Metro PCS 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-29

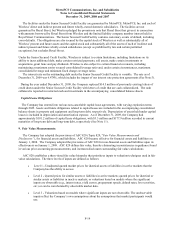

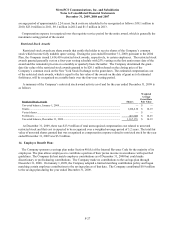

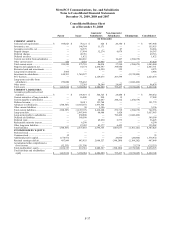

Deferred taxes are provided for those items reported in different periods for income tax and financial reporting

purposes. The Company’s net deferred tax liability consisted of the following deferred tax assets and liabilities (in

thousands):

2009 2008

Deferred tax assets:

Net operating loss carryforward......................................................................................................... $ 342,693 $ 141,965

Deferred revenue ............................................................................................................................... 15,867 15,917

Allowance for uncollectible accounts ................................................................................................ 871 1,645

Deferred rent...................................................................................................................................... 25,599 19,342

Deferred compensation ...................................................................................................................... 44,938 28,609

Asset retirement obligation................................................................................................................ 3,804 2,161

Credit carryforwards.......................................................................................................................... 5,892 2,583

Other comprehensive loss.................................................................................................................. 9,624 21,464

Transaction taxes ............................................................................................................................... 4,840 3,884

Unrealized loss on investments.......................................................................................................... 47,158 47,657

Other.................................................................................................................................................. 12,507 19,933

Gross deferred tax assets.................................................................................................................... 513,793 305,160

Valuation allowance .......................................................................................................................... (47,158) (47,657)

Total deferred tax assets, net.............................................................................................................. 466,635 257,503

Deferred tax liabilities:

Depreciation....................................................................................................................................... (570,816) (352,106)

Deferred cost of handset sales............................................................................................................ (23,040) (19,349)

FCC licenses...................................................................................................................................... (264,916) (199,422)

Partnership interest ............................................................................................................................ (114,952) (70,284)

Other.................................................................................................................................................. (3,269) (4,019)

Deferred tax liabilities ....................................................................................................................... (976,993) (645,180)

Net deferred tax liability .................................................................................................................... $ (510,358) $ (387,677)

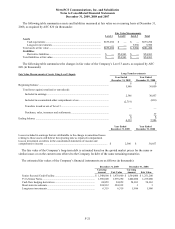

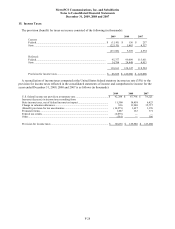

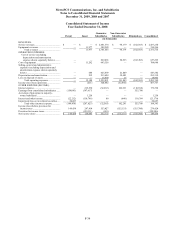

Deferred tax assets and liabilities at December 31, 2009 and 2008 are as follows (in thousands):

2009 2008

Current deferred tax asset .................................................................................................................... $ 1,948 $ 1,832

Non-current deferred tax liability ........................................................................................................ (512,306) (389,509)

Net deferred tax liability ...................................................................................................................... $ (510,358) $ (387,677)

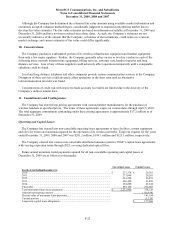

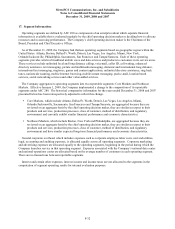

At December 31, 2009, the Company has approximately $909.1 million and $360.4 million of financial reporting

net operating loss carryforwards for federal and state income tax purposes, respectively. The Company’s net

operating loss carryforwards for federal and state tax purposes were approximately $93.9 million and $39.6 million,

respectively, greater than its net operating loss carryforwards for financial reporting purposes due to the Company’s

inability to realize excess tax benefits under ASC 718 until such benefits reduce income taxes payable. The federal

net operating loss will begin to expire in 2023. The state net operating losses will begin to expire in 2013. At

December 31, 2009 the Company has approximately $0.2 million of alternative minimum tax credit carryforwards

for state income tax purposes. These alternative minimum tax credits carryforward indefinitely.

The Company took advantage of Worker, Homeownership and Business Assistance Act of 2009. The act

removed an alternative minimum tax limitation on certain carryback years which allowed the Company to carryback

$1.4 million and $4.6 million of alternative minimum tax net operating losses for 2006 and 2007, respectively.

Financial statement deferred tax assets must be reduced by a valuation allowance if, based on the weight of

available evidence, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

The Company believes that realization of the deferred tax assets is more likely than not based on the future reversal

of existing temporary differences which give rise to the deferred tax liabilities, with the exception of the deferred tax

asset related to the unrealized tax loss. During 2009 and 2008, an impairment of investments was recorded for

financial statement purposes resulting in an unrealized loss. Recognition of this unrealized loss for tax purposes

would result in a capital loss. The Company has not generated capital gains within the carryback period and does

not anticipate generating sufficient capital gains within the carryforward period to realize this deferred tax asset.