Metro PCS 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.90

Capital Lease Obligations

We have entered into various non-cancelable capital lease agreements, with expirations through 2025. Assets and

future obligations related to capital leases are included in the accompanying consolidated balance sheets in property

and equipment and long-term debt, respectively. Depreciation of assets held under capital lease obligations is

included in depreciation and amortization expense.

Capital Expenditures and Other Asset Acquisitions and Dispositions

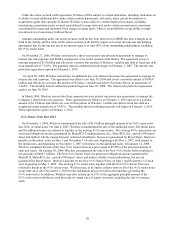

Capital Expenditures. We currently expect to incur capital expenditures in the range of $600.0 million to $800.0

million on a consolidated basis for the year ending December 31, 2010.

During the year ended December 31, 2009, we incurred approximately $831.7 million in capital expenditures.

These capital expenditures were primarily for the expansion and improvement of our existing network infrastructure

and costs associated with the construction of new markets.

During the year ended December 31, 2008, we incurred $954.6 million in capital expenditures. These capital

expenditures were primarily for the expansion and improvement of our existing network infrastructure and costs

associated with the construction of new markets.

During the year ended December 31, 2007, we incurred $767.7 million in capital expenditures. These capital

expenditures were primarily for the expansion and improvement of our existing network infrastructure and costs

associated with the construction of new markets.

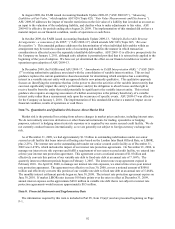

Other Acquisitions and Dispositions. We participated as a bidder in FCC Auction 73, and on June 26, 2008, we

were granted one 12 MHz 700 MHz license for a total aggregate purchase price of approximately $313.3 million.

This 700 MHz license supplements the 10 MHz of AWS spectrum previously granted to us in the Boston-Worcester,

Massachusetts/New Hampshire/Rhode Island/Vermont Economic Area as a result of FCC Auction 66.

During the years ended December 31, 2009 and 2008, we closed on various agreements for the acquisition and

exchange of spectrum in the net aggregate amount of approximately $14.6 million and $21.8 million in cash,

respectively.

During the year ended December 31, 2009, we received $52.3 million in fair value of FCC licenses in exchanges

with other parties.

On February 2, 2010, we entered into a like-kind spectrum exchange agreement covering licenses in certain

markets with another service provider, or Service Provider. The Service Provider will acquire 10 MHz of AWS

spectrum in Dallas/Fort Worth, Texas; Shreveport-Bossier City, Louisiana; and an additional 10 MHz of AWS

spectrum in certain other Washington markets, as well as an additional 10 MHz of PCS spectrum in Sacramento,

California. We will acquire an additional 10 MHz of AWS spectrum in Santa Barbara, California; Tampa-St.

Petersburg-Clearwater, Florida; and 10MHz of AWS spectrum in Dallas/Fort Worth, Texas and Shreveport-Bossier

City, Louisiana. Consummation of this spectrum exchange agreement is subject to customary closing conditions,

including FCC consent. In addition, we have entered into short-term lease agreements with the Service Provider

that, subject to FCC approval, authorize the Service Provider and us to use the spectrum covered by the spectrum

exchange agreement until the spectrum exchange is consummated.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.