Metro PCS 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

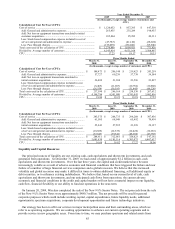

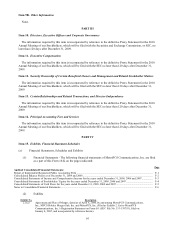

Year Ended December 31,

2009 2008 2007

(In thousands, except average number of customers and

CPU)

Calculation of Cost Per User (CPU):

Cost of service ........................................................................................ $ 1,120,052 $ 857,295 $ 647,510

Add: General and administrative expenses .......................................... 265,455 235,289 198,955

Add: Net loss on equipment transactions unrelated to initial

customer acquisition............................................................................ 105,864 95,282 49,331

Less: Stock-based compensation expense included in cost of

service and general and administrative expense .................................. (47,783) (41,142) (28,024)

Less: Pass through charges .................................................................. (173,099) (136,801) (95,946)

Total costs used in the calculation of CPU ............................................. $ 1,270,489 $ 1,009,923 $ 771,826

Divided by: Average number of customers ............................................ 6,145,414 4,631,168 3,508,497

CPU ........................................................................................................ $ 17.23 $ 18.17 $ 18.33

Three Months Ended

March 31,

2008

June 30,

2008

September 30,

2008

December 31,

2008

(In thousands, except average number of customers and CPU)

Calculation of Cost Per User (CPU):

Cost of service ......................................................................... $ 188,473 $ 206,140 $ 219,423 $ 243,259

Add: General and administrative expenses ........................... 57,727 60,239 57,738 59,584

Add: Net loss on equipment transactions unrelated to

initial customer acquisition................................................... 26,409 21,380 23,596 23,897

Less: Stock-based compensation expense included in cost

of service and general and administrative expense ............... (8,465) (11,007) (10,782) (10,888)

Less: Pass through charges ................................................... (26,554) (30,583) (31,445) (48,220)

Total costs used in the calculation of CPU .............................. $ 237,590 $ 246,169 $ 258,530 $ 267,632

Divided by: Average number of customers ............................. 4,198,794 4,501,980 4,741,043 5,082,856

CPU ......................................................................................... $ 18.86 $ 18.23 $ 18.18 $ 17.55

Three Months Ended

March 31,

2009

June 30,

2009

September 30,

2009

December 31,

2009

(In thousands, except average number of customers and CPU)

Calculation of Cost Per User (CPU):

Cost of service ......................................................................... $ 245,575 $ 268,733 $ 298,288 $ 307,456

Add: General and administrative expenses ........................... 61,505 68,049 65,492 70,410

Add: Net loss on equipment transactions unrelated to

initial customer acquisition................................................... 25,843 27,595 23,299 29,127

Less: Stock-based compensation expense included in cost

of service and general and administrative expense ............... (10,669) (12,673) (12,426) (12,016)

Less: Pass through charges ................................................... (37,643) (39,641) (48,030) (47,785)

Total costs used in the calculation of CPU .............................. $ 284,611 $ 312,063 $ 326,623 $ 347,192

Divided by: Average number of customers ............................. 5,685,830 6,185,116 6,303,075 6,407,637

CPU ......................................................................................... $ 16.69 $ 16.82 $ 17.27 $ 18.06

Liquidity and Capital Resources

Our principal sources of liquidity are our existing cash, cash equivalents and short-term investments, and cash

generated from operations. At December 31, 2009, we had a total of approximately $1.2 billion in cash, cash

equivalents and short-term investments. Over the last three years, the capital and credit markets have become

increasingly volatile as a result of adverse economic and financial conditions that have triggered the failure and near

failure of a number of large financial services companies and a global recession. We believe that this increased

volatility and global recession may make it difficult at times to obtain additional financing, sell additional equity or

debt securities, or to refinance existing indebtedness. We believe that, based on our current level of cash, cash

equivalents and short-term investments, and our anticipated cash flows from operations, the current adverse

economic and financial conditions in the credit and capital markets will not have a material impact on our liquidity,

cash flow, financial flexibility or our ability to fund our operations in the near-term.

On January 20, 2009, Wireless completed the sale of the New 9¼% Senior Notes. The net proceeds from the sale

of the New 9¼% Senior Notes were approximately $480.3 million. The net proceeds will be used for general

corporate purposes which could include working capital, capital expenditures, future liquidity needs, additional

opportunistic spectrum acquisitions, corporate development opportunities and future technology initiatives.

Our strategy has been to offer our services in major metropolitan areas and their surrounding areas, which we

refer to as operating segments. We are seeking opportunities to enhance our current operating segments and to

provide service in new geographic areas. From time to time, we may purchase spectrum and related assets from