Metro PCS 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.89

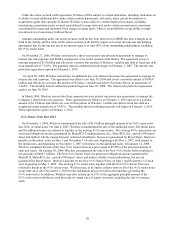

Under the senior secured credit agreement, Wireless will be subject to certain limitations, including limitations on

its ability to incur additional debt, make certain restricted payments, sell assets, make certain investments or

acquisitions, grant liens and pay dividends. Wireless is also subject to certain financial covenants, including

maintaining a maximum senior secured consolidated leverage ratio and, under certain circumstances, maximum

consolidated leverage and minimum fixed charge coverage ratios. There is no prohibition on our ability to make

investments in or loan money to Royal Street.

Amounts outstanding under our senior secured credit facility bear interest at a LIBOR rate plus a margin as set

forth in the facility and the terms of the senior secured credit facility require us to enter into interest rate hedging

agreements that fix the interest rate in an amount equal to at least 50% of our outstanding indebtedness, including

the 9¼% senior notes.

On November 21, 2006, Wireless entered into a three-year interest rate protection agreement to manage its

interest rate risk exposure and fulfill a requirement of its senior secured credit facility. The agreement covers a

notional amount of $1.0 billion and effectively converts this portion of Wireless’ variable rate debt to fixed-rate debt

at an annual rate of 7.169%. The quarterly interest settlement periods began on February 1, 2007. The interest rate

protection agreement expired on February 1, 2010.

On April 30, 2008, Wireless entered into an additional two-year interest rate protection agreement to manage its

interest rate risk exposure. The agreement was effective on June 30, 2008 and covers a notional amount of $500.0

million and effectively converts this portion of Wireless’ variable rate debt to fixed rate debt at an annual rate of

5.464%. The monthly interest settlement periods began on June 30, 2008. The interest rate protection agreement

expires on June 30, 2010.

In March 2009, Wireless entered into three separate two-year interest rate protection agreements to manage the

Company’s interest rate risk exposure. These agreements are effective on February 1, 2010 and cover a notional

amount of $1.0 billion and effectively convert this portion of Wireless’ variable rate debt to fixed rate debt at a

weighted average annual rate of 4.381%. The monthly interest settlement periods will begin on February 1, 2010.

These agreements expire on February 1, 2012.

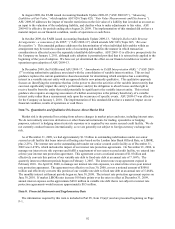

9¼% Senior Notes Due 2014

On November 3, 2006, Wireless consummated the sale of $1.0 billion principal amount of its 9¼% senior notes

due 2014, or initial notes. On June 6, 2007, Wireless consummated the sale of the additional notes. The initial notes

and the additional notes are referred to together as the existing 9¼% senior notes. The existing 9¼% senior notes are

unsecured obligations and are guaranteed by MetroPCS Communications, Inc., MetroPCS, Inc., and all of Wireless

direct and indirect wholly-owned domestic restricted subsidiaries, but are not guaranteed by Royal Street. Interest is

payable on the initial notes on May 1 and November 1 of each year, beginning with May 1, 2007, with respect to

the initial notes, and beginning on November 1, 2007 with respect to the additional notes. On January 14, 2009,

Wireless completed the sale of the New 9¼% Senior Notes at a price equal to 89.50% of the principal amount of

such new notes. On January 20, 2009, Wireless consummated the sale of the New 9¼% Senior Notes resulting in

net proceeds of $480.3 million. The New 9¼% Senior Notes are unsecured obligations and are guaranteed by

MetroPCS, MetroPCS, Inc., and all of Wireless’ direct and indirect wholly-owned subsidiaries, but are not

guaranteed by Royal Street. Interest is payable on the New 9¼% Senior Notes on May 1 and November 1 of each

year, beginning on May 1, 2009. The existing 9¼% senior notes together with the New 9¼% Senior Notes are

referred to herein as the 9¼% senior sotes. Wireless may, at its option, redeem some or all of the 9¼% senior notes

at any time on or after November 1, 2010 for the redemption prices set forth in the indenture governing the

9¼% senior notes. In addition, Wireless may also redeem up to 35% of the aggregate principal amount of the

9¼% senior notes with the net cash proceeds of certain sales of equity securities, including the sale of common

stock.