Metro PCS 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-13

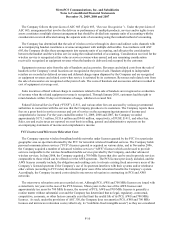

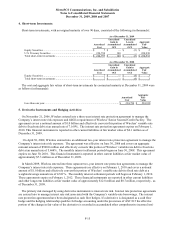

Earnings per Share

Basic earnings per share (“EPS”) are based upon the weighted average number of common shares outstanding for

the period. Diluted EPS is computed in the same manner as EPS after assuming issuance of common stock for all

potentially dilutive equivalent shares, whether exercisable or not.

In accordance with ASC 260 (Topic 260, “Earnings Per Share”), unvested share-based payment awards that

contain rights to receive non-forfeitable dividends or dividend equivalents, whether paid or unpaid, are considered a

“participating security” for purposes of computing earnings or loss per common share and the two-class method of

computing earnings per share is required for all periods presented. During the year ended December 31, 2009, the

Company issued restricted stock awards. Unvested shares of restricted stock are participating securities such that

they have rights to receive forfeitable dividends. In accordance with ASC 260, the unvested restricted stock was

considered a “participating security” for purposes of computing earnings per common share and was therefore

included in the computation of basic and diluted earnings per common share.

The Series D Preferred Stock and Series E Preferred Stock (collectively, the “preferred stock”) that was

outstanding during the year ended December 31, 2007 were participating securities, such that in the event a dividend

was declared or paid on the common stock, the Company would have simultaneously declared and paid a dividend

on the preferred stock as if they had been converted into common stock. In accordance with ASC 260, the preferred

stock was considered a “participating security” for purposes of computing earnings per common share and,

therefore, the preferred stock was included in the computation of basic and diluted earnings per common share using

the two-class method, except during periods of net losses. When determining basic earnings per common share

under ASC 260, undistributed earnings for a period were allocated to a participating security based on the

contractual participation rights of the security to share in those earnings as if all of the earnings for the period had

been distributed (See Note 16).

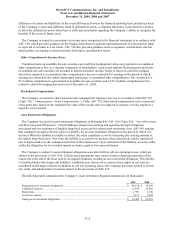

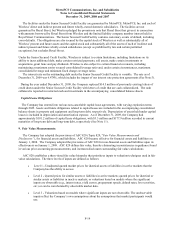

Recent Accounting Pronouncements

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities, an amendment of FASB Statement No. 133,” (“SFAS No. 161”) amending ASC 815 (Topic 815,

“Derivatives and Hedging”). SFAS No. 161 requires enhanced disclosures about a company’s derivative and

hedging activities. These enhanced disclosures discuss (a) how and why a company uses derivative instruments, (b)

how derivative instruments and related hedge items are accounted for under SFAS No. 133 and its related

interpretations, and (c) how derivative instruments and related hedged items affect a company’s financial position,

results of operations and cash flows. SFAS No. 161 became effective for fiscal years beginning on or after

November 15, 2008. The implementation of this standard did result in enhanced disclosures, but did not affect the

Company’s financial condition, results of operations or cash flows.

In June 2009, the FASB issued SFAS No. 168, “The FASB Accounting Standards Codification and the Hierarchy

of Generally Accepted Accounting Principles – A Replacement of FASB No. 162,” (“SFAS No. 168”) amending

(ASC 105 (Topic 105, “Generally Accepted Accounting Principles”)). SFAS 168 replaces SFAS No. 162, “The

Hierarchy of Generally Accepted Accounting Principles,” and establishes the FASB Accounting Standards

CodificationTM, as the source of authoritative accounting principles recognized by the FASB to be applied by

nongovernmental entities in the preparation of financial statements in conformity with GAAP. SFAS No. 168 was

effective for interim or annual financial reporting periods ending after September 15, 2009. The implementation of

this standard did not have a material impact on the Company’s financial condition, results of operations or cash

flows, but did change the way authoritative accounting pronouncements are referenced in the consolidated financial

statements.

In August 2009, the FASB issued Accounting Standards Update 2009-05 (“ASU 2009-05”), “Measuring

Liabilities at Fair Value,” which updates ASC 820 (Topic 820, “Fair Value Measurements and Disclosures”).

ASU 2009-05 addresses the impact of transfer restrictions on the fair value of a liability that is traded as an asset as

an input to the valuation of the underlying liability, and clarifies when to make adjustments to fair value. ASU

2009-05 was effective for periods ending after August 26, 2009. The implementation of this standard did not have a

material impact on the Company’s financial condition, results of operations or cash flows.