Metro PCS 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-16

and reclassified to interest expense in the period in which the hedged transaction affects earnings. The ineffective

portion of the change in fair value of a derivative qualifying for hedge accounting is recognized in earnings in the

period of the change. For the year ended December 31, 2009, the change in fair value did not result in

ineffectiveness.

At the inception of the cash flow hedges and quarterly thereafter, the Company performs an assessment to

determine whether changes in the fair values or cash flows of the derivatives are deemed highly effective in

offsetting changes in the fair values or cash flows of the hedged transaction. If at any time subsequent to the

inception of the cash flow hedges, the assessment indicates that the derivative is no longer highly effective as a

hedge, the Company will discontinue hedge accounting and recognize all subsequent derivative gains and losses in

results of operations. The Company estimates that approximately $24.2 million of net losses that are reported in

accumulated other comprehensive loss at December 31, 2009 are expected to be reclassified into earnings within the

next 12 months.

Cross-default Provisions

The Company’s interest rate protection agreements contain cross-default provisions to the Company’s Senior

Secured Credit Facility. The Company’s Senior Secured Credit Facility allows interest rate protection agreements to

become secured if the counterparty to the agreement is a current lender under the facility. If the Company were to

default on the Senior Secured Credit Facility, it would trigger these provisions, and the counterparties to the interest

rate protection agreements could request immediate payment on interest rate protection agreements in net liability

positions, similar to their existing rights as a lender. There are no collateral requirements in the interest rate

protection agreements. The aggregate fair value of interest rate protection agreements with cross-default provisions

that are in a net liability position on December 31, 2009 is $24.9 million.

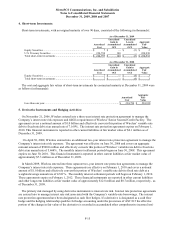

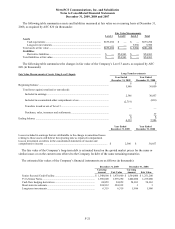

Fair Values of Derivative Instruments

(in thousands) Liability Derivatives

As of December 31, 2009 As of December 31, 2008

Balance Sheet Location Fair Value Balance Sheet Location Fair Value

Derivatives designated as hedging

instruments under ASC 815

Interest rate protection agreements Other current liabilities $ (24,157) Other current liabilities $ —

Interest rate protection agreements Other long-term liabilities (702) Other long-term liabilities (54,963)

Total derivatives designated as

hedging instruments under ASC

815

$ (24,859)

$ (54,963)

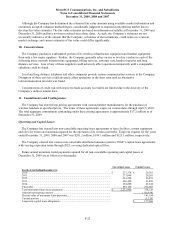

The Effect of Derivative Instruments on the Consolidated Statement of Income and Comprehensive Income

For the Years Ended December 31,

Amount of Gain (Loss) Recognized in

OCI on Derivative (Effective Portion)

Amount of Gain (Loss) Reclassified from

Accumulated OCI into Income (Effective

Portion)

Derivatives in ASC 815 Cash

Flow Hedging Relationships 2009 2008 2007

Location of Gain

(Loss) Reclassified

from Accumulated

OCI into Income

(Effective Portion) 2009 2008 2007

Interest rate protection agreements $ (24,230) $ (50,866) $ (22,055) Interest expense $ (54,334) $ (19,406) $ 3,312