Metro PCS 2009 Annual Report Download - page 128

Download and view the complete annual report

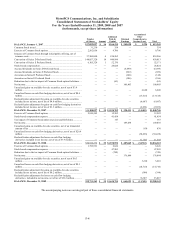

Please find page 128 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-14

In October 2009, the FASB issued Accounting Standards Update 2009-13, “Multiple-Deliverable Revenue

Arrangements - a consensus of the EITF,” (“ASU 2009-13”) which amends ASC 605 (Topic 605, “Revenue

Recognition”). This amended guidance addresses the determination of when individual deliverables within an

arrangement may be treated as separate units of accounting and modifies the manner in which transaction

consideration is allocated across the separately identifiable deliverables. ASU 2009-13 is effective prospectively for

the Company on January 1, 2011, although early adoption is permitted provided that it is retroactively applied to the

beginning of the year of adoption. The Company has not yet determined the effect on its financial condition or

results of operations upon adoption of ASU 2009-13.

In December 2009, the FASB issued ASU 2009-17, “Amendments to FASB Interpretation 46(R),” (“ASU 2009-

17”) revising authoritative guidance associated with the consolidation of variable interest entities. This revised

guidance replaces the current quantitative-based assessment for determining which enterprise has a controlling

interest in a variable interest entity with an approach that is now primarily qualitative. This qualitative approach

focuses on identifying the enterprise that has (i) the power to direct the activities of the variable interest entity that

can most significantly impact the entity’s performance; and (ii) the obligation to absorb losses and the right to

receive benefits from the entity that could potentially be significant to the variable interest entity. This revised

guidance also requires an ongoing assessment of whether an enterprise is the primary beneficiary of a variable

interest entity rather than a reassessment only upon the occurrence of specific events. ASU 2009-17 was effective

for the Company on January 1, 2010. The implementation of this standard did not have a material impact on the

Company’s financial condition, results of operations or cash flows.

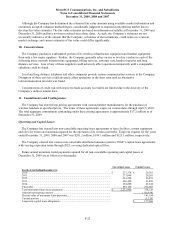

3. Majority-Owned Subsidiary:

On November 24, 2004, MetroPCS, through its wholly-owned subsidiaries, together with C9 Wireless, LLC, an

independent, unaffiliated third-party, formed a limited liability company, Royal Street Communications, that

qualified to bid for closed licenses and to receive bidding credits as a very small business DE on open licenses in

FCC Auction 58. MetroPCS indirectly owns 85% of the limited liability company member interest of Royal Street

Communications, but may elect only two of five members of the Royal Street Communications’ management

committee, which has the full power to direct the management of Royal Street. Royal Street Communications has

formed limited liability company subsidiaries which hold all licenses won in Auction 58. At Royal Street’s request

and subject to Royal Street’s control and direction, MetroPCS assisted or is assisting in the construction of Royal

Street’s networks and has agreed to purchase, via a resale arrangement, as much as 85% of the engineered service

capacity of Royal Street’s networks. The Company’s consolidated financial statements include the balances and

results of operations of MetroPCS and its wholly-owned subsidiaries as well as the balances and results of

operations of Royal Street. The Company consolidates its interest in Royal Street in accordance with ASC 810.

Royal Street qualifies as a variable interest entity under ASC 810 because the Company is the primary beneficiary of

Royal Street and will absorb all of Royal Street’s expected losses. Royal Street does not guarantee MetroPCS

Wireless, Inc.’s (“Wireless”) obligations under its senior secured credit facility, pursuant to which Wireless may

borrow up to $1.7 billion, as amended, (the “Senior Secured Credit Facility”) and its $1.95 billion of 9¼% Senior

Notes due 2014 (the “9¼% Senior Notes”). C9 Wireless, LLC, a beneficial interest holder in Royal Street, has no

recourse to the general credit of MetroPCS. All intercompany accounts and transactions between the Company and

Royal Street have been eliminated in the consolidated financial statements.

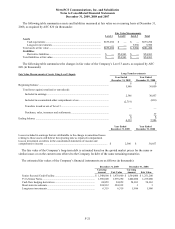

C9 Wireless, LLC has a right to sell, or put, its limited liability company interests in Royal Street

Communications to the Company at specific future dates based on a contractually determined amount (the “Put

Right”). The Put Right represents an unconditional obligation of MetroPCS and its wholly-owned subsidiaries to

purchase from C9 Wireless, LLC its limited liability company interests in Royal Street Communications. In

accordance with ASC 480 (Topic 480, “Distinguishing Liabilities from Equity”), this obligation is recorded as a

liability and is measured at each reporting date at the amount of cash that would be required to settle the obligation

under the contract terms if settlement occurred at the reporting date.