Metro PCS 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-12

differences for assets and liabilities. In the event differences between the financial reporting basis and the tax basis

of the Company’s assets and liabilities result in deferred tax assets, a valuation allowance is provided for a portion

or all of the deferred tax assets when there is sufficient uncertainty regarding the Company’s ability to recognize the

benefits of the assets in future years.

The Company accounts for uncertainty in income taxes recognized in the financial statements in accordance with

ASC 740, which provides guidance on the financial statement recognition and measurement of a tax position taken

or expected to be taken in a tax return. ASC 740 also provides guidance on de-recognition, classification, interest

and penalties, accounting in interim periods, disclosures, and transition issues.

Other Comprehensive Income (Loss)

Unrealized gains on available-for-sale securities and cash flow hedging derivatives are reported in accumulated

other comprehensive loss as a separate component of stockholders’ equity until realized. Realized gains and losses

on available-for-sale securities are included in interest and other income. Gains or losses on cash flow hedging

derivatives reported in accumulated other comprehensive loss are reclassified to earnings in the period in which

earnings are affected by the underlying hedged transaction. Accumulated other comprehensive loss consisted of a

$3.5 million comprehensive gain related to available-for-sale securities and a $15.4 million comprehensive loss

related to cash flow hedging derivatives as of December 31, 2009.

Stock-Based Compensation

The Company accounts for share-based awards exchanged for employee services in accordance with ASC 718

(Topic 718, “Compensation – Stock Compensation”). Under ASC 718, share-based compensation cost is measured

at the grant date, based on the estimated fair value of the award, and is recognized as expense over the employee’s

requisite service period.

Asset Retirement Obligations

The Company accounts for asset retirement obligations as determined by ASC 410 (Topic 410, “Asset Retirement

and Environmental Obligations”) which addresses financial accounting and reporting for legal obligations

associated with the retirement of tangible long-lived assets and the related asset retirement costs. ASC 410 requires

that companies recognize the fair value of a liability for an asset retirement obligation in the period in which it is

incurred. When the liability is initially recorded, the entity capitalizes a cost by increasing the carrying amount of

the related long-lived asset. Over time, the liability is accreted to its present value each period, and the capitalized

cost is depreciated over the estimated useful life of the related asset. Upon settlement of the liability, an entity either

settles the obligation for its recorded amount or incurs a gain or loss upon settlement.

The Company is subject to asset retirement obligations associated with its cell site operating leases, which are

subject to the provisions of ASC 410. Cell site lease agreements may contain clauses requiring restoration of the

leased site at the end of the lease term to its original condition, creating an asset retirement obligation. This liability

is classified under other long-term liabilities. Landlords may choose not to exercise these rights as cell sites are

considered useful improvements. In addition to cell site operating leases, the Company has leases related to switch

site, retail, and administrative locations subject to the provisions of ASC 410.

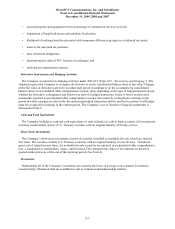

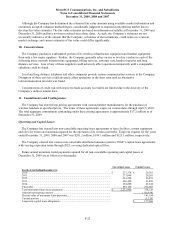

The following table summarizes the Company’s asset retirement obligation transactions (in thousands):

2009 2008

Beginning asset retirement obligations.............................................................................................. $ 46,518 $ 14,298

Liabilities incurred ............................................................................................................................ 12,149 28,816

Reductions......................................................................................................................................... (773) (138)

Accretion expense ............................................................................................................................. 5,111 3,542

Ending asset retirement obligations................................................................................................... $ 63,005 $ 46,518