Metro PCS 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

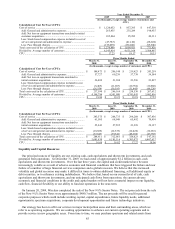

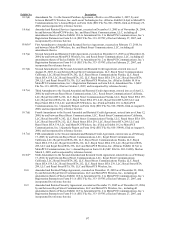

Contractual Obligations and Commercial Commitments

The following table provides aggregate information about our contractual obligations as of December 31, 2009.

Also, see Note 11 to our annual consolidated financial statements included elsewhere in this report.

Payments Due by Period

Total

Less

Than

1 Year 1 - 3 Years 3 - 5 Years

More

Than

5 Years

(In thousands)

Contractual Obligations:

Long-term debt, including current portion........

.

$ 3,498,000 $ 16,000 $ 32,000 $ 3,450,000 $ —

Interest expense on long-term debt(1)...............

.

1,250,283 280,593 558,078 411,612 —

Purchase obligations (2) ....................................

.

275,247 183,705 71,889 19,653 —

Other long-term liabilities (3)............................

.

26,898 24,157 2,741 — —

Handset purchase commitment.........................

.

17,200 17,200 — — —

Contractual tax obligations (4) ..........................

.

2,773 2,773 — — —

Capital lease obligations...................................

.

338,128 20,363 41,137 43,643 232,985

Operating leases................................................

.

2,232,900 271,374 537,092 531,296 893,138

Total cash contractual obligations ....................

.

$ 7,641,429 $ 816,165 $ 1,242,937 $ 4,456,204 $ 1,126,123

____________________________

(1) Interest expense on long-term debt includes future interest payments on outstanding obligations under our senior secured credit facility and

9¼% senior notes. The senior secured credit facility bears interest at a floating rate tied to a fixed spread to the London Inter Bank Offered Rate.

The interest expense presented in this table is based on the rates at December 31, 2009 which was 6.474% and includes the impact of our interest

rate protection agreements, for the senior secured credit facility.

(2) Includes expected commitments for future capital lease obligations and purchases of network equipment.

(3) Represents payment obligations under our interest rate protection agreements.

(4) Represents the liability reported in accordance with the provisions of ASC 740 (Topic 740, “Income Taxes”). Due to the high degree of

uncertainty regarding the timing of potential future cash outflows associated with these liabilities, other than the items included in the table

above, the Company was unable to make a reasonably reliable estimate of the amount and period in which these remaining liabilities might be

paid. Accordingly, unrecognized tax benefits of $3.3 million as of December 31, 2009, have been excluded from the contractual obligations table

above. For further information related to unrecognized tax benefits, see Note 15, “Income Taxes,” to the consolidated financial statements

included in this Report.

Inflation

We believe that inflation has not materially affected our operations.

Effect of New Accounting Standards

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities, an amendment of FASB Statement No. 133,” (“SFAS No. 161”) amending ASC 815 (Topic 815,

“Derivatives and Hedging”). SFAS No. 161 requires enhanced disclosures about a company’s derivative and

hedging activities. These enhanced disclosures discuss (a) how and why a company uses derivative instruments, (b)

how derivative instruments and related hedge items are accounted for under SFAS No. 133 and its related

interpretations, and (c) how derivative instruments and related hedged items affect a company’s financial position,

results of operations and cash flows. SFAS No. 161 became effective for fiscal years beginning on or after

November 15, 2008. The implementation of this standard did result in enhanced disclosures, but did not affect our

financial condition, results of operations or cash flows.

In June 2009, the FASB issued SFAS No. 168, “The FASB Accounting Standards Codification and the Hierarchy

of Generally Accepted Accounting Principles – A Replacement of FASB No. 162,” (“SFAS No. 168”) amending

(ASC 105 (Topic 105, “Generally Accepted Accounting Principles”)). SFAS 168 replaces SFAS No. 162, “The

Hierarchy of Generally Accepted Accounting Principles,” and establishes the FASB Accounting Standards

CodificationTM, as the source of authoritative accounting principles recognized by the FASB to be applied by

nongovernmental entities in the preparation of financial statements in conformity with GAAP. SFAS No. 168 was

effective for interim or annual financial reporting periods ending after September 15, 2009. The implementation of

this standard did not have a material impact on our financial condition, results of operations or cash flows, but did

change the way authoritative accounting pronouncements are referenced in our consolidated financial statements.