Metro PCS 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-15

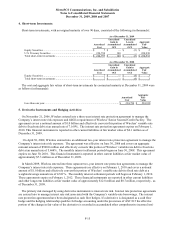

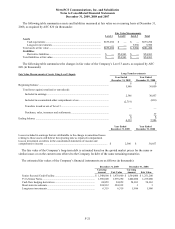

4. Short-term Investments:

Short-term investments, with an original maturity of over 90 days, consisted of the following (in thousands):

As of December 31, 2009

Amortized

Cost

Unrealized

Gain in

Accumulated

OCI

Unrealized

Loss in

Accumulated

OCI

Aggregate

Fair

Value

Equity Securities.........................................................................

.

$ 7 $ — $ (5) $ 2

U.S. Treasury Securities .............................................................

.

224,790 140 — 224,930

Total short-term investments ......................................................

.

$ 224,797 $ 140 $ (5) $ 224,932

As of December 31, 2008

Amortized

Cost

Unrealized

Gain in

Accumulated

OCI

Unrealized

Gain in

Accumulated

OCI

Aggregate

Fair

Value

Equity Securities.........................................................................

.

$ 7 $ — $ (4) $ 3

Total short-term investments ......................................................

.

$ 7 $ — $ (4) $ 3

The cost and aggregate fair values of short-term investments by contractual maturity at December 31, 2009 were

as follows (in thousands):

Amortized

Cost

Aggregate

Fair

Value

Less than one year............................................................................................................... $ 224,790 $ 224,930

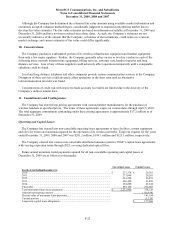

5. Derivative Instruments and Hedging Activities:

On November 21, 2006, Wireless entered into a three-year interest rate protection agreement to manage the

Company’s interest rate risk exposure and fulfill a requirement of Wireless’ Senior Secured Credit Facility. The

agreement covers a notional amount of $1.0 billion and effectively converts this portion of Wireless’ variable rate

debt to fixed-rate debt at an annual rate of 7.169%. The interest rate protection agreement expires on February 1,

2010. This financial instrument is reported in other current liabilities at fair market value of $4.1 million as of

December 31, 2009.

On April 30, 2008, Wireless entered into an additional two-year interest rate protection agreement to manage the

Company’s interest rate risk exposure. The agreement was effective on June 30, 2008 and covers an aggregate

notional amount of $500.0 million and effectively converts this portion of Wireless’ variable rate debt to fixed rate

debt at an annual rate of 5.464%. The monthly interest settlement periods began on June 30, 2008. This agreement

expires on June 30, 2010. This financial instrument is reported in other current liabilities at fair market value of

approximately $7.3 million as of December 31, 2009.

In March 2009, Wireless entered into three separate two-year interest rate protection agreements to manage the

Company’s interest rate risk exposure. These agreements are effective on February 1, 2010 and cover a notional

amount of $1.0 billion and effectively convert this portion of Wireless’ variable rate debt to fixed rate debt at a

weighted average annual rate of 4.381%. The monthly interest settlement periods will begin on February 1, 2010.

These agreements expire on February 1, 2012. These financial instruments are reported in other current liabilities

and other long-term liabilities at fair market value of approximately $12.8 million and $0.7 million, respectively, as

of December 31, 2009.

The primary risk managed by using derivative instruments is interest rate risk. Interest rate protection agreements

are entered into to manage interest rate risk associated with the Company’s variable-rate borrowings. The interest

rate protection agreements have been designated as cash flow hedges. If a derivative is designated as a cash flow

hedge and the hedging relationship qualifies for hedge accounting under the provisions of ASC 815 the effective

portion of the change in fair value of the derivative is recorded in accumulated other comprehensive income (loss)