Metro PCS 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-11

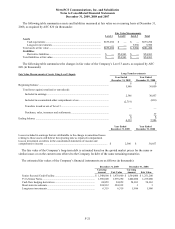

to have indefinite lives and together represent the cost of the Company’s spectrum. The carrying value of FCC

licenses and microwave relocation costs was $2.5 billion as of December 31, 2009.

In accordance with the requirements of ASC 350, the Company performs its annual indefinite-lived intangible

assets impairment test as of each September 30th or more frequently if events or changes in circumstances indicate

that the carrying value of the indefinite-lived intangible assets might be impaired. The impairment test consists of a

comparison of the estimated fair value with the carrying value. The Company estimates the fair value of its

indefinite-lived intangible assets using a direct value methodology in accordance with ASC 805 (Topic 805,

“Business Combinations”). The direct value approach determines fair value using a discounted cash flow model.

Cash flow projections and assumptions, although subject to a degree of uncertainty, are based on a combination of

the Company’s historical performance and trends, its business plans and management’s estimate of future

performance, giving consideration to existing and anticipated competitive economic conditions. Other assumptions

include the Company’s weighted average cost of capital and long-term rate of growth for its business. The Company

believes that its estimates are consistent with assumptions that marketplace participants would use to estimate fair

value. The Company corroborates its determination of fair value of the indefinite-lived intangible assets, using the

discounted cash flow approach described above, with other market-based valuation metrics. An impairment loss

would be recorded as a reduction in the carrying value of the related indefinite-lived intangible assets and charged to

results of operations.

For the purpose of performing the annual impairment test as of September 30, 2009, the indefinite-lived

intangible assets were aggregated and combined into a single unit of accounting in accordance with ASC 350 based

on the management of the business on a national scope. The Company believes that utilizing its indefinite-lived

intangible assets as a group represents the highest and best use of the assets, and the value of the indefinite-lived

intangible assets would not be significantly impacted by a sale of one or a portion of the indefinite-lived intangible

assets, among other factors. Previously, the Company’s indefinite-lived intangible assets were segregated by

regional clusters for the purpose of performing the annual impairment test. As of September 30, 2009, in accordance

with the requirements in ASC 350, these intangibles were separately tested for impairment prior to being combined

as a single unit of accounting. No impairment was recognized as the fair value of each indefinite-lived intangible

asset was in excess of its carrying value as of September 30, 2009. Although the Company does not expect its

estimates or assumptions to change significantly in the future, the use of different estimates or assumptions within

the discounted cash flow model when determining the fair value of the indefinite-lived intangible assets or using a

methodology other than a discounted cash flow model could result in different values for the indefinite-lived

intangible assets and may affect any related impairment charge. The most significant assumptions within the

Company’s discounted cash flow model are the discount rate, the projected growth rate and management’s future

business plans. A one percent decline in annual revenue growth rates, a one percent decline in annual net cash flows

or a one percent increase in discount rate would not result in an impairment related to the combined single unit of

accounting as of September 30, 2009.

Furthermore, if any of the indefinite-lived intangible assets are subsequently determined to have a finite useful

life, such assets would be tested for impairment in accordance with ASC 360 (Topic 360,“Property, Plant, and

Equipment”), and the intangible assets would then be amortized prospectively over the estimated remaining useful

life. There also have been no subsequent indicators of impairment including those indicated in ASC 360, and

accordingly, no subsequent interim impairment tests were performed.

Advertising and Promotion Costs

Advertising and promotion costs are expensed as incurred and are included in selling, general and administrative

expenses in the accompanying consolidated statements of income and comprehensive income. Advertising costs

totaled $150.8 million, $99.0 million and $73.2 million during the years ended December 31, 2009, 2008 and 2007,

respectively.

Income Taxes

The Company records income taxes pursuant to ASC 740 (Topic 740, “Income Taxes”). ASC 740 uses an asset

and liability approach to account for income taxes, wherein deferred taxes are provided for book and tax basis