Metro PCS 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-18

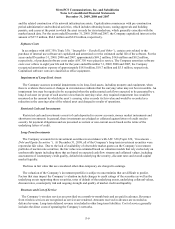

8. Long-Term Debt:

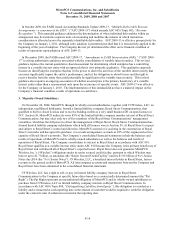

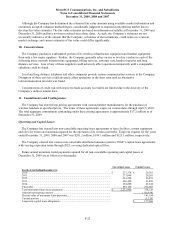

Long-term debt consisted of the following (in thousands):

2009 2008

9¼% Senior Notes ..................................................................................................................

.

$ 1,950,000 $ 1,400,000

Senior Secured Credit Facility................................................................................................

.

1,548,000 1,564,000

Capital Lease Obligations.......................................................................................................

.

181,194 91,343

Total long-term debt ...............................................................................................................

.

3,679,194 3,055,343

Add: unamortized (discount) premium on debt ......................................................................

.

(33,919) 19,649

Total debt................................................................................................................................

.

3,645,275 3,074,992

Less: current maturities ..........................................................................................................

.

(19,326) (17,009)

Total long-term debt ...............................................................................................................

.

$ 3,625,949 $ 3,057,983

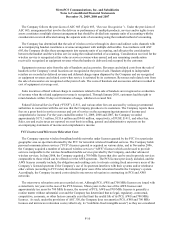

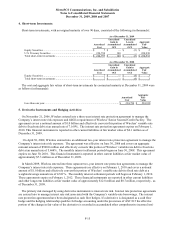

Maturities of the principal amount of long-term debt, excluding capital lease obligations, at face value are as

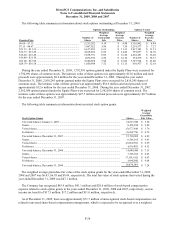

follows (in thousands):

For the Year Ending December 31,

2010.................................................................................................................................................................. $ 16,000

2011.................................................................................................................................................................. 16,000

2012.................................................................................................................................................................. 16,000

2013.................................................................................................................................................................. 1,500,000

2014.................................................................................................................................................................. 1,950,000

Total ................................................................................................................................................................. $ 3,498,000

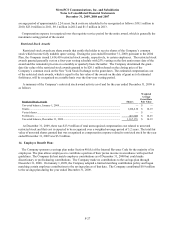

9¼% Senior Notes due 2014

On November 3, 2006, Wireless completed the sale of $1.0 billion of principal amount of 9¼% Senior Notes due

2014, (the “Initial Notes”). On June 6, 2007, Wireless completed the sale of an additional $400.0 million of 91/4%

Senior Notes due 2014 (the “Additional Notes”) under the existing indenture governing the Initial Notes at a price

equal to 105.875% of the principal amount of such Additional Notes. On January 20, 2009, Wireless completed the

sale of an additional $550.0 million of 9¼% Senior Notes due 2014 (the “New 9¼% Senior Notes” and, together

with the Initial Notes and Additional Notes, the “9¼% Senior Notes”) under a new indenture substantially similar to

the indenture governing the Initial Notes at a price equal to 89.50% of the principal amount of such New 9¼%

Senior Notes resulting in net proceeds of approximately $480.3 million.

The 91/4% Senior Notes are unsecured obligations and are guaranteed by MetroPCS, MetroPCS, Inc., and all of

Wireless’ direct and indirect wholly-owned subsidiaries, but are not guaranteed by Royal Street. Interest is payable

on the 9¼% Senior Notes on May 1 and November 1 of each year. Wireless may, at its option, redeem some or all

of the 9¼% Senior Notes at any time on or after November 1, 2010 for the redemption prices set forth in the

indentures governing the 9¼% Senior Notes. In addition, prior to November 1, 2009, Wireless may, at its option,

redeem up to 35% of the aggregate principal amount of the 9¼% Senior Notes with the net cash proceeds of certain

sales of equity securities. Wireless may also, at its option, prior to November 1, 2010, redeem some or all of the

notes at the “make whole” price set forth in the indentures governing the 9¼% Senior Notes.

Senior Secured Credit Facility

On November 3, 2006, Wireless entered into the Senior Secured Credit Facility, which consists of a $1.6 billion

term loan facility and a $100.0 million revolving credit facility. On November 3, 2006, Wireless borrowed

$1.6 billion under the Senior Secured Credit Facility. The term loan facility is repayable in quarterly installments in

annual aggregate amounts equal to 1% of the initial aggregate principal amount of $1.6 billion. The term loan

facility will mature in November 2013 and the revolving credit facility will mature in November 2011.