Metro PCS 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.86

third parties or the FCC. We believe that our existing cash, cash equivalents and short-term investments and our

anticipated cash flows from operations will be sufficient to fully fund planned expansion.

The construction of our network and the marketing and distribution of our wireless communications products and

services have required, and will continue to require, substantial capital investment. Capital outlays have included

license acquisition costs, capital expenditures for construction of our network infrastructure, costs associated with

clearing and relocating non-governmental incumbent licenses, funding of operating cash flow losses incurred as we

launch services in new metropolitan areas and other working capital costs, debt service and financing fees and

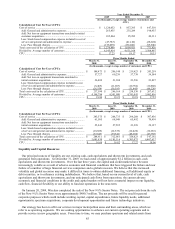

expenses. Our capital expenditures for the years ended December 31, 2009, 2008 and 2007 were approximately

$831.7 million, $954.6 million and $767.7 million, respectively. These expenditures were primarily associated with

the construction of the network infrastructure in our Northeast Markets and our efforts to increase the service area

and capacity of our existing Core Markets network through the addition of cell sites, DAS, and switches. We

believe the increased service area and capacity in existing markets will improve our service offerings, helping us to

attract additional customers and retain existing customers and increase revenues.

In September 2009, Wireless entered into a Master Procurement Agreement , or MPA, with a network

infrastructure and equipment provider under which the provider will sell and license to Wireless on a non-exclusive

basis long-term evolution, or LTE, system products and services, or collectively the LTE Products and Services.

The initial term of the MPA, unless earlier terminated in accordance with the terms of the MPA, continues to the

earlier to occur of four years or the date which Wireless has purchased a minimum number of certain products under

the MPA. Upon the conclusion of the initial term, at Wireless’ sole option, the MPA may be renewed on an annual

basis for up to five one-year renewal terms. The MPA includes discounts and incentives for Wireless’ purchase and

licensing of LTE Products and Services, and provides that, except in certain circumstances, Wireless will make

certain prepayments for LTE Products and Services during the first fourteen months of the initial term. Except as

may be otherwise permitted at certain times under the MPA, if Wireless (i) terminates the MPA before the end of the

initial term without cause or Wireless does not renew the MPA after the initial term and (ii) has not purchased a

minimum number of certain products, Wireless will be obligated to pay for certain products previously delivered

and accepted and may also have to pay certain liquidated damages.

As of December 31, 2009, we owed an aggregate of approximately $3.5 billion under our senior secured credit

facility and 9¼% senior notes as well as approximately $181.2 million under our capital lease obligations.

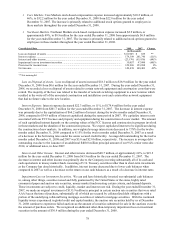

Our senior secured credit facility calculates consolidated Adjusted EBITDA as: consolidated net income plus

depreciation and amortization; gain (loss) on disposal of assets; non-cash expenses; gain (loss) on extinguishment of

debt; provision for income taxes; interest expense; and certain expenses of MetroPCS Communications, Inc. minus

interest and other income and non-cash items increasing consolidated net income.

We consider consolidated Adjusted EBITDA, as defined above, to be an important indicator to investors because

it provides information related to our ability to provide cash flows to meet future debt service, capital expenditures

and working capital requirements and fund future growth. We present consolidated Adjusted EBITDA because

covenants in our senior secured credit facility contain ratios based on this measure. Other wireless carriers may

calculate consolidated Adjusted EBITDA differently. If our consolidated Adjusted EBITDA were to decline below

certain levels, covenants in our senior secured credit facility that are based on consolidated Adjusted EBITDA,

including our maximum senior secured leverage ratio covenant, may be violated and could cause, among other

things, an inability to incur further indebtedness and in certain circumstances a default or mandatory prepayment

under our senior secured credit facility. Our maximum senior secured leverage ratio is required to be less than 4.5 to

1.0 based on consolidated Adjusted EBITDA plus the impact of certain new markets. The lenders under our senior

secured credit facility use the senior secured leverage ratio to measure our ability to meet our obligations on our

senior secured debt by comparing the total amount of such debt to our consolidated Adjusted EBITDA, which our

lenders use to estimate our cash flow from operations. The senior secured leverage ratio is calculated as the ratio of

senior secured indebtedness to consolidated Adjusted EBITDA, as defined by our senior secured credit facility. For

the twelve months ended December 31, 2009, our senior secured leverage ratio was 1.67 to 1.0, which means for

every $1.00 of consolidated Adjusted EBITDA, we had $1.67 of senior secured indebtedness. In addition,

consolidated Adjusted EBITDA is also utilized, among other measures, to determine management’s compensation

levels. Consolidated Adjusted EBITDA is not a measure calculated in accordance with GAAP, and should not be

considered a substitute for operating income, net income, or any other measure of financial performance reported in

accordance with GAAP. In addition, consolidated Adjusted EBITDA should not be construed as an alternative to,

or more meaningful than cash flows from operating activities, as determined in accordance with GAAP.