Metro PCS 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

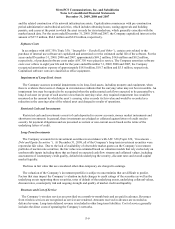

F-3

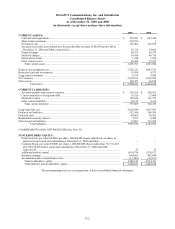

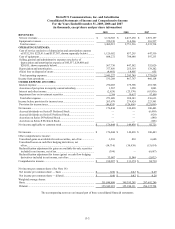

MetroPCS Communications, Inc. and Subsidiaries

Consolidated Statements of Income and Comprehensive Income

For the Years Ended December 31, 2009, 2008 and 2007

(in thousands, except share and per share information)

2009 2008 2007

REVENUES:

Service revenues .................................................................................... $ 3,130,385 $ 2,437,250 $ 1,919,197

Equipment revenues............................................................................... 350,130 314,266 316,537

Total revenues....................................................................................... 3,480,515 2,751,516 2,235,734

OPERATING EXPENSES:

Cost of service (exclusive of depreciation and amortization expense

of $332,319, $225,911 and $157,387, shown separately below) ......... 1,120,052 857,295 647,510

Cost of equipment.................................................................................. 884,272 704,648 597,233

Selling, general and administrative expenses (exclusive of

depreciation and amortization expense of $45,537, $29,408 and

$20,815, shown separately below)....................................................... 567,730 447,582 352,020

Depreciation and amortization............................................................... 377,856 255,319 178,202

(Gain) loss on disposal of assets ............................................................ (4,683) 18,905 655

Total operating expenses....................................................................... 2,945,227 2,283,749 1,775,620

Income from operations.......................................................................... 535,288 467,767 460,114

OTHER EXPENSE (INCOME):

Interest expense ..................................................................................... 270,285 179,398 201,746

Accretion of put option in majority-owned subsidiary........................... 1,567 1,258 1,003

Interest and other income....................................................................... (2,629) (23,170) (63,936)

Impairment loss on investment securities .............................................. 2,386 30,857 97,800

Total other expense............................................................................... 271,609 188,343 236,613

Income before provision for income taxes.............................................. 263,679 279,424 223,501

Provision for income taxes..................................................................... (86,835) (129,986) (123,098)

Net income.............................................................................................. 176,844 149,438 100,403

Accrued dividends on Series D Preferred Stock .................................... — — (6,499)

Accrued dividends on Series E Preferred Stock..................................... — — (929)

Accretion on Series D Preferred Stock .................................................. — — (148)

Accretion on Series E Preferred Stock................................................... — — (106)

Net income applicable to common stock ................................................ $ 176,844 $ 149,438 $ 92,721

Net income.............................................................................................. $ 176,844 $ 149,438 $ 100,403

Other comprehensive income:

Unrealized gains on available-for-sale securities, net of tax.................. 3,210 830 6,640

Unrealized losses on cash flow hedging derivatives, net

of tax.................................................................................................... (14,710) (30,438) (13,614)

Reclassification adjustment for gains on available-for-sale securities

included in net income, net of tax........................................................ (394) — (6,687)

Reclassification adjustment for losses (gains) on cash flow hedging

derivatives included in net income, net of tax ..................................... 33,087 11,544 (2,032)

Comprehensive income........................................................................... $ 198,037 $ 131,374 $ 84,710

Net income per common share: (See Note 16)

Net income per common share — basic ................................................ $ 0.50 $ 0.43 $ 0.29

Net income per common share — diluted.............................................. $ 0.49 $ 0.42 $ 0.28

Weighted average shares:

Basic ...................................................................................................... 351,898,898 349,395,285 287,692,280

Diluted ................................................................................................... 355,942,921 355,380,111 296,337,724

The accompanying notes are an integral part of these consolidated financial statements.