Metro PCS 2009 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

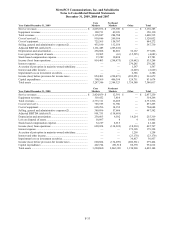

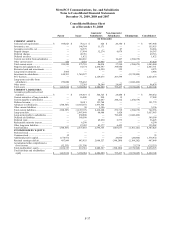

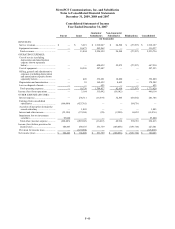

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-41

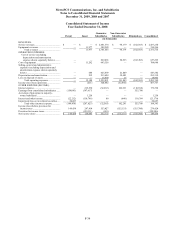

Consolidated Statement of Cash Flows

Year Ended December 31, 2009

Parent Issuer

Guarantor

Subsidiaries

Non-Guarantor

Subsidiaries Eliminations Consolidated

(in thousands)

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income (loss) ....................................................... . $ 176,844 $ 174,388 $ 553,413 $ (151,055) $ (576,746) $ 176,844

Adjustments to reconcile net income (loss) to net

cash provided by (used in) operating activities:

Depreciation and amortization ................................... — 228 325,589 52,039 — 377,856

Provision for uncollectible accounts receivable ........ — 199 — — — 199

Deferred rent expense ................................................ — — 20,107 4,115 — 24,222

Cost of abandoned cell sites....................................... — — 5,274 3,012 — 8,286

Stock-based compensation expense........................... — — 47,783 — — 47,783

Non-cash interest expense.......................................... — 11,309 — — — 11,309

(Gain) loss on disposal of assets ................................ — — (4,884) 201 — (4,683)

Gain on sale of investments ....................................... (644) — — —— (644)

Accretion of asset retirement obligations .................. — — 4,380 731 — 5,111

Accretion of put option in majority-owned

subsidiary ................................................................. — 1,567 — — — 1,567

Impairment loss in investment securities................... 2,386 — — — — 2,386

Deferred income taxes................................................ — 110,925 (764) — — 110,161

Changes in assets and liabilities................................. 80,199 (324,674) (175,735) (994) 560,156 138,952

Net cash provided by (used in) operating

activities ................................................................... 258,785 (26,058) 775,163 (91,951) (16,590) 899,349

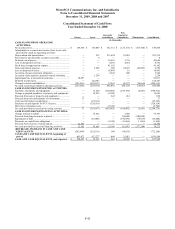

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of property and equipment........................ — (9,177) (757,503) (64,994) — (831,674)

Change in prepaid purchases of property and

equipment................................................................. — (33,115) — — — (33,115)

Proceeds from sale of plant and equipment ............... — — 434 4,896 — 5,330

Purchase of investments............................................. (486,645) — — — — (486,645)

Proceeds from sale and maturity of investments ....... 262,500 — — — — 262,500

Change in restricted cash and investments ................ — (15,113) — — — (15,113)

Purchases of and deposits for FCC licenses .............. — (3,800) (11,717) — — (15,517)

Proceeds from exchange of FCC licenses.................. — — 949 — — 949

Issuance of related party debt..................................... — (465,000) — — 465,000 —

Proceeds from related party debt ............................... — 296,700 — — (296,700) —

Microwave relocation costs ....................................... ——(3,669) — — (3,669)

Net cash used in investing activities .......................... (224,145) (229,505) (771,506) (60,098) 168,300 (1,116,954)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Change in book overdraft........................................... — (17,047) — (3,267) — (20,314)

Proceeds from long-term loan.................................... — — — 465,000 (465,000) —

Proceeds from 9 ¼% Senior Notes Due 2014 ........... — 492,250 — — — 492,250

Debt issuance costs .................................................... — (11,925) — — — (11,925)

Repayment of debt ..................................................... — (16,000) — (296,700) 296,700 (16,000)

Payments on capital lease obligations ....................... — — (3,599) (16,590) 16,590 (3,599)

Proceeds from exercise of stock options.................... 8,626 — — — — 8,626

Net cash provided by (used in) financing

activities ................................................................... 8,626 447,278 (3,599) 148,443 (151,710) 449,038

INCREASE (DECREASE) IN CASH AND

CASH EQUIVALENTS ........................................ 43,266 191,715 58 (3,606) — 231,433

CASH AND CASH EQUIVALENTS,

beginning of period ................................................ 598,823 78,121 624 20,380 —697,948

CASH AND CASH EQUIVALENTS, end of

period....................................................................... $ 642,089 $ 269,836 $ 682 $ 16,774 $ — $ 929,381