Metro PCS 2009 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

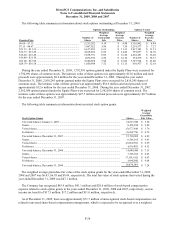

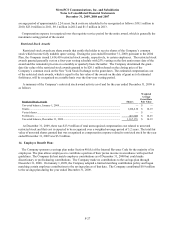

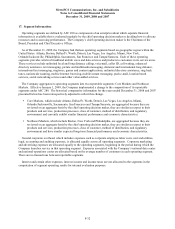

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-33

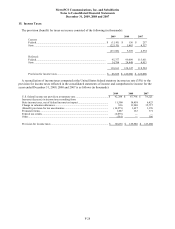

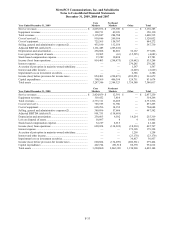

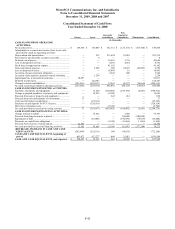

Year Ended December 31, 2009

Core

Markets

Northeast

Markets Other Total

Service revenues ........................................................................... $ 2,895,076 $ 235,309 $ — $ 3,130,385

Equipment revenues...................................................................... 300,731 49,399 — 350,130

Total revenues............................................................................... 3,195,807 284,708 — 3,480,515

Cost of service(1).......................................................................... 910,866 209,186 — 1,120,052

Cost of equipment......................................................................... 725,565 158,707 — 884,272

Selling, general and administrative expenses(2) ........................... 435,180 132,550 — 567,730

Adjusted EBITDA (deficit)(3)...................................................... 1,161,485 (205,241) —

Depreciation and amortization...................................................... 258,888 82,801 36,167 377,856

Loss (gain) on disposal of assets................................................... 10,905 (63) (15,525) (4,683)

Stock-based compensation expense.............................................. 37,289 10,494 — 47,783

Income (loss) from operations ...................................................... 854,403 (298,473) (20,642) 535,288

Interest expense ............................................................................ — — 270,285 270,285

Accretion of put option in majority-owned subsidiary.................. — — 1,567 1,567

Interest and other income.............................................................. — — (2,629) (2,629)

Impairment loss on investment securities ..................................... — — 2,386 2,386

Income (loss) before provision for income taxes.......................... 854,403 (298,473) (292,251) 263,679

Capital expenditures ..................................................................... 300,569 406,394 124,711 831,674

Total assets ................................................................................... 3,247,306 2,384,323 1,754,388 7,386,017

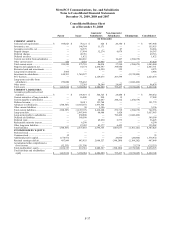

Year Ended December 31, 2008

Core

Markets

Northeast

Markets Other Total

Service revenues ........................................................................... $ 2,424,859 $ 12,391 $ — $ 2,437,250

Equipment revenues...................................................................... 310,452 3,814 — 314,266

Total revenues............................................................................... 2,735,311 16,205 — 2,751,516

Cost of service(1).......................................................................... 785,595 71,700 — 857,295

Cost of equipment......................................................................... 690,296 14,352 — 704,648

Selling, general and administrative expenses(2) ........................... 389,896 57,686 — 447,582

Adjusted EBITDA (deficit)(3)...................................................... 901,751 (118,618) —

Depreciation and amortization...................................................... 230,603 6,502 18,214 255,319

Loss on disposal of assets ............................................................. 18,897 4 4 18,905

Stock-based compensation expense.............................................. 32,227 8,915 — 41,142

Income (loss) from operations ...................................................... 620,024 (134,039) (18,218) 467,767

Interest expense ............................................................................ — — 179,398 179,398

Accretion of put option in majority-owned subsidiary.................. — — 1,258 1,258

Interest and other income.............................................................. — — (23,170) (23,170)

Impairment loss on investment securities ..................................... — — 30,857 30,857

Income (loss) before provision for income taxes.......................... 620,024 (134,039) (206,561) 279,424

Capital expenditures ..................................................................... 402,724 491,518 60,370 954,612

Total assets ................................................................................... 3,204,860 2,062,320 1,154,968 6,422,148