Metro PCS 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-31

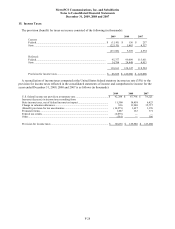

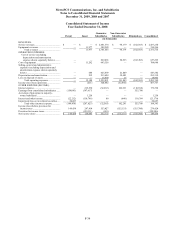

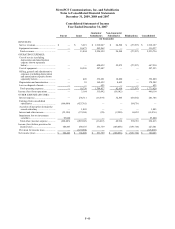

16. Net Income per Common Share:

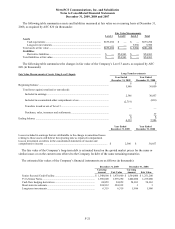

The following table sets forth the computation of basic and diluted net income per common share for the periods

indicated (in thousands, except share and per share data):

2009 2008 2007

Basic EPS — Two Class Method:

Net income .................................................................................. $ 176,844 $ 149,438 $ 100,403

Accrued dividends and accretion:

Series D Preferred Stock............................................................ — — (6,647)

Series E Preferred Stock............................................................ — — (1,035)

Net income applicable to common stock..................................... $ 176,844 $ 149,438 $ 92,721

Amount allocable to common shareholders................................. 99.6% 100.0% 88.8%

Rights to undistributed earnings .................................................. $ 176,160 $ 149,438 $ 82,330

Weighted average shares outstanding — basic............................ 351,898,898 349,395,285 287,692,280

Net income per common share — basic ...................................... $ 0.50 $ 0.43 $ 0.29

Diluted EPS:

Rights to undistributed earnings .................................................. $ 176,160 $ 149,438 $ 82,330

Weighted average shares outstanding — basic............................ 351,898,898 349,395,285 287,692,280

Effect of dilutive securities:

Stock options ............................................................................. 4,044,023 5,984,826 8,645,444

Weighted average shares outstanding — diluted......................... 355,942,921 355,380,111 296,337,724

Net income per common share — diluted ................................... $ 0.49 $ 0.42 $ 0.28

In accordance with ASC 260, unvested share-based payment awards that contain rights to receive non-forfeitable

dividends or dividend equivalents, whether paid or unpaid, are considered a “participating security” for purposes of

computing earnings or loss per common share and the two-class method of computing earnings per share is required

for all periods presented.

Under the restricted stock award agreements, unvested shares of restricted stock have rights to receive non-

forfeitable dividends. For the year ended December 31, 2009, the Company has calculated diluted earnings per share

under both the treasury stock method and the two-class method. There was not a significant difference in the per

share amounts calculated under the two methods, and the two-class method is disclosed. There were no restricted

stock awards issued prior to January 1, 2009. For the year ended December 31, 2009, 1.4 million restricted common

shares issued to employees have been excluded from the computation of basic net income per common share since

the shares are not vested and remain subject to forfeiture.

Net income per common share for the year ended December 31, 2007 is computed in accordance with ASC 260.

Under ASC 260, the preferred stock is considered a “participating security” for purposes of computing earnings or

loss per common share and, therefore, the preferred stock is included in the computation of basic and diluted net

income per common share using the two-class method, except during periods of net losses. Preferred stock was

included in the computation of income per common share through April 24, 2007, the date of conversion to common

stock as a result of the Offering. When determining basic earnings per common share under ASC 260, undistributed

earnings for a period are allocated to a participating security based on the contractual participation rights of the

security to share in those earnings as if all of the earnings for the period had been distributed.

For the years ended December 31, 2009, 2008 and 2007, 15.8 million, 11.9 million and 4.4 million, respectively,

of stock options were excluded from the calculation of diluted net income per common share since the effect was

anti-dilutive.

For the year ended December 31, 2007, 44.2 million of convertible shares of Series D Preferred Stock were

excluded from the calculation of diluted net income per common share since the effect was anti-dilutive.

For the year ended December 31, 2007, 1.9 million of convertible shares of Series E Preferred Stock were

excluded from the calculation of diluted net income per common share since the effect was anti-dilutive.