Metro PCS 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

Provision for Income Taxes. Income tax expense was $130.0 million and $123.1 million for the years ended

December 31, 2008 and 2007, respectively. The effective tax rate was 46.5% and 54.4% for the years ended

December 31, 2008 and 2007, respectively. Our effective rates differ from the statutory federal rate of 35.0% due to

state and local taxes, non-deductible expenses and an increase in the valuation allowance related to the impairment

loss recognized on investment securities.

Net Income. Net income increased $49.0 million, or approximately 49%, to $149.4 million for the year ended

December 31, 2008 compared to $100.4 million for the year ended December 31, 2007. The increase in net income

was primarily attributable to an increase in income from operations, a decrease in interest expense and a decrease in

the impairment loss on investment securities. These items were partially offset by lower interest and other income

for the year ended December 31, 2008.

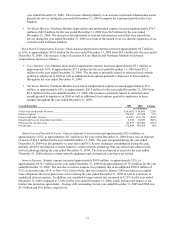

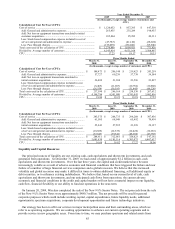

Performance Measures

In managing our business and assessing our financial performance, we supplement the information provided by

financial statement measures with several customer-focused performance metrics that are widely used in the

wireless industry. These metrics include average revenue per user per month, or ARPU, which measures service

revenue per customer; cost per gross customer addition, or CPGA, which measures the average cost of acquiring a

new customer; cost per user per month, or CPU, which measures the non-selling cash cost of operating our business

on a per customer basis; and churn, which measures turnover in our customer base. For a reconciliation of Non-

GAAP performance measures and a further discussion of the measures, please read “— Reconciliation of Non-

GAAP Financial Measures” below.

The following table shows annual metric information for 2007, 2008 and 2009.

Year Ended December 31,

2009 2008 2007

Customers:

End of period ............................................................................................

.

6,639,524 5,366,833 3,962,786

Net additions.............................................................................................

.

1,272,691 1,404,047 1,021,800

Churn:

Average monthly rate................................................................................

.

5.5% 4.7% 4.7%

ARPU ........................................................................................................

.

$ 40.68 $ 41.39 $ 43.31

CPGA ........................................................................................................

.

$ 145.79 $ 127.21 $ 127.97

CPU ...........................................................................................................

.

$ 17.23 $ 18.17 $ 18.33

Customers. Net customer additions were 1,272,691 for the year ended December 31, 2009, compared to

1,404,047 for the year ended December 31, 2008. The decrease in net customer additions is primarily attributable to

current economic conditions and increased competition. Total customers were 6,639,524 as of December 31, 2009,

an increase of approximately 24% over the customer total as of December 31, 2008. The increase in total customers

is primarily attributable to the continued demand for our service offerings and the launch of our services in the New

York and Boston metropolitan areas in early 2009. Net customer additions were 1,404,047 for the year ended

December 31, 2008, compared to 1,021,800 for the year ended December 31, 2007. Total customers were 5,366,833

as of December 31, 2008, an increase of 35% over the customer total as of December 31, 2007. The increase in total

customers in 2008 was largely attributable to the continued demand for our service offerings, and the launch of our

services in new markets.

Churn. As we do not require a long-term service contract, our churn percentage is expected to be higher than

traditional wireless carriers that require customers to sign a one- to two-year contract with significant early

termination fees. Average monthly churn represents (a) the number of customers who have been disconnected from

our system during the measurement period less the number of customers who have reactivated service, divided by

(b) the sum of the average monthly number of customers during such period. We classify delinquent customers as

churn after they have been delinquent for 30 days. In addition, when an existing customer establishes a new account

in connection with the purchase of an upgraded or replacement phone and does not identify themselves as an

existing customer, we count the phone leaving service as a churn and the new phone entering service as a gross

customer addition. Churn for the year ended December 31, 2009 was 5.5%, compared to 4.7% for the year ended

December 31, 2008. The increase in churn was primarily related to incremental gross additions of approximately

1.3 million customers during the nine months ended September 30, 2009 as compared to the same period in 2008,

coupled with churn from increased competition. Our customer activity is influenced by seasonal effects related to

traditional retail selling periods and other factors that arise from our target customer base. Based on historical