Metro PCS 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-26

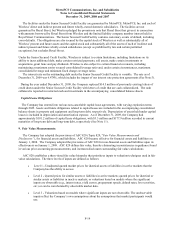

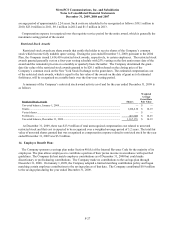

The following table summarizes information about stock options outstanding at December 31, 2009:

Options Outstanding Options Vested

Exercise Price

Number of

Shares

Weighted

Average

Contractual

Life

Weighted

Average

Exercise

Price

Number of

Shares

Weighted

Average

Exercise

Price

$0.08 - $7.13.................................................................... 5,213,202 4.18 $ 4.48 5,116,802 $ 4.44

$7.15 - $8.67.................................................................... 3,467,022 5.86 $ 7.30 3,219,577 $ 7.27

$11.33 - $11.33................................................................ 6,617,893 6.63 $ 11.33 5,637,183 $ 11.33

$12.77 - $15.29................................................................ 4,018,892 8.95 $ 14.44 339,077 $ 14.78

$16.20 - $16.20................................................................ 5,038,791 8.09 $ 16.20 2,258,291 $ 16.20

$16.40 - $21.10................................................................ 1,072,952 8.50 $ 18.10 354,579 $ 18.33

$23.00 - $23.00................................................................ 4,940,608 7.08 $ 23.00 3,393,934 $ 23.00

$24.79 - $36.58................................................................ 1,050,904 7.52 $ 32.11 630,477 $ 32.18

During the year ended December 31, 2009, 1,792,991 options granted under the Equity Plans were exercised for

1,792,991 shares of common stock. The intrinsic value of these options was approximately $15.0 million and total

proceeds were approximately $8.6 million for the year ended December 31, 2009. During the year ended

December 31, 2008, 2,810,245 options granted under the Equity Plans were exercised for 2,810,245 shares of

common stock. The intrinsic value of these options was approximately $38.6 million and total proceeds were

approximately $12.6 million for the year ended December 31, 2008. During the year ended December 31, 2007,

2,562,056 options granted under the Equity Plans were exercised for 2,562,056 shares of common stock. The

intrinsic value of these options was approximately $47.7 million and total proceeds were approximately $9.7 million

for the year ended December 31, 2007.

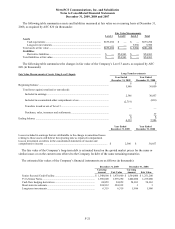

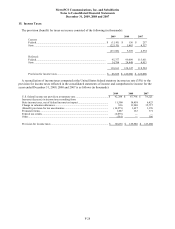

The following table summarizes information about unvested stock option grants:

Stock Option Grants Shares

Weighted

Average

Grant-Date

Fair Value

Unvested balance, January 1, 2007........................................................................................... 14,633,949 $ 3.60

Grants ....................................................................................................................................... 8,476,998 $ 9.89

Vested shares............................................................................................................................ (5,677,364) $ 3.76

Forfeitures ................................................................................................................................ (1,694,774) $ 4.76

Unvested balance, December 31, 2007..................................................................................... 15,738,809 $ 6.99

Grants ....................................................................................................................................... 6,566,165 $ 6.95

Vested shares............................................................................................................................ (6,824,591) $ 6.59

Forfeitures ................................................................................................................................ (639,403) $ 8.12

Unvested balance, December 31, 2008..................................................................................... 14,840,980 $ 7.11

Grants ....................................................................................................................................... 3,725,564 $ 6.43

Vested shares............................................................................................................................ (7,101,612) $ 6.63

Forfeitures ................................................................................................................................ (994,588) $ 6.64

Unvested balance, December 31, 2009..................................................................................... 10,470,344 $ 7.24

The weighted average grant-date fair value of the stock option grants for the years ended December 31, 2009,

2008 and 2007 was $6.43, $6.95 and $9.89, respectively. The total fair value of stock options that vested during the

year ended December 31, 2009 was $47.1 million.

The Company has recognized $43.9 million, $41.1 million and $28.0 million of stock-based compensation

expense related to stock option grants in the years ended December 31, 2009, 2008 and 2007, respectively, and an

income tax benefit of $17.3 million, $17.2 million and $11.0 million, respectively.

As of December 31, 2009, there was approximately $71.7 million of unrecognized stock-based compensation cost

related to unvested share-based compensation arrangements, which is expected to be recognized over a weighted