Metro PCS 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

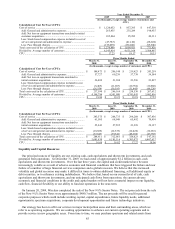

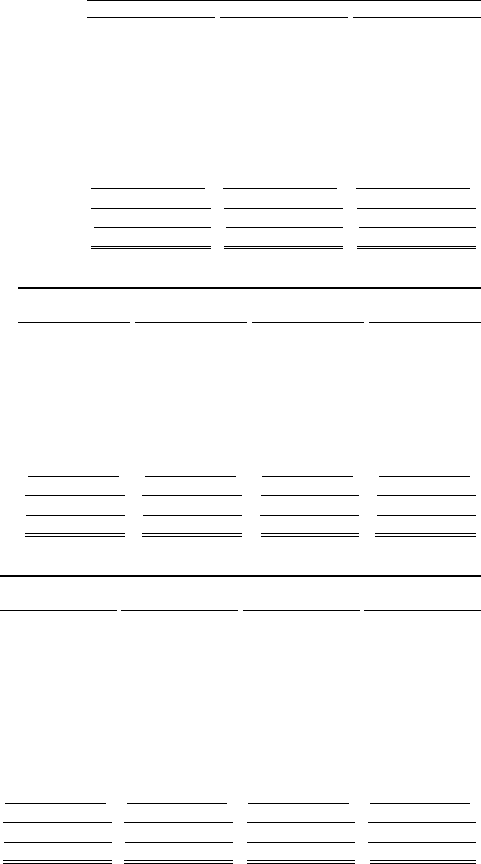

Year Ended December 31,

2009 2008 2007

(In thousands, except gross customer additions and

CPGA)

Calculation of Cost Per Gross Addition (CPGA):

Selling expenses .........................................................................................

.

$ 302,275 $ 212,293 $ 153,065

Less: Equipment revenues .......................................................................

.

(350,130) (314,266) (316,537)

Add: Impact to service revenues of promotional activity ........................

.

42,931 — —

Add: Equipment revenue not associated with new customers .................

.

169,929 149,029 142,822

Add: Cost of equipment...........................................................................

.

884,272 704,648 597,233

Less: Equipment costs not associated with new customers .....................

.

(275,793) (244,311) (192,153)

Gross addition expenses..............................................................................

.

$ 773,484 $ 507,393 $ 384,430

Divided by: Gross customer additions........................................................

.

5,305,505 3,988,692 3,004,177

CPGA .........................................................................................................

.

$ 145.79 $ 127.21 $ 127.97

Three Months Ended

March 31,

2008

June 30,

2008

September 30,

2008

December 31,

2008

(In thousands, except gross customer additions and CPGA)

Calculation of Cost Per Gross Addition (CPGA):

Selling expenses .......................................................................... $ 46,647 $ 53,180 $ 58,916 $ 53,551

Less: Equipment revenues ........................................................ (100,384) (80,245) (76,030) (57,606)

Add: Equipment revenue not associated with new

customers................................................................................ 45,803 37,613 33,295 32,318

Add: Cost of equipment............................................................ 200,158 160,088 160,538 183,864

Less: Equipment costs not associated with new customers ...... (72,212) (58,993) (56,891) (56,215)

Gross addition expenses............................................................... $ 120,012 $ 111,643 $ 119,828 $ 155,912

Divided by: Gross customer additions......................................... 960,083 792,823 934,607 1,301,179

CPGA .......................................................................................... $ 125.00 $ 140.82 $ 128.21 $ 119.82

Three Months Ended

March 31,

2009

June 30,

2009

September 30,

2009

December 31,

2009

(In thousands, except gross customer additions and CPGA)

Calculation of Cost Per Gross Addition (CPGA):

Selling expenses ...................................................................... $ 74,906 $ 74,272 $ 72,968 $ 80,129

Less: Equipment revenues.................................................... (68,631) (92,762) (83,253) (105,484)

Add: Impact to service revenues of promotional activity ..... — 24,728 12,481 5,721

Add: Equipment revenue not associated with new

customers............................................................................ 41,215 41,829 38,742 48,143

Add: Cost of equipment........................................................ 225,018 227,400 199,092 232,762

Less: Equipment costs not associated with new

customers............................................................................ (67,058) (69,424) (62,041) (77,270)

Gross addition expenses........................................................... $ 205,450 $ 206,043 $ 177,989 $ 184,001

Divided by: Gross customer additions..................................... 1,530,565 1,288,818 1,156,242 1,329,880

CPGA ...................................................................................... $ 134.23 $ 159.87 $ 153.94 $ 138.36

CPU — We utilize CPU as a tool to evaluate the non-selling cash expenses associated with ongoing business

operations on a per customer basis, to track changes in these non-selling cash costs over time, and to help evaluate

how changes in our business operations affect non-selling cash costs per customer. In addition, CPU provides

management with a useful measure to compare our non-selling cash costs per customer with those of other wireless

providers. We believe investors use CPU primarily as a tool to track changes in our non-selling cash costs over time

and to compare our non-selling cash costs to those of other wireless providers, although other wireless carriers may

calculate this measure differently. The following table reconciles total costs used in the calculation of CPU to cost of

service, which we consider to be the most directly comparable GAAP financial measure to CPU.