Metro PCS 2009 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

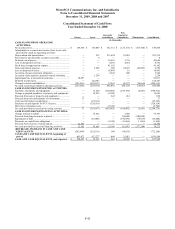

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-46

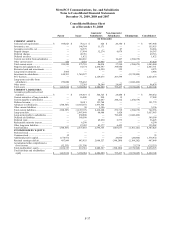

21. Quarterly Financial Data (Unaudited):

The following financial information reflects all normal recurring adjustments that are, in the opinion of

management, necessary for a fair statement of the Company’s results of operations for the interim periods.

Summarized data for each interim period for the years ended December 31, 2009 and 2008 is as follows (in

thousands, except per share data):

Three Months Ended

March 31,

2009

June 30,

2009

September 30,

2009

December 31,

2009

Total revenues ....................................................................

.

$ 795,329 $ 859,612 $ 895,593 $ 929,981

Income from operations......................................................

.

131,487 115,773 158,207 129,821

Net income (1)....................................................................

.

43,973 26,196 73,550 33,125

Net income per common share — basic .............................

.

$ 0.12 $ 0.07 $ 0.21 $ 0.10

Net income per common share — diluted ..........................

.

$ 0.12 $ 0.07 $ 0.21 $ 0.09

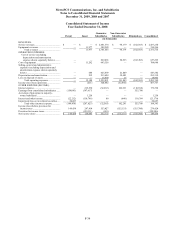

Three Months Ended

March 31,

2008

June 30,

2008

September 30,

2008

December 31,

2008

Total revenues ....................................................................

.

$ 662,354 $ 678,807 $ 686,721 $ 723,634

Income from operations......................................................

.

112,028 135,644 120,653 99,442

Net income (2)....................................................................

.

39,519 50,465 44,880 14,574

Net income per common share — basic .............................

.

$ 0.11 $ 0.14 $ 0.13 $ 0.04

Net income per common share — diluted ..........................

.

$ 0.11 $ 0.14 $ 0.13 $ 0.04

______________________________

(1) During the three months ended March 31, 2009, June 30, 2009, September 30, 2009, and December 31, 2009, the Company recognized

an impairment loss on investment securities in the amount of approximately $0.9 million, $0.5 million, $0.4 million, and $0.6 million,

respectively.

(2) During the three months ended March 31, 2008, June 30, 2008, September 30, 2008, and December 31, 2008, the Company recognized

an impairment loss on investment securities in the amount of approximately $8.0 million, $9.1 million, $3.0 million, and $10.8 million,

respectively.

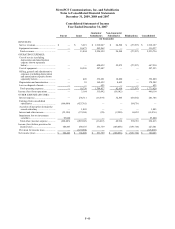

22. Subsequent Events:

On February 2, 2010, the Company entered into a like-kind spectrum exchange agreement covering licenses in

certain markets with another service provider (“Service Provider”). The Service Provider will acquire 10 MHz of

AWS spectrum in Dallas/Fort Worth, Texas; Shreveport-Bossier City, Louisiana; and an additional 10 MHz of AWS

spectrum in certain other Washington markets, as well as an additional 10 MHz of PCS spectrum in Sacramento,

California. The Company will acquire an additional 10 MHz of AWS spectrum in Santa Barbara, California;

Tampa-St. Petersburg-Clearwater, Florida; and an additional 10 MHz of AWS spectrum in Dallas/Fort Worth, Texas

and Shreveport-Bossier City, Louisiana. Consummation of this spectrum exchange agreement is subject to

customary closing conditions, including FCC consent. In addition, the Company entered into short-term lease

agreements with the Service Provider that, subject to FCC approval, authorize the Service Provider and the

Company to use the spectrum covered by the spectrum exchange agreement until the spectrum exchange is

consummated.