Metro PCS 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-8

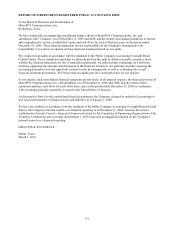

Allowance for Uncollectible Accounts Receivable

The Company maintains allowances for uncollectible accounts for estimated losses resulting from the inability of

independent retailers to pay for equipment purchases and for amounts estimated to be uncollectible from other

carriers. The following table summarizes the changes in the Company’s allowance for uncollectible accounts (in

thousands):

2009 2008 2007

Balance at beginning of period....................................................................................... $ 4,106 $ 2,908 $ 1,950

Additions:

Charged to expense...................................................................................................... 199 8 129

Direct reduction to revenue and other accounts........................................................... 595 1,337 1,037

Deductions...................................................................................................................... (2,855) (147) (208)

Balance at end of period ................................................................................................. $ 2,045 $ 4,106 $ 2,908

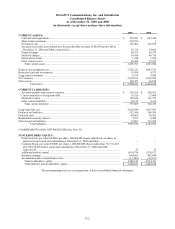

Prepaid Charges

Prepaid charges consisted of the following (in thousands):

2009 2008

Prepaid vendor purchases ............................................................................................................ $ — $ 17,829

Prepaid rent ................................................................................................................................. 32,236 23,689

Prepaid maintenance and support contracts................................................................................. 4,540 4,482

Prepaid insurance ........................................................................................................................ 2,312 2,165

Prepaid advertising ...................................................................................................................... 2,140 2,331

Other............................................................................................................................................ 7,125 5,851

Prepaid charges............................................................................................................................ $ 48,353 $ 56,347

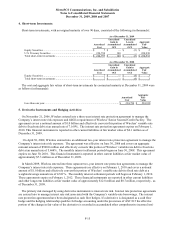

Property and Equipment

Property and equipment, net, consisted of the following (in thousands):

2009 2008

Construction-in-progress .................................................................................................... $ 283,365 $ 898,454

Network infrastructure (1)................................................................................................... 3,756,300 2,522,206

Office equipment................................................................................................................ 158,732 63,848

Leasehold improvements.................................................................................................... 55,631 47,784

Furniture and fixtures ......................................................................................................... 14,033 10,273

Vehicles.............................................................................................................................. 401 311

4,268,462 3,542,876

Accumulated depreciation and amortization (1) ................................................................. (1,016,249) (695,125)

Property and equipment, net............................................................................................... $ 3,252,213 $ 2,847,751

_________________

(1) As of December 31, 2009 and 2008, approximately $183.4 million and $30.0 million, respectively, of network infrastructure assets were

held by the Company under capital lease arrangements. Accumulated amortization relating to these assets totaled $9.8 million and $1.0

million as of December 31, 2009 and 2008, respectively.

Property and equipment are stated at cost. Additions and improvements are capitalized, while expenditures that

do not enhance or extend the asset’s useful life are charged to operating expenses as incurred. When the Company

sells, disposes of or retires property and equipment, the related gains or losses are included in operating results.

Depreciation is applied using the straight-line method over the estimated useful lives of the assets once the assets are

placed in service, which are seven to ten years for network infrastructure assets, three to ten years for capitalized

interest, up to fifteen years for capital lease assets, three to eight years for office equipment, which includes software

and computer equipment, three to seven years for furniture and fixtures and five years for vehicles. Leasehold

improvements are amortized over the shorter of the remaining term of the lease and any renewal periods reasonably

assured or the estimated useful life of the improvement. Maintenance and repair costs are charged to expense as

incurred. The Company follows the provisions of ASC 835 (Topic 835, “Interest”), with respect to its FCC licenses