Metro PCS 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2009, 2008 and 2007

F-6

Notes to Consolidated Financial Statements

1. Organization and Business Operations:

MetroPCS Communications, Inc. (“MetroPCS”), a Delaware corporation, together with its consolidated

subsidiaries (the “Company”), is a wireless telecommunications carrier that offers wireless broadband mobile

services. As of December 31, 2009, the Company offered services primarily in the metropolitan areas of Atlanta,

Boston, Dallas/Ft. Worth, Detroit, Las Vegas, Los Angeles, Miami, New York, Orlando/Jacksonville, Philadelphia,

Sacramento, San Francisco and Tampa/Sarasota. The Company sells products and services to customers through

Company-owned retail stores as well as through relationships with independent retailers.

On November 24, 2004, MetroPCS, through its wholly-owned subsidiaries, and C9 Wireless, LLC, an

independent third-party, formed a limited liability company called Royal Street Communications, LLC (“Royal

Street Communications”), to bid on spectrum auctioned by the Federal Communications Commission (“FCC”) in

Auction 58. The Company owns 85% of the limited liability company member interest of Royal Street

Communications, but may only elect two of the five members of Royal Street Communications’ management

committee (See Note 3). The consolidated financial statements include the balances and results of operations of

MetroPCS and its wholly-owned subsidiaries as well as the balances and results of operations of Royal Street

Communications and its wholly-owned subsidiaries (collectively, “Royal Street”). The Company consolidates its

interest in Royal Street in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards

Codification (“ASC”) 810 (Topic 810, “Consolidation”). Royal Street qualifies as a variable interest entity under

ASC 810 because the Company is the primary beneficiary of Royal Street and would absorb all of Royal Street’s

expected losses. The redeemable minority interest in Royal Street is included in long-term liabilities. All

intercompany accounts and transactions between the Company and Royal Street have been eliminated in the

consolidated financial statements.

2. Summary of Significant Accounting Policies:

Consolidation

The accompanying consolidated financial statements include the balances and results of operations of MetroPCS

and its wholly- and majority-owned subsidiaries. All intercompany balances and transactions have been eliminated

in consolidation.

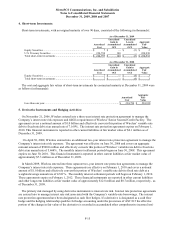

Operating Segments

ASC 280 (Topic 280, “Segment Reporting”), establishes standards for the way that public business enterprises

report information about operating segments in annual financial statements. At December 31, 2009, the Company

had thirteen operating segments based on geographic regions within the United States: Atlanta, Boston,

Dallas/Ft. Worth, Detroit, Las Vegas, Los Angeles, Miami, New York, Orlando/Jacksonville, Philadelphia,

Sacramento, San Francisco and Tampa/Sarasota. The Company aggregates its operating segments into two

reportable segments: Core Markets and Northeast Markets (See Note 17).

Use of Estimates in Financial Statements

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported

amounts of certain assets and liabilities and disclosure of contingent liabilities at the date of the financial statements

and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

The most significant of such estimates used by the Company include:

• valuation of inventories;

• valuation of investment securities;

• estimated useful life of assets;