Kraft 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

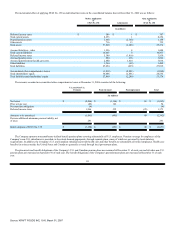

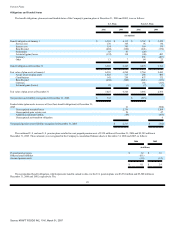

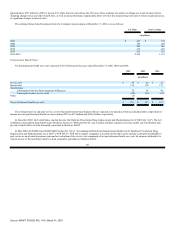

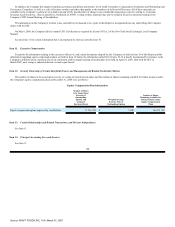

Third-Party Guarantees:

At December 31, 2006, the Company's third-party guarantees, which are primarily derived from acquisition and divestiture activities, approximated

$21 million, of which $8 million have no specified expiration dates. Substantially all of the remainder expire through 2016, with no guarantees expiring during

2007. The Company is required to perform under these guarantees in the event that a third party fails to make contractual payments or achieve performance

measures. The Company has a liability of $16 million on its consolidated balance sheet at December 31, 2006, relating to these guarantees.

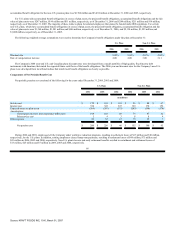

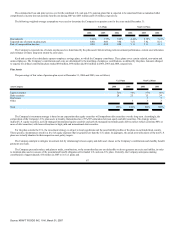

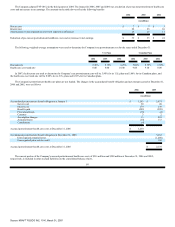

Note 19. Quarterly Financial Data (Unaudited):

2006 Quarters

First

Second

Third

Fourth

(in millions, except per share data)

Net revenues $ 8,123 $ 8,619 $ 8,243 $ 9,371

Gross profit $ 2,932 $ 3,184 $ 3,000 $ 3,300

Net earnings $ 1,006 $ 682 $ 748 $ 624

Weighted average shares for diluted EPS 1,662 1,656 1,648 1,642

Per share data:

Basic EPS $ 0.61 $ 0.41 $ 0.46 $ 0.38

Diluted EPS $ 0.61 $ 0.41 $ 0.45 $ 0.38

Dividends declared $ 0.23 $ 0.23 $ 0.25 $ 0.25

Market price—high $ 31.25 $ 33.31 $ 36.47 $ 36.67

—low $ 27.44 $ 28.97 $ 29.50 $ 33.48

94

Source: KRAFT FOODS INC, 10-K, March 01, 2007