Metro PCS 2009 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-34

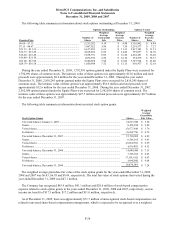

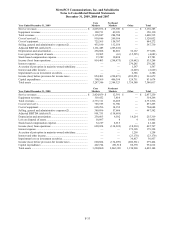

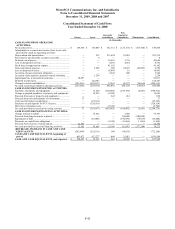

Year Ended December 31, 2007

Core

Markets

Northeast

Markets Other Total

Service revenues ........................................................................... $ 1,919,197 $ — $ — $ 1,919,197

Equipment revenues...................................................................... 316,537 — — 316,537

Total revenues............................................................................... 2,235,734 — — 2,235,734

Cost of service(1).......................................................................... 642,206 5,304 — 647,510

Cost of equipment......................................................................... 597,233 — — 597,233

Selling, general and administrative expenses(2) ........................... 323,572 28,448 — 352,020

Adjusted EBITDA (deficit)(3)...................................................... 694,761 (27,766) —

Depreciation and amortization...................................................... 170,876 319 7,007 178,202

(Gain) loss on disposal of assets ................................................... (2,621) 21 3,255 655

Stock-based compensation expense.............................................. 22,037 5,987 — 28,024

Income (loss) from operations ...................................................... 504,468 (34,092) (10,262) 460,114

Interest expense ............................................................................ — — 201,746 201,746

Accretion of put option in majority-owned subsidiary.................. — — 1,003 1,003

Interest and other income.............................................................. — — (63,936) (63,936)

Impairment loss on investment securities ..................................... — — 97,800 97,800

Income (loss) before provision for income taxes.......................... 504,468 (34,092) (246,875) 223,501

Capital expenditures ..................................................................... 579,131 77,926 110,652 767,709

Total assets ................................................................................... 2,927,498 1,020,718 1,857,914 5,806,130

____________________________

(1) Cost of service includes stock-based compensation expense disclosed separately. For the years ended December 31, 2009, 2008 and 2007,

cost of service includes $4.2 million, $2.9 million and $1.8 million, respectively, of stock-based compensation expense.

(2) Selling, general and administrative expenses include stock-based compensation expense disclosed separately. For the years ended

December 31, 2009, 2008 and 2007, selling, general and administrative expenses include $43.6 million, $38.2 million and $26.2 million,

respectively, of stock-based compensation expense.

(3) Adjusted EBITDA (deficit) is presented in accordance with ASC 280 as it is the primary financial measure utilized by management to

facilitate evaluation of each segments’ ability to meet future debt service, capital expenditures and working capital requirements and to

fund future growth.

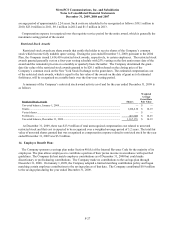

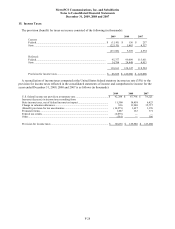

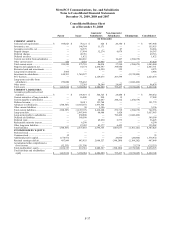

The following table reconciles segment Adjusted EBITDA (Deficit) for the years ended December 31, 2009,

2008 and 2007 to consolidated income before provision for income taxes:

2009 2008 2007

Segment Adjusted EBITDA (Deficit):

Core Markets Adjusted EBITDA................................................................................. $ 1,161,485 $ 901,751 $ 694,761

Northeast Markets Adjusted EBITDA (Deficit) .......................................................... (205,241) (118,618) (27,766)

Total............................................................................................................................ 956,244 783,133 666,995

Depreciation and amortization..................................................................................... (377,856) (255,319) (178,202)

Gain (loss) on disposal of assets .................................................................................. 4,683 (18,905) (655)

Stock-based compensation expense............................................................................. (47,783) (41,142) (28,024)

Interest expense ........................................................................................................... (270,285) (179,398) (201,746)

Accretion of put option in majority-owned subsidiary................................................. (1,567) (1,258) (1,003)

Interest and other income............................................................................................. 2,629 23,170 63,936

Impairment loss on investment securities .................................................................... (2,386) (30,857) (97,800)

Consolidated income before provision for income taxes......................................... $ 263,679 $ 279,424 $ 223,501

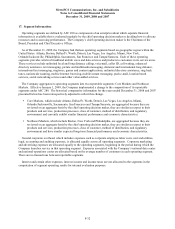

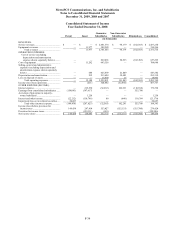

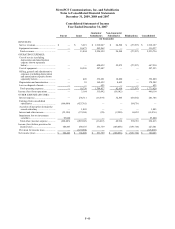

18. Guarantor Subsidiaries:

In connection with Wireless’ sale of the 91/4% Senior Notes and the entry into the Senior Secured Credit Facility,

MetroPCS, MetroPCS Inc., and each of Wireless’ direct and indirect present and future wholly-owned domestic

subsidiaries (the “guarantor subsidiaries”), provided guarantees on the 91/4% Senior Notes and Senior Secured Credit

Facility. These guarantees are full and unconditional as well as joint and several. Certain provisions of the Senior

Secured Credit Facility and the indentures relating to the 9¼% Senior Notes restrict the ability of Wireless to loan

funds to MetroPCS. However, Wireless is allowed to make certain permitted payments to MetroPCS under the

terms of the Senior Secured Credit Facility and the indentures relating to the 9¼% Senior Notes. Royal Street and

MetroPCS Finance, Inc. (“MetroPCS Finance”) (the “non-guarantor subsidiaries”) are not guarantors of the 91/4%

Senior Notes or the Senior Secured Credit Facility.