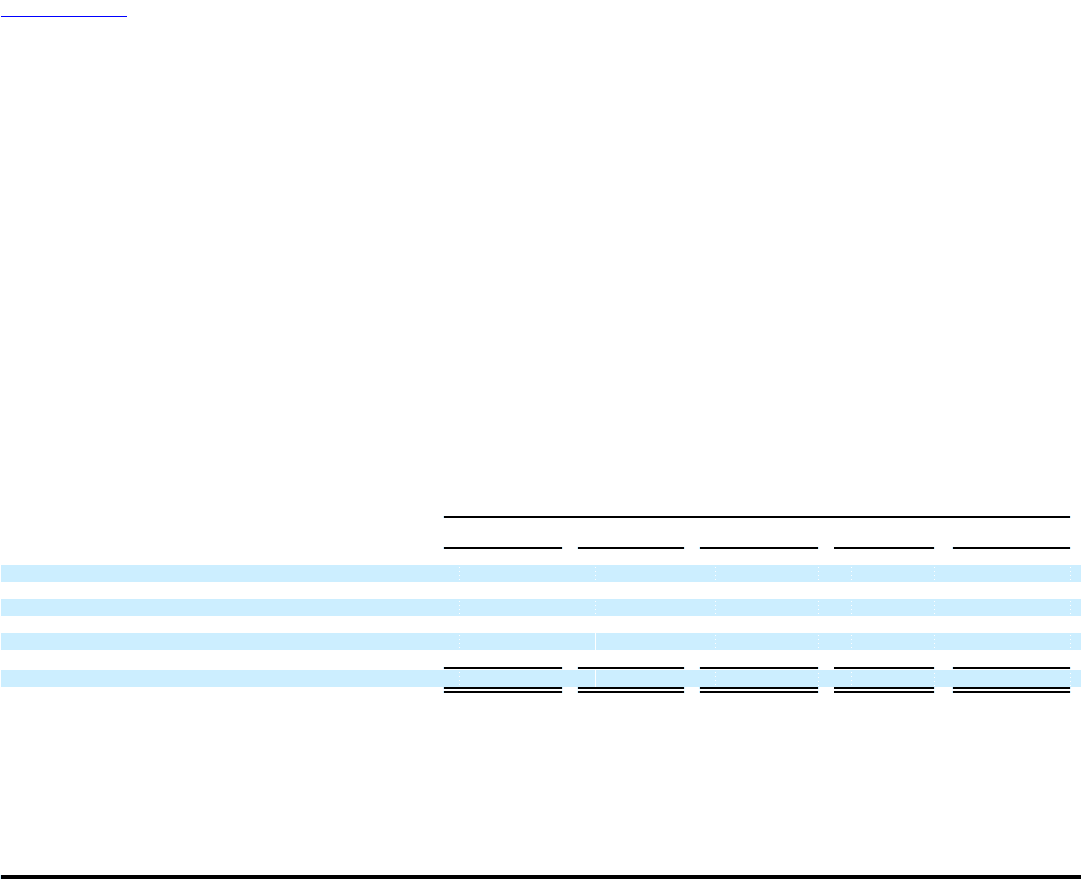

Table 12 — Contractual Obligations

Payments due by period

Less than More than

Total 1 year 1-3 years 3-5 years 5 years

(Dollars in thousands)

Debt $ 150,000 $ — $ 150,000 $ — $ —

Capital lease obligations 560 240 320 — —

Operating leases 47,289 5,280 10,280 9,838 21,891

Derivative financial instruments 56,879 47,197 14,767 (4,575) (510)

Interim services agreement 2,461 1,641 820 — —

Other obligations 9,627 9,157 470 — —

Total contractual cash obligations $ 266,816 $ 63,515 $ 176,657 $ 5,263 $ 21,381

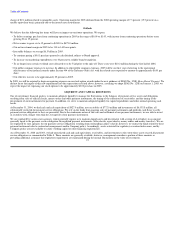

Debt consists of amounts outstanding under the term loan and revolving credit facility at December 31, 2004, as described in "Other Funding Sources."

Capital and operating leases consist of various leases relating to buildings and equipment. Derivative financial instruments represent the net payable

(receivable) under our interest rate swap agreements. The interim services agreement is the obligation under our agreement with Viad for certain services to

be provided to the Company as described in Note 3 of the Notes to the Consolidated Financial Statements. Other obligations are unfunded capital

commitments related to our limited partnership interests included in our investment portfolio.

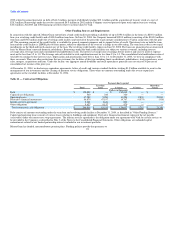

MoneyGram has funded, noncontributory pension plans. Funding policies provide that payments to

24