Metro PCS 2009 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

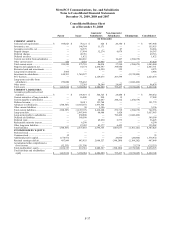

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-45

Year Ended December 31,

2009 2008 2007

Operating lease payments and related expenses included in cost of

service................................................................................................. $ 13.8 $ 5.2 $ 1.8

Capital lease maintenance expenses included in cost of service ........... 2.5 0.2 —

DAS equipment depreciation included in depreciation expense ........... 18.6 2.7 —

Capital lease interest included in interest expense ................................ 11.6 1.7 —

Capital lease payments included in financing activities........................ 2.8 1.2 —

2009 2008

Network service fees included in prepaid charges..................................................... $ 2.3 $ 1.8

DAS equipment included in property and equipment, net......................................... 257.0 159.4

Deferred network service fees included in other assets............................................. 22.1 35.2

Lease payments and related fees included in accounts payable and accrued

expenses.................................................................................................................. 4.9 1.0

Current portion of capital lease obligations included in current maturities of long-

term debt ................................................................................................................. 2.8 0.8

Non-current portion of capital lease obligations included in long-term debt, net...... 146.0 75.8

Deferred DAS service fees included in other long-term liabilities............................ 1.3 0.6

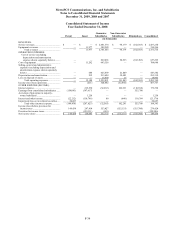

20. Supplemental Cash Flow Information:

Year Ended December 31,

2009 2008 2007

(in thousands)

Cash paid for interest.................................................................................................... $ 248,800 $ 177,210 $ 194,921

Cash paid for income taxes........................................................................................... 3,085 2,617 423

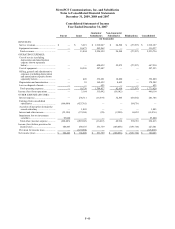

Non-cash investing and financing activities

The Company’s accrued purchases of property and equipment were approximately $21.4 million, $161.9 million

and $42.5 million for the years ended December 31, 2009, 2008 and 2007, respectively. Included within the

Company’s accrued purchases are estimates by management for construction services received based on a

percentage of completion.

Assets acquired under capital lease obligations were $92.2 million and $92.9 million for the years ended

December 31, 2009 and 2008, respectively.

During the year ended December 31, 2009, the Company received $52.3 million in fair value of FCC licenses in

exchanges with other parties.

The Company accrued dividends of $6.5 million related to the Series D Preferred Stock for the year ended

December 31, 2007.

The Company accrued dividends of $0.9 million related to the Series E Preferred Stock for the year ended

December 31, 2007.

On April 24, 2007, concurrent with the closing of the Company’s initial public offering of 57,500,000 shares of

common stock, all outstanding shares of preferred stock, including accrued but unpaid dividends, were converted

into 150,962,644 shares of common stock.

See Note 2 for the non-cash increase in the Company’s asset retirement obligations.