Metro PCS 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

• establish advance notice requirements for nominations for election to the board of directors or for

proposing matters that can be acted upon by stockholders at stockholder meetings.

In addition, Section 203 of the Delaware General Corporation Law imposes restrictions on business combinations

such as mergers between us and a holder of 15% or more of our voting stock.

Any of the foregoing events or other events could cause revenues, customer additions, operating income, capital

expenditures and other financial or statistical information to vary from our forward-looking estimates by a material

amount.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We currently maintain our executive offices in Richardson, Texas, and regional offices in Alameda, California;

Folsom, California; Irvine, California; Los Angeles, California; Riverside, California; Ft. Lauderdale, Florida;

Jacksonville, Florida; Orlando, Florida; Tampa, Florida; Norcross, Georgia; Shreveport, Louisiana; Chelmsford,

Massachusetts; Grand Rapids, Michigan; Livonia, Michigan; Las Vegas, Nevada; Hawthorne, New York; Ft.

Washington, Pennsylvania; and Plano, Texas. As of December 31, 2009, we also operated 153 retail stores

throughout our metropolitan areas. Our executive offices, all of our regional offices, switch sites, retail stores and

virtually all of our cell sites are leased from unaffiliated third parties. We believe these properties, which are being

used for their intended purposes, are adequate and well-maintained.

Item 3. Legal Proceedings

We are involved in litigation from time to time, including litigation regarding intellectual property claims that we

consider to be in the normal course of business. Other than the matter listed below we are not currently party to any

pending legal proceedings that we believe would, individually or in the aggregate, have a material adverse effect on

our financial condition, cash flows or results of operations.

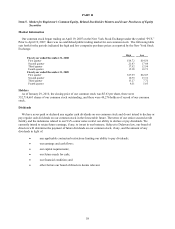

MetroPCS and certain current officers and a director (collectively, the “defendants”) have been named as

defendants in a putative securities class action lawsuit filed on December 15, 2009 in the United States District

Court for the Northern District of Texas, Civil Action No. 3:09-CV-2392. Plaintiff, Ervant Zeronian, alleges that

the defendants violated Section 10(b) of the Exchange Act and Rule 10b-5, and Section 20(a) of the Exchange Act.

The complaint alleges that the defendants made false and misleading statements about MetroPCS’ business,

prospects and operations. The putative claims are based upon statements made in press releases, earnings calls and

the like during the period from February 26, 2009 through November 4, 2009. The lawsuit seeks, among other relief,

a determination that the alleged claims may be asserted on a class-wide basis, unspecified compensatory damages,

attorney’s fees, other expenses, and costs. Defendants have not yet been served with the complaint.

Due to the complex nature of the legal and factual issues involved in this class action matter, the outcome is not

presently determinable. If this matter were to proceed beyond the pleading stage, MetroPCS could be required to

incur substantial costs and expenses to defend this matter and/or be required to pay substantial damages or

settlement costs, which could materially adversely affect our business, financial condition and results of operations.

Item 4. Reserved